In today’s dynamic financial landscape, micro-lending institutions are navigating increasingly complex regulatory requirements and operational challenges while striving to enhance the borrower experience – a strategic differentiator. To thrive in this environment, a comprehensive loan management software that consolidates key processes like origination, servicing, and collection into one unified platform is essential.

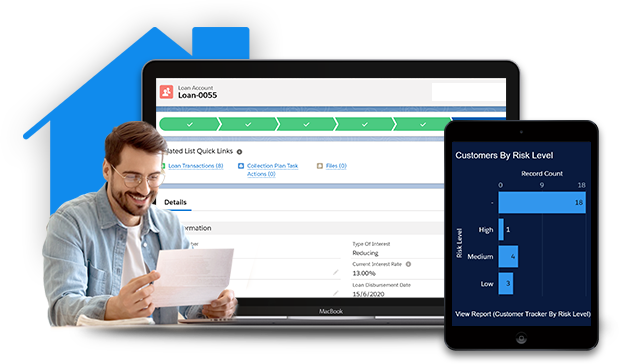

Powered by new age technology, Damco’s unified loan origination software and servicing solution, LoansNeo empowers micro lending financial firms, lenders, and other financial institutions to automate, streamline, and simplify various aspects of the loan cycle, from prospecting to closing deals, monitoring, and collections. With intuitive features such as digital document management, dedicated portals for onboarding and collections, built-in approvals, and intelligent reporting, LoansNeo ensures transparency and fosters stronger relationships with borrowers across various Lines-of-Businesses (LoBs), including personal loans, property loans, home loans, mortgage loans, and motor loans.

Unified Platform

Provide borrowers with a single source of truth for consistent and transparent loans processing.

Efficient Onboarding

Simplify the application process with pre-filled form fields, automated verification, easy data aggregation, and automated issue alerts.

Accelerated Approvals

Reduce turnaround time from weeks and days to minutes with automated data analysis, risk mitigating steps and decision-making.

Maximized Collections

Ensure timely payments with automated alerts, customized communication and borrower rating-linked insights.

Optimized Revenue Generation

Increase profitability with streamlined loan tracking, improved productivity and risk management.

Transform Your Lending Operations with Damco’s Loan Servicing Software, LoansNeo

As one of the leading non-banking financial companies, the client has supported over 14,000 customers by meeting their loan requirements. A tailored Salesforce Sales Cloud-powered solution was implemented to manage their end-to-end sales journey while serving as a single source of truth. Through this implementation, the client was able to reduce lending turnaround time from several days to minutes, decrease the efforts required for document collection and legal checks by 70%, and improve employee efficiency by almost 100%.

Know more

Salesforce Crest (Gold) Partner:

We Are a Crest (Gold) Consulting Partner of Salesforce with core competencies offering a broad array of services through a global delivery model.

We Understand Customer Relationship Management:

We have been delivering comprehensive, responsive on-premise and cloud CRM application support, managed services, and consulting for around 20 years. Our longstanding proficiency with the most popular commercial CRM software technologies translates well into the Salesforce landscape which includes consulting services and product customization portfolio spanned across Sales Cloud, Service Cloud, Marketing Cloud, Experience Cloud, Pardot, Field Service Lightning, Einstein Analytics, and MuleSoft.

We understand Your Industry:

We have strong expertise in driving digital transition through Salesforce services across 15+ industries including Insurance, Financial Services including Fintech, Retail, Manufacturing, Real Estate, Non-Profit, Professional Services, Healthcare, Logistics, Education, Technology Services and more.

Our Services Are Proven and Trusted:

Our industry standards and deep expertise have earned us the trust and loyalty of more than 80 organizations globally exclusively within our Salesforce Practice. We have built a reputation as a trusted partner that helps customers maintain, secure, and expand stable systems through periods of organizational growth, course correction, or turbulence.

But We Are More Than Just Salesforce Experts:

We understand how CRM should fit into your enterprise-wide strategic roadmap, and our practice combines deep Salesforce expertise with extensive business and process acumen. Apart from resolving system issues and recommending solutions, we co-create accelerators to achieve business objectives in ways that Salesforce-only service firms cannot match.

Frequently Asked Questions

Loan Management Software (LMS) is a market-first digital solution designed to streamline loan administration processes in financial institutions such as banks, credit unions, non-banking financial companies (NBFC) and online lending platforms. A loan management system automates various stages of the loan lifecycle, from application and approval to servicing and repayment. Its primary objective is to enhance the efficiency of loan management workflows, improve the accuracy of credit decisions, and elevate the overall customer experience throughout the lending journey.

As a top loan origination software and management solution, LoansNeo offers lenders flexible options to collect repayments from borrowers whether through automatic debits or manual methods. It ensures prompt repayment from borrowers, updates the loan balance accurately, and amortizes both interest and principal components with each repayment. Additionally, this loan management system efficiently manages various scenarios such as part-payments, loan foreclosures, rescheduling, and waivers.

Absolutely! Damco's loan processing software, LoansNeo offers comprehensive reporting features giving lenders valuable insights into their lending business. Accessible reports include details on active loans, balance sheets, trial balances, general ledger details, and information on due loan payments and ageing. With customizable reporting options, lenders can tailor reports to meet their unique requirements ensuring they have the precise information needed to drive strategic decisions.

A loan servicing software such as LoansNeo transforms loan management by automating key stages of the loan lifecycle, reducing manual tasks, and ensuring timely processing of applications, approvals, and repayments. This automation not only speeds up decision-making but also enhances overall workflow efficiency, empowering lenders to focus more on strategic initiatives and delivering exceptional customer service.