Digital transformation has been the undisputed buzzword for quite a while now. Everyone, from C-suite executives to entry-level employees, has heard about it and may have even participated enthusiastically in the organizational venture to make it happen. The digital transformation wave has caught on to such an extent that even industries that did not enjoy a high degree of digital maturity have taken the leap of faith to reap its benefits. The same can be said about digital transformation in the insurance industry.

Digital transformation in insurance has given the sector a significant boost. It helps insurers overcome any underlying challenges while keeping up with change. It also unlocked new avenues to improve products and services and make them more customer-oriented. If you are still on the fence as to whether it is viable, here’s everything you need to know about insurance company digital transformation.

Table of Contents

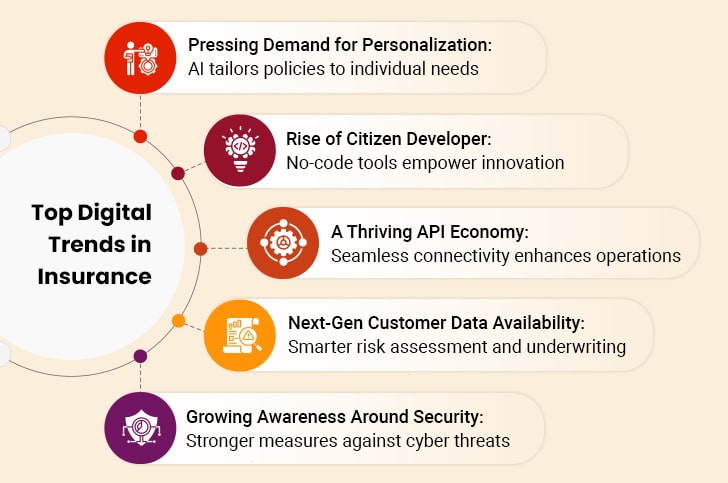

Notable Insurance Digital Transformation Trends

- 1. Pressing Demand for Personalization

- 2. Rise of the Citizen Developer

- 3. A Thriving API Economy

- 4. Next-Gen Customer Data Availability

- 5. Growing Awareness Around Security

Benefits of Digital Transformation in Insurance

Challenges in Insurance Digital Transformation and How to Overcome Them

Steps for Digital Transformation in the Insurance Industry

Closing Thoughts

Case in Focus

Notable Insurance Digital Transformation Trends

First, let’s begin by understanding the current market conditions that establish a conducive environment for digital transformation for insurance companies:

1. Pressing Demand for Personalization

There is no contesting the fact that customers want personalization, be it in marketing or product offerings. With digital transformation in the insurance industry, it is possible to implement end-to-end services and product personalization. Tools like Customer Relationship Management (CRM) platforms allow insurers to gain a 360-degree view of a prospect and tailor campaigns, strategies, and policies based on their profile. Making allowances for customer preferences helps insurers lay the foundation for meaningful customer relationships.

2. Rise of the Citizen Developer

Insurers have hesitated to embrace digitalization due to the hassles of selecting and retaining an in-house development team to build customized solutions. Not to mention that the timeline for such product deliveries is stretched out to the point where it may border on obsolescence. Low-code and no-code platforms have made it easier for laypersons to develop niche digital solutions. As such, the existing team members can be an asset to developing practical and usable solutions that can replace legacy systems.

3. A Thriving API Economy

The insurance sector is highly segmented with various stakeholders using digital tools that fit their tech stack. As such, gaining familiarity with disparate ecosystems is a challenge presented by insurance company digital transformation. With Application Programming Interface (API), it is possible to integrate different products and services and patch together a digital universe that operates seamlessly. By connecting disparate systems, API acts as the glue that holds the entire digitalized vertical of the insurance industry together.

4. Next-Gen Customer Data Availability

Data is the fuel that drives the insurance industry. Everything – from customer name to policy number is data, which comes in handy while processing customer requests. With digitalization, insurers can work intelligently with data to optimize the use of their resources and assets.

At the same time, the influx of first-party customer data, be it through their social media or smart wearable devices, makes it easier to enhance products and services. The customer data, if consolidated across multiple lines of business, is an excellent answer to improve cross-sell and up-sell opportunities and accelerate revenue growth.

5. Growing Awareness Around Security

Insurance is a highly regulated industry. Failure to comply with the extant laws or guidelines could hamper the insurance business. At the same time, any lapses attract hefty fines and public distrust. Digital transformation for insurance companies plays a crucial role in safeguarding the interests of insurance companies and policyholders by setting up a comprehensive system of checks and balances. From identity verification to traceable auditing, digitalization ensures compliance on all fronts.

Benefits of Digital Transformation in Insurance

Here’s a quick dive into the benefits of insurance digital transformation:

- Accurate risk assessment and management

- Faster decision-making

- Higher efficiency and productivity across functions

- Product/service personalization to meet customer demand

- Business scalability and agility to become future-ready

- Intelligent automation to improve efficiencies across functions

- Robust data security, governance and privacy management

- Increased revenue potential

- Lower operational costs

- Intelligent analytics and reporting for more accurate insight-based decision-making

- Long-term customer retention through enhanced customer experience

When one considers the above advantages as a whole, it is evident that digital transformation for insurance companies attracts the ultimate triple prize – loyal and satisfied customers, higher profit margins, and accelerated yet sustainable growth.

Embark on Your Digital Transformation Journey

Challenges in Insurance Digital Transformation and How to Overcome Them

1. Legacy System Dependency

Most insurance firms continue to use old legacy systems, which are slow, rigid, and costly to maintain. In addition, they are difficult to integrate with newer digital solutions.

To get around this, insurers must transition to cloud-based solutions in phases. APIs can be implemented to bridge the gap between the old and the new systems so that operations are smoother. A phased rollout approach should be followed, where the core processes are upgraded first, reducing disruption while embracing new technologies.

2. Regulatory Compliance and Legal Barriers

The insurance sector is highly regulated, with strict regulations on data protection, cybersecurity, and equitable pricing. Digital transformation programs must follow changing laws, which can be intricate and time-consuming.

To overcome this challenge, insurers need to collaborate closely with legal professionals and regulatory authorities. Investing on compliance automation tools and AI-based monitoring helps insurers keep up with regulations and compliance. Audits and employee training on compliance best practices further minimize legal exposures.

3. Employee Resistance to Change

Most employees are likely to resist digital change for fear of losing their jobs or for inability to work with new technologies. Such resistance slows down the implementation process and reduces efficiency.

Insurers must concentrate on change management to counter this. Offering on-the-job training, workshops, and ongoing assistance helps employees build confidence with new digital technologies. Leadership must clearly articulate the advantages of digital transformation and engage employees in decision-making. Identifying and rewarding employees who adopt digital change can also stimulate adoption.

4. Lack of Digital Skills in the Workforce

Most insurance professionals are skilled but lack the technical know-how to run sophisticated digital platforms. Without training, digital transformation in insurance will not be maximally effective.

To counter this, companies can invest in ongoing learning initiatives. Collaborating with technology firms and similar learning institutions can offer specialized training for workers. Promoting a digital-first approach through upskilling initiatives and certifications makes the shift into the digital age easier.

5. Integration Challenges Between Various Technologies

Insurance firms employ numerous digital tools in multiple processes such as underwriting, claims adjudication, and customer support. In most instances, the different tools do not integrate well together, resulting in inefficiencies.

APIs and cloud-based platforms bring disparate systems together and form a seamless digital experience. Careful research must be done before incorporating new technologies for compatibility. Collaborating with knowledgeable technology consultants also helps in simplifying the integration process and lessening downtime.

6. Customer Adoption Challenges

While younger customers can readily adopt digital insurance services, older customers can find it difficult to navigate online platforms and might prefer conventional interactions.

To cater to this, insurers can provide a hybrid solution, integrating digital self-service with human assistance. Making digital interfaces easy to use, providing chatbots for help, and giving step-by-step instructions eases the process for all customers. Implement multiple customer support channels, including phone, email, and live chat, to enhance digital adoption.

7. Handling High Volumes of Data

The insurance sector produces huge volumes of data, from customer data to claims history. If not managed, data easily becomes daunting and challenging to analyze properly.

Insurers can process large datasets quickly through artificial intelligence (AI) and machine learning (ML). Insurers can also centralize data repositories through cloud solutions and integrating real-time analytics tools. Data hygiene practices like frequent updates of redundant records help maintain data accuracy and usability.

8. Providing Seamless Customer Experience

An underwhelming digital experience can enrage customers and prompt dissatisfaction. Dull navigation, slow response rates, and inadequate personalization can push customers away. To enhance customer experience, insurers must invest in friendly interfaces, mobile apps, and AI-enabled chatbots that respond instantly. Soliciting customer feedback and regularly enhancing digital platforms delivers a smooth and pleasant experience. Personalization by AI and analytics can go one step ahead in improving customer engagement and forging long-term loyalty.

Steps for Digital Transformation in the Insurance Industry

Irrespective of the lines of businesses, the insurance digital transformation journey is broadly the same and involves the following key steps:

- Step I. Conduct a pan-organization review of the existing processes, deficiencies, and tech stacks.

- Step II. Identify gaps that urgently need fixing and prioritize them based on their impact. While doing so, also identify areas/tasks that can be automated.

- Step III. Create a digital transformation roadmap with milestones that detail the end goal, the stakeholders, anticipated outcomes, etc. Circulate it across the organization to sensitize everyone and bring them on board.

- Step IV. Make data hygiene a priority and implement a solid data management system that focuses on data centralization for consistency.

- Step V. Prepare for migration to a cloud-first, modern infrastructure and gradually replace legacy systems with digital alternatives.

- Step VI. Train and sensitize employees, agents, brokers, etc., and motivate them to adopt digital solutions.

- Step VII. Analyze, assess, and monitor to streamline processes, workflows, products, and services.

Thus, we have covered People, Process, and Technology, the three primary pillars of digital technology. Do note that these steps are merely indicative and the overall digital transformation in insurance strategy varies from business to business.

Closing Thoughts

Insurance industry digital transformation is no longer just a nice-to-have feature or a competitive differentiator, it is the medium to make your business future-ready. With the insurance digital transformation trends pointing in the favorable direction and the ever-increasing Insurtech options available, now is an excellent time to take the plunge and get started with your insurance industry digital transformation journey.

Schedule a consultation with an expert from Damco and you will have a reliable tech partner, mentor, and enabler to accompany you along the way!

Case in Focus

A multi-line insurer based out of the US was on a mission to modernize its core systems. They faced issues with the management of in-house legacy systems, unstructured and decentralized data from disparate sources, and multiple modeling systems for core processes, to name a few. The company sought help from Damco for the digital transformation journey. After understanding the client’s expectations, Damco was successful in modernizing the core systems and weaving everything together on a centralized platform. You can read all about this success story on our website.