Today, lending companies are equipped with a range of options when it comes to loan management software. Based on the kind of loan your business offers, there are certain characteristics that you should consider while choosing loan origination and servicing software. Providing your customers with the best loan management service is vital if you want to stand out in the competitive lending industry. An appropriate tool for loan processing makes the difference between a business being at the top of its game or just one of the many options for borrowers to select from without any differentiating factor.

Software for loan management have dual purpose. The first is to streamline the lending process from the loan application to the final decision. The second purpose is to decrease errors by handling redundant tasks like collections. Reliable software is equipped with a range of features that make the lending process easier and provide a business edge in the competitive lending industry.

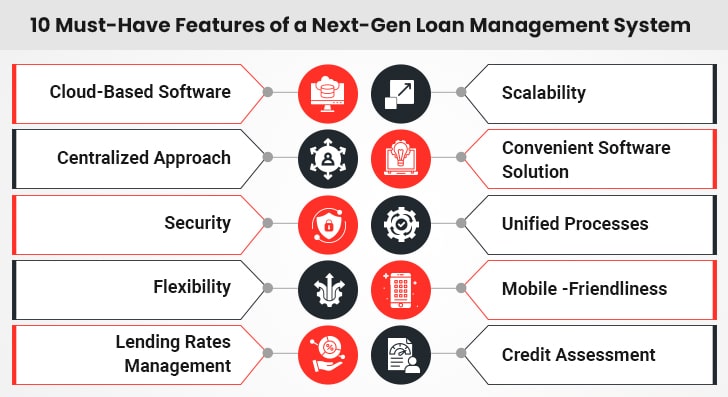

Must-Have Features of a Next-Gen Loan Management System

A loan management system should have the requisite tools that help streamline the entire loan process. The software should include vital features that help complete a deal faster and provide more accurate analytical insights and customer data to flourish in today’s market.

Here are some important features your loan management system needs to have to improve borrower experience:

1. Cloud-Based Software

Some businesses do not have the option of an on-demand IT team to support new software implementation. In such cases, having cloud-based software is beneficial. A reliable cloud-basedloan management software offers ease of deployment with the help of its cloud functionality to facilitate deployment for lenders. This ensures fast implementation, software flexibility, and the ability to contact the IT department of your service provider for support. In a lot of cases, these cloud-based systems also include automatic updates and regular upgrades. Most of all, being on the cloud provides your team with easy access to the loan management software from anywhere and faster availability of information.

2. Scalability

Every business wants to grow and expand its services and products. A lot of systems for loan management are fixed and hard coded in such a manner that it becomes challenging for the software to support a business as it grows. A dependable loan management system for your organization should have scalable modules that align with the changes introduced in your business as it grows. The software should allow you to introduce new services and products to your business to meet the latest market demands.

3. Centralized Approach

It is important to have a centralized storage system that hosts the various stages of a loan lending lifecycle. The lending industry often faces a lack of sufficient systems that work effectively from beginning to end in a loan cycle. Small businesses, especially, cannot afford to have different systems that store and retrieve the data of borrowers. Choosing lending management software that supports the various loan management system modules, ranging from origination to servicing, will help your company save a huge amount of money every month and provide your organization with a comprehensive view of the profile of your loan applicant. You will be able to see the lending stage of the application, the person who’s handling the case, and all the information concerned from anywhere, anytime.

4. Convenient Software Solution

Time plays a key role in the lending industry. Thus, discovering a tool that assists your team to begin functioning quickly is important. Your chosen system for loan management should be easy to use, meaning it shouldn’t require a lot of time on staff training. Thus, successful user adoption is of utmost importance when choosing the right commercial loan management software for your business

Revolutionize Your Loan Management

5. Security

While managing the sensitive data of borrowers, it is important for lenders to make sure that they follow data security best practices. You need to select lending software that allows your business to set up centralized data storage that can be accessed only by authorized people with the right permissions. Also, as a lender, you need to ensure that your commercial loan management software complies with the privacy standards of the industry and has the highest compliance measures and certifications.

6. Unified Processes

While getting ready to complete the lending lifecycle, lenders need to consider different modules like onboarding, credit assessment, funding, underwriting, etc. With the help of a system that provides all these modules built into the platform, supports customizable modules, and allows integration of third-party apps, you reduce your burden and make the lending process hassle-free. You also boost customer experience and save precious time for your team.

7. Flexibility

Every lender runs their organization their way and every business have its specific requirements. Hence, it is vital to choose a loan management system that is configured easily. This way you find out what’s best for your business and make the required changes to your software for loan management so that it aligns with the functionality of your business.

8. Mobile-Friendliness

The present-day borrower is looking for the fastest and easiest way to get loans from lenders. To stay competitive in the market, lenders can’t afford to stay stuck with outdated software. To keep yourself updated with the present trends and maintain an edge in the market, you require a quality system for loan management that is easily accessible from anywhere, on any device. Most borrowers today have their personal smartphones, so having a mobile-ready feature is pivotal for your commercial loan management software.

9. Lending Rates Management

The best loan management systems should be able to provide the ability to manage lending rates of all kinds of loans, automatically calculate loan origination fees or commissions, or apply base lending rates that are period-specific and depend on the credibility of the borrower.

10. Credit Assessment

The success of a lending deal depends on the accuracy of the credit assessment. Thus, it is important to find lending software that helps assess the creditworthiness of applicants. The system should be able to draw out information from the various credit bureaus and provide the right information promptly. The best loan management systems provide these integrations to promote efficiency and offer a comprehensive view of the credit scores of the applicant.

The Benefits of Implementing Next-Gen Loan Management Software

Listed below are the benefits that lending companies may harness with the implementation of loan management software.

1. Streamlined Loan Management

Next-Gen loan management software helps lenders work better. It automates tasks like checking loan applications, calculating interest, and tracking payments. This means processing more loans in less time without mistakes. With easier workflows, lenders focus on important tasks that help the business grow. This leads to faster loan processing and allows lenders to serve more customers effectively.

2. Enhanced Customer Experience

Using progressive software for loan management makes the customer experience much better. The software often has self-service options where borrowers see their loan details, make payments, and check their application status easily. This lets customers manage their loans without needing to call for help all the time. Faster loan approvals also make customers happier. By giving quick updates and easy access to information, lenders build better relationships with their clients.

3. Improved Compliance

Staying compliant with laws is very important in lending, and modern loan management software helps lenders do this easily. The software automatically includes the latest rules in its processes and creates reports needed for audits. It helps lenders keep track of their compliance, reducing the risk of fines or legal issues. This approach ensures that lenders operate within legal guidelines and keep trust with customers and regulators.

4. Better Risk Management

Advanced lending management software helps lenders manage risks better. It provides real-time information about borrowers and their payment history. By looking at this data, lenders spot potential problems early, like late payments or falling credit scores. This helps them take action before issues get worse. With better risk management tools in place, lenders make smart decisions on loan approvals and terms. This leads to healthier financial outcomes.

5. Data Analytics and Insights

Modern loan management software uses data analysis to give valuable data into lending operations. By collecting and analyzing data, lenders see trends in borrower behavior. This information helps them make smart decisions about lending strategies. For example, if data shows a strong demand for a certain type of loan among specific regions or age groups, lenders may adjust their marketing efforts accordingly. Access to actionable data helps lenders better meet their customer needs.

6. Seamless Integration with Other Systems

Using cloud loan management software allows it to connect easily with other important systems like accounting software. This eliminates data silos and ensures that all information flows smoothly between systems without errors. With connected systems, lenders access extensive data that improves decision-making and operational efficiency. Furthermore, this connectivity simplifies workflows by allowing different departments to work together on lending processes. Overall, seamless integration enhances productivity and supports a more streamlined lending operation.

7. Cost Savings

High-tech lending management software saves money for lenders over time. By automating tasks that took a lot of time before, lending companies lower labor costs related to processing loans. Fewer mistakes mean less money spent fixing problems. Furthermore, improved efficiency allows staff to handle more loans without increasing overhead costs. These cost savings contribute directly to higher profitability for lenders. This allows them to offer competitive rates and terms to borrowers.

8. Scalability

Modern loan management software grows with your business needs. As lenders take on more customers or enter new markets, the software handles more applications without losing quality. This scalability helps lending companies adjust quickly to changes without requiring them to invest in new systems all the time. Overall, it ensures that lenders continue providing seamless service as they grow, making it critical for long-term success.

Discover how loan management software can revolutionize your microfinance operations today.

Challenges When Choosing Loan Management Software and How Loans Neo Overcomes Them

Lenders often confront a multitude of challenges when choosing software for loan management. Deep dive to explore the common challenges and how Loans Neo addresses them effectively.

Lack of Customization Options

Some loan management systems do not allow for customization, which limits their effectiveness. As a result, lenders may find themselves stuck with features they do not use or lack necessary tools for their operations. Damco’s Loans Neo allows for customization, enabling lenders to tailor the software according to their unique requirements.

Data Security Concerns

Keeping customer information safe is crucial for any lending business. Data breaches lead to serious problems, like losing trust and facing legal issues. Loans Neo prioritizes data security with strong protection measures, ensuring that sensitive information remains confidential.

Manual Data Entry Errors

Entering data manually causes mistakes and delays. Errors in borrower information may lead to incorrect decisions and affect customer trust. Loans Neo automates data entry and verification, which minimizes errors and ensures accurate information throughout the loan process.

Compliance with Regulations

Staying compliant with changing laws may be tricky. Not following the rules may result in penalties and damage to a company’s reputation. Loans Neo includes features that help lenders maintain compliance easily by keeping track of necessary regulations.

High Costs of Implementation

Investing in new software may be expensive for small lending companies with limited budgets. High initial costs may discourage companies from upgrading their systems Loans Neo provides flexible pricing plans, making it affordable for different sizes of lending institutions.

Managing Multiple Applications

Handling many loan applications at once is challenging for lenders. Without a good system, it’s easy to lose track of applications or miss important deadlines. Loans Neo streamlines application management, allowing lenders to track and process multiple requests efficiently without confusion.

Insufficient Training and Support

Learning new software may be difficult without proper guidance. If users do not feel comfortable with the new system, they may struggle to use it effectively. Loans Neo provides comprehensive training and ongoing support, helping users become comfortable with the system quickly.

Conclusion

To stay updated with the emerging trends in the financial market, it is vital to streamline the lending process. This way you can cater to your business needs in an easier and faster manner. While choosing the best loan management system for your business, it is important to consider factors like personalization, scalability, and cloud-based software. Such a system can meet both the long-term and short-term requirements of your business and allows you to process loans efficiently without any errors.