The insurance sector in the Middle East, particularly UAE, Saudi Arabia, and Bahrain, has become a new focal point for economic and financial development, driven by demographic changes and growing economic prosperity. As interest in risk mitigation through insurance has surged, underwriting activity across the region is expected to continue its rapid expansion. Key drivers include mandatory insurance schemes for health and motor coverage. Despite these positive trends, the Middle East remains one of the least developed insurance markets globally, presenting both challenges and opportunities for growth.

Fragmented market structures, gaps in regulation, and a lack of skilled professionals have hindered the industry’s full potential in the region. Additionally, limited product offerings that cater to cultural and religious preferences—particularly in life insurance—continue to be a concern. However, the region holds significant promise, especially as international insurance companies express increasing interest.

To accelerate the sector’s development, insurers in the Middle East must adopt innovative strategies. One such approach is embracing modern insurance software, which streamlines operations, enhances regulatory compliance, and supports the introduction of new products. By investing in digital transformation, insurers can overcome longstanding challenges, driving the industry towards sustained growth and greater efficiency.

Impact of Technology on the Insurance Industry

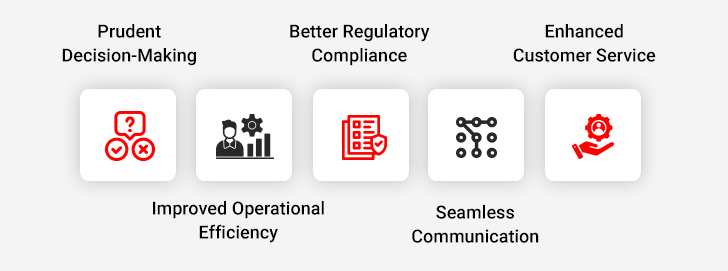

Technology has significantly transformed the insurance industry, enhancing its operational efficiency and replacing traditional processes with more effective solutions. This shift has become a key driver of change, yielding substantial benefits that are evident across the sector. Some of the key advantages include:

Ways Insurance Software is Transforming the Middle Eastern Insurance Industry

1. Prudent Decision-Making

Traditionally, the Middle Eastern insurance industry is labor-intensive, relying heavily on actuarial analysis to make decisions regarding pricing, risk, and capital management. In the absence of dedicated insurance management software, precise and predictive analysis of business data presents challenges. However, with the availability of reliable software, the quality of analysis improves significantly. It allows insurers to efficiently collect and process volumes of data, thereby transforming risk and capital management. For insurers, this translates into valuable, actionable insights that empower them to make more informed, data-driven decisions.

2. Improved Operational Efficiency

In the Middle East, where fragmented market structures and regulatory gaps often hinder smooth operations, modern insurance management software is a game-changer. It centralizes all data into a unified, searchable database, streamlining access to critical information. Additionally, it automates labor-intensive tasks such as billing, claims processing, and regulatory reporting—areas that are particularly challenging in a region with diverse compliance requirements.

3. Better Regulatory Compliance

Navigating the regulatory landscape in the Middle East, with its varied and evolving laws across different countries, is challenging for insurers. Relying on manual methods to stay compliant is both inefficient and risky. Modern insurance software offers a solution by continuously tracking regulatory updates and automatically identifying areas that need attention. This proactive approach ensures that insurers effortlessly adapt to both local and international requirements. It reduces the burden of compliance while minimizing the risk of fines or legal complications.

Unlock More Business Value with InsureEdge

4. Seamless Communication

Similar to other regions, the Middle Eastern insurance service sector experiences challenges pertaining to seamless collaboration and breakdowns in communication while working with customers, carriers, or other stakeholders. These challenges insurance software solutions equipped with task management, automatic notification, and communication tracking capabilities. These tools enhance collaboration and ensure that all parties remain informed and engaged throughout the process.

5. Enhanced Customer Service

In today’s competitive insurance landscape, customer expectations are higher than ever, especially in the Middle East where the industry is still developing. Customers demand quick, accurate assessments, faster claim resolutions, and the convenience of self-service options. Modern insurance software is equipped with features like AI-powered chatbots, instant policy issuance, and real-time claim tracking, enabling insurers to offer a seamless, efficient experience.

Conclusion

Insurance technology has started making an impact on the Middle Eastern insurance industry. With innovation and the rapid implementation of new technologies, there has been a remarkable change in the operations of insurance companies. InsurTech has not only facilitated the insurance companies with the capabilities to penetrate new markets, and retain customers, but has also allowed integrated and user-oriented services. This has reshaped the insurance industry of the Middle East and made things easy and convenient for everyone involved in the process. Learn more about insurance technology and partner with us to take your business to the next level.

Case in Focus

A leading Caribbean insurance company was struggling with outdated, legacy systems and fragmented data. The insurer was unable to gain a complete view of its business due to the lack of a synchronized data system. Damco stepped in to help the client transform and integrate their core processes with a centralized insurance management system. This helped the insurer gain a single source of truth about the company, policies, and customers while improving operational productivity. The complete case study is available on our website.