Long before computers could learn from patterns and offer suggestions, life insurance was a world of forms, calculators, and long wait times. Underwriters spent hours poring over documents. Claims teams moved at a measured pace, and customers often felt frustrated by a maze of complicated processes and long wait times. The slow and opaque processes were often exasperating for both agents and policyholders.

Today, a shift is in process. Generative AI in insurance is moving from theory into everyday life insurance operations. It sifts through large volumes of data, surfaces useful insights, and supports better decisions. In underwriting, artificial intelligence helps review risk factors faster, allowing applications to move forward without unnecessary delays.

Picture a young parent filing a claim late at night after an unexpected loss. Instead of confusion and silence, they receive timely updates and plain explanations as the process moves ahead. Or imagine an underwriter working through medical histories with less fatigue because a generative AI system has already pointed out the most relevant details. This is the emerging reality of AI in life insurance underwriting and operations.

In this blog, we will cover how generative AI is transforming insurance operations. Let’s get started.

Table of Contents

Understanding Generative AI in Life Insurance

Strategic Use Cases for Gen AI in Life Insurance

Essential Factors for Successful Implementation

3 Critical Challenges with Mitigation Strategies

Insights from a Few Success Stories

Six Traits of Life Insurers Succeeding with Gen AI Adoption

Understanding Generative AI in Life Insurance

Generative AI is a branch of artificial intelligence that doesn’t just analyze data; it creates new content, predictions, and solutions based on the patterns it learns. Unlike traditional AI, which follows predefined rules, Gen AI can generate innovative solutions in real time. This ability to create makes it a game-changer for life insurance operations.

However, what sets Gen AI apart? It’s the difference between automation and innovation. Traditional AI might automate underwriting processes. Gen AI, however, can predict risk more accurately by building models from vast datasets, including unstructured or previously unused data.

In life insurance, where decisions rely on judgment as much as data, this ability to create is especially valuable. That is why many life insurers have already started experimenting with it. In fact, 82% of life and annuity insurers say they are using generative AI in at least one business function.

Strategic Use Cases for Gen AI in Life Insurance

“GenAI applications will create a significant impact across the value chain, yielding substantial efficiency gains and cost savings. The biggest savings, ranging from 40% to 60%, are expected to come from productivity gains in customer service.”

– Christopher Freese, Managing Director at BCG

Gen AI is not just for tech giants. Even small and medium-sized life insurance companies can leverage it in several ways to drive business value. Here are some popular use cases:

1. Enhanced Underwriting and Predictive Risk Assessment

Underwriting is the backbone of life insurance. Gen AI can enhance this process by analyzing vast amounts of data quickly and efficiently. It can more accurately predict risk, leading to better pricing and reduced losses. For example, Gen AI can analyze medical records, lifestyle data, and even social media to assess risk in ways that traditional methods can’t.

2. Personalized Customer Interactions

Today’s customers expect personalized experiences. Gen AI can help life insurers meet these expectations by creating tailored policies and recommendations. By analyzing customer data, Gen AI can suggest products that fit individual needs, improving customer satisfaction and retention.

3. Fraud Detection and Prevention

Efficient fraud detection in life insurance is the need of the hour. Gen AI can detect unusual patterns and predict potential fraudulent activities before it occurs. By continuously learning from new data, Gen AI systems become more skilled in identifying fraud, safeguarding both the insurer and the insured.

Boost Productivity with Life Insurance Policy Administration Solution

4. Claims Processing Optimization

The claims process can be slow and cumbersome. Gen AI can streamline this by automating the claims adjudication process and reducing the time it takes to settle claims. This leads to faster payouts and happier customers.

Essential Factors for Successful Implementation

Only about 7% of insurers have successfully scaled their AI initiatives across the organization, even though many start pilots. This shows that deploying Gen AI is not just about technology. It’s about strategy, compliance, and change management. Here is how life insurers can ensure the successful implementation of Gen AI in insurance operations:

I. Data Quality and Management

Data is the fuel for Gen AI. But it’s not just about having data; it’s about having the right data. Insurers need to ensure their data is clean, comprehensive, and accessible. Overcoming data silos and ensuring interoperability between systems is crucial. Without high-quality data, even the most advanced AI systems will falter.

II. Integration with Existing Systems

Gen AI doesn’t operate in a vacuum. It needs to integrate seamlessly with existing IT systems. This can be challenging, especially in organizations with legacy systems. Insurers must plan for this integration to avoid operational disruptions. Ensuring compatibility and interoperability should be a top priority.

III. Regulatory Compliance and Ethical Concerns

The regulatory landscape for AI is still evolving. Insurers must navigate these waters carefully. Ensuring that AI systems comply with existing regulations and ethical standards is critical. This includes addressing privacy concerns and safeguarding customer data. It’s not just about avoiding penalties; it’s about building trust with customers and regulators alike.

IV. Change Management and Workforce Adaptation

Deploying Gen AI isn’t just a technological shift; it’s a cultural one. Employees need to be on board with the changes. This requires training and upskilling to help the workforce adapt to new AI-driven processes. Fostering a culture that embraces innovation and change is essential for the successful deployment of Gen AI.

3 Critical Challenges with Mitigation Strategies

“While we believe in the potential of gen AI, it will take a lot of engagement, investment, and commitment from top management teams and organizations to make it real.”

– Khaled Rifai, partner at McKinsey

Generative AI brings real promise to life insurance, but it also raises important concerns. Insurers that are moving forward carefully are not ignoring these issues. They are addressing them early with practical strategies.

Making AI Decisions Easy to Explain

One of the biggest challenges is that AI decisions can feel like a “black box.” When a system suggests a risk score or pricing outcome, it is not always clear how it arrived at that conclusion.

In life insurance, this lack of clarity matters. Underwriters must be able to explain decisions to customers and regulators. To address this, insurers are prioritizing transparency. They are choosing systems that surface clear reasoning, document decision paths, and allow human experts to review and override outcomes when needed.

Protecting Sensitive Customer Data

Data privacy is another serious concern. Life insurers handle deeply personal information, from medical histories to financial details. Any exposure can damage trust and invite regulatory scrutiny.

To reduce this risk, insurers are tightening data controls. Access is restricted, sensitive information is masked where possible, and data usage is closely monitored. Many organizations are also separating training data from live customer data to prevent accidental exposure.

Slowing Down to Get It Right

Instead of rushing deployments, many insurers are taking a phased approach. They test AI tools in limited environments, learn from early results, and expand only when outcomes are reliable.

This deliberate pace helps teams spot gaps, correct errors, and build confidence internally. It also ensures that new tools support decision-making rather than quietly reshaping it in ways no one fully understands.

Overcoming Technological Barriers

Not all insurers are tech-savvy. Implementing Gen AI requires overcoming technological barriers, such as outdated infrastructure and a lack of in-house expertise. Partnering with AI vendors or consulting firms can provide the necessary support. Continuous investment in technology and training will also help mitigate these barriers.

Managing Change within the Organization

Change is hard, but it’s necessary. To manage change effectively, insurers need a clear strategy that includes communication, training, and support. Engaging employees early in the process and providing them with the tools they need to succeed can make the transition smoother.

Common Challenges and Mitigation Strategies

| Challenge | How to Address It |

|---|---|

| Lack of Explainability | Use tools that show reasoning clearly |

| Data Privacy Concerns | Mask data and restrict access |

| Legacy Systems | Use phased rollouts and API connectors |

| Skills Gap | Practical training and hands-on learning |

| Change Resistance | Start small and show early wins |

Insights from a Few Success Stories

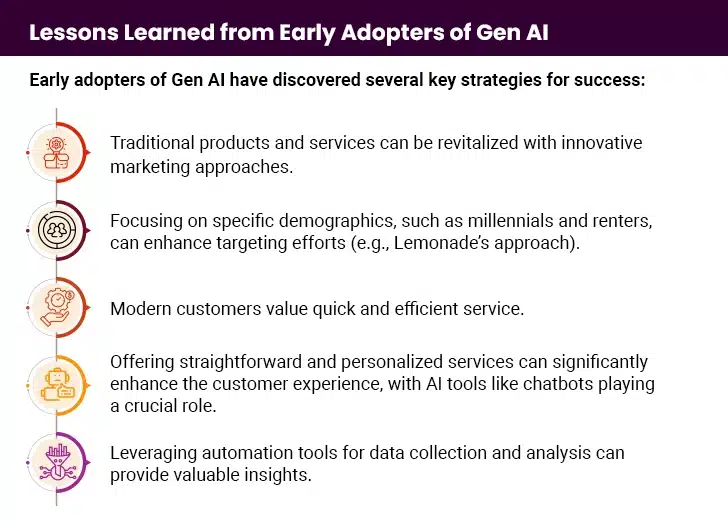

Let’s look at some real-world examples where Gen AI has already made a significant impact.

Successful Implementations in Life Insurance

Several life insurers have successfully integrated Gen AI into their operations. For instance, Maya, Lemonade company’s chatbot, simplifies the process for website visitors to get information and sign up. Maya guides visitors through a questionnaire to find the most suitable services and provides quick quotes. It ensures customers are paid within three minutes and receive insurance within 90 seconds. Using advanced CX.ai technology, Maya chats with customers to provide customized, instant answers to complex questions and assists with policy changes. Maya leverages natural language processing (NLP) and machine learning algorithms to understand customer queries and deliver accurate responses in real-time.

Another chatbot, Jim, manages payouts and handles the entire claims process without human involvement. Jim uses robotic process automation (RPA) and AI-driven decision-making to streamline claims. In its launch year, Jim processed approximately 20,000 claims and paid out around $2.5 million with no human intervention. Jim’s technology ensures efficient and accurate claims processing, reducing time and effort for both the company and customers.

Six Traits of Life Insurers Succeeding with Gen AI Adoption

Drawing on experience supporting generative AI initiatives across insurers, six clear patterns emerge among life insurance organizations that are getting AI adoption right. These insurers are not chasing trends. They are solving real problems in core parts of the business.

1. Start with One Core Life Insurance Function That Truly Matters

Leading life insurers begin by asking a basic question: Which critical function, if improved, would change how the business works every day?

Instead of spreading AI across dozens of small pilots, they focus on one area that sits at the heart of operations, such as underwriting, policy servicing, or claims.

For example, in life insurance, knowledge-intensive processes such as underwriting guidelines, medical rules, and policy terms often slow teams down. Applying AI in insurance here helps underwriters and agents find answers faster, apply rules more consistently, and reduce back-and-forth.

What sets leaders apart:

- They align teams across underwriting, IT, compliance, and cloud infrastructure early.

- They are realistic about cost versus performance and choose tools that can scale without locking them into one vendor.

- They address data challenges upfront, knowing life insurance data often lives in PDFs, medical reports, and legacy systems.

- They invest heavily in training and adoption, knowing that tools only create value when people actually use them.

2. Think End to End, Not Feature by Feature

Strong results come when insurers improve an entire domain, not just one step in the process.

In life insurance, individual improvements, like fraud detection in life insurance applications, faster medical reviews, or better customer communication, each help on its own. But the real impact comes when underwriting, claims, fraud checks, and customer service are improved together.

An end-to-end view allows insights from one step to strengthen another. For example, underwriting data can support later claims decisions, and fraud signals identified early can reduce losses down the line.

The key question leaders ask is: Which life insurance domain would benefit most if improved from start to finish?

3. Use Gen AI Alongside Existing AI

Despite the attention on generative AI, most of the value in AI in insurance still comes from traditional models. Leading insurers understand this balance.

Rule-based systems, predictive models, and analytics already support underwriting, pricing, and claims severity. Gen AI works best when it enhances these systems. For example, call centre analytics can be paired with gen AI to better understand customer intent. Claims severity models can be supported by gen AI tools that help flag prevention opportunities or guide next steps.

The goal is not replacement. It is better coordination across tools.

4. Be Clear on What to Build and What to Buy

Smart insurers are deliberate about where they build custom solutions and where they rely on vendors.

If a capability creates a long-term advantage, such as underwriting logic closely tied to proprietary data, it often makes sense to build in-house. But for functions like CRM integration or document summarization, ready-made solutions may be faster and more practical.

This approach reduces dependency on vendors while keeping internal teams focused on what truly differentiates the business.

5. Design for Reuse from Day One

When insurers choose to build, they avoid one-off solutions. Instead, they create reusable components that can support multiple use cases.

Think shared document extraction logic, common data pipelines, or standard review workflows. These building blocks make it easier to scale new ideas across underwriting, claims, and customer service without having to start from scratch each time.

Over time, this approach improves consistency and lowers maintenance effort.

6. Bring Risk Teams in Early

Risk and compliance cannot be an afterthought, especially in life insurance.

Leading organizations involve risk teams from the very beginning. Together, they define guardrails, monitoring processes, and clear exit options if something goes wrong. Performance is tracked continuously, and systems can be paused if risks emerge.

This early collaboration speeds things up rather than slowing them down. Fewer surprises mean faster approvals and smoother rollouts.

There is no single formula for scaling gen AI in life insurance. But insurers making real progress share a few habits. They focus on meaningful problems. They think in end-to-end terms. They carefully balance build and buy decisions. And they invest just as much in people and processes as they do in technology.

As AI in insurance continues to evolve, these practical choices will separate insurers who experiment from those who truly transform.

Al-Powered Transformation: The Days Ahead

Gen AI is still in its early stages, but the future looks promising. However, insurers must balance AI with caution. They should take trust, governance, and customer safety into consideration while implementing Gen AI.

Emerging Technologies in Gen AI

Emerging technologies like quantum computing and advanced machine learning algorithms will further enhance the capabilities of Gen AI. These innovations will allow for even more accurate predictions, faster processing, and more personalized customer interactions. The key emerging technologies include:

- Smart language models for underwriting

- AI-driven fraud pattern recognition

- Adaptive risk scoring engines

- Voice and text intelligence for customer service

- Document intelligence for policy and claims files

Conclusion

As Gen AI evolves, it will become an integral part of life insurance operations. We can expect to see more accurate risk assessments, increased automation, and a greater focus on personalized customer experiences. Insurers who embrace these changes will be well-positioned to lead the industry into the future.

Gen AI is not just a tool; it’s a real catalyst for transformation in the life insurance industry. By understanding its innate potential and carefully considering the key factors for deployment, insurers can discover new levels of efficiency, customer satisfaction, and profitability. The future of life insurance is here, and it’s powered by Gen AI.