As the insurance industry becomes more digitally advanced, insurers may wonder whether automation continues to offer the same competitive edge as it once did.

The short answer—yes, automation still has a lot to offer to the insurance industry.

While automation has become ubiquitous, it continues to shine by offering streamlined operations and elastic systems that are highly resilient to disruptions and future trends. In fact, as technologies continue to mature, automation is set to become smarter and more intuitive in making insurance businesses more efficient and profitable. Activities such as claims will become increasingly accurate and data-driven to welcome the next generation of insurance claims automation software. The same applies to underwriting, policy generation, customer support, and other value chains.

Before we understand how automation will shape the future of insurance and take a look at the projected trends, let’s explore why claims transformation is the need of the hour.

Table of Contents

Why Is Insurance Claims Transformation Necessary?

Emerging Claims Digital Transformation Trends

- 1. AI-powered Personalization

- 2. Blockchain for Transparency

- 3. IoT and Telematics Integration

- 4. Generative AI for Faster Claims Processing

- 5. Intelligent Document Processing for Automation

- 6. Predictive Analytics for Risk Assessment

- 7. Embedded Insurance for Seamless Claims

- 8. Robotic Process Automation

Rethinking the Role of Automation in Insurance Claims

Insurance Claims Transformation: Future Landscape

Case in Focus

Why Is Insurance Claims Transformation Necessary?

I. Improving Efficiency in Claims Processing

Traditional claims processing is often slow and complex. Manual handling of claims leads to delays and errors. Claims transformation in insurance introduces automation to reduce processing time. AI and machine learning help in quick decision-making, and digital tools streamline claim verification and settlement. Faster claims settlement improves customer trust.

Automated workflows also reduce paperwork and administrative burden. Claims adjusters can, thus, focus on complex cases and insurers benefit from cost savings. Faster settlements boost customer satisfaction. All in all, claims transformation ensures seamless communication between insurers and policyholders.

II. Reducing Insurance Claims Fraud

Fraud is a major issue in the insurance industry, and manual claim handling makes fraud detection difficult. Trends in claims management show the rise of AI-powered fraud detection. AI analyzes patterns to identify fraudulent activities. As a result, insurers can flag suspicious claims early. Predictive analytics prevent financial losses while blockchain improves transparency and security. Automated identity verification ensures legitimacy. Fraud prevention reduces false claims numbers, resulting in reduced operational costs and enhanced trust in the industry.

III. Enhancing Customer Experience

Policyholders expect fast and hassle-free claims processing. As such, delayed claims lead to frustration. Insurance claims transformation focuses on improving customer satisfaction.

Self-service portals provide instant updates, while chatbots answer queries in real time, enhancing the overall customer experience. Personalized services further boost customer engagement by catering to individual needs. Mobile apps enable quick claim submissions, streamlining the process for users. Additionally, digital solutions simplify document submission, making it more convenient and efficient. Customers can also track the status of their claims at any time, fostering a sense of transparency that builds trust with policyholders. Ultimately, this improved experience leads to higher customer retention.

IV. Keeping Up with Evolving Insurance Claims Trends

Insurance is changing with technology as traditional methods fail to match the pace of modern demands. Insurance claims trends show a shift toward digital-first solutions.

AI and automation help reduce delays in the claims process, while IoT facilitates real-time claim assessments. Insurers are increasingly using drones to evaluate property damage efficiently. Predictive analytics enhance risk assessment, allowing for more accurate decision-making. Moreover, digital claims processes align with evolving customer expectations, offering convenience and speed. Additionally, transforming the claims process enables insurers to adapt to new regulations more effectively.

V. Time and Cost Savings

Manual claims handling increases costs as human errors lead to expensive disputes. Claims transformation in insurance cuts costs through automation. Here’s how:

- AI-driven decision-making reduces operational expenses

- Paperless processing saves money on documentation

- AI-powered fraud detection minimizes financial losses

- Cloud-based systems lower IT infrastructure costs

- Faster claims settlement reduces litigation expenses

Efficient workflows facilitated by new-age technologies reduce workforce costs. Insurers can offer better pricing with lower costs.

VI. Ensuring Regulatory Compliance

Insurance regulations are evolving, and compliance failures result in penalties. Trends in claims management highlight the need for automated compliance checks. Here’s how technology helps insurers follow legal requirements:

- Automated reporting ensures transparency

- Blockchain provides tamper-proof records

- AI detects discrepancies early

- Compliance automation reduces the risk of human error

- Secure data storage meets privacy regulations requirements

VII. Using Data for Better Decision-Making

Data plays a crucial role in making better business decisions, especially in the insurance sector. Manual claim assessments often overlook key insights, whereas transforming insurance claims through big data enables smarter and more efficient processing. AI analyzes past claims to make accurate predictions, helping insurers better understand risk patterns. Predictive analytics also aid in identifying fraudulent claims, while machine learning enhances underwriting accuracy. Additionally, real-time data tracking improves risk assessment, allowing insurers to make more informed decisions. As a result, data-driven insights not only enhance customer service but also lead to more accurate policy pricing.

VIII. Adapting to New Customer Expectations

Customers today prefer digital solutions, as traditional claims processing no longer meets their expectations. Recent trends in the insurance industry indicate a significant rise in digital claim settlements, driven by the demand for faster and more convenient processes. Modern customers expect instant claim approvals, and online platforms make filing claims quick and hassle-free. Additionally, AI-powered chatbots provide immediate support, addressing customer inquiries in real time. Personalized services further enhance satisfaction by catering to individual needs. As a result, insurers who embrace digital transformation are better positioned to meet evolving customer demands.

IX. Enhancing Stakeholder Collaboration

Smooth communication improves claim processing while manual coordination slows down approvals. Trends in claims management emphasize digital collaboration. Cloud-based systems connect insurers, agents, and policyholders. Automated workflows eliminate communication gaps while shared databases improve accuracy. Real-time updates enhance teamwork, and digital signatures speed up approvals. Seamless collaboration reduces disputes and strengthens teamwork.

X. Preparing for Future Market Demands

Customers increasingly prefer digital solutions, as traditional claims processing no longer meets their expectations. The insurance industry has witnessed a significant rise in digital claim settlements, driven by the growing demand for faster and more convenient processes. Modern customers expect instant claim approvals, and online platforms simplify the process of filing claims, making it quick and hassle-free. Additionally, AI-powered chatbots offer real-time support, efficiently addressing customer inquiries. Personalized services also play a crucial role in enhancing customer satisfaction by catering to individual preferences. Consequently, insurers that embrace digital transformation are better equipped to meet the evolving demands of their customers.

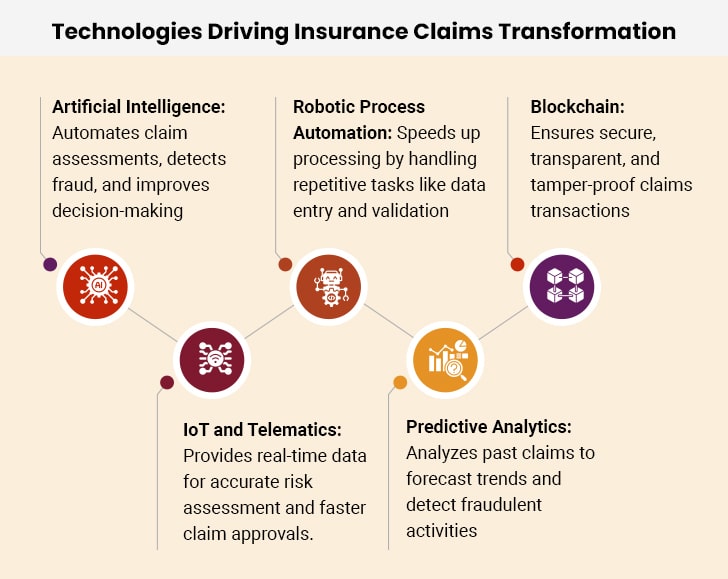

Emerging Claims Digital Transformation Trends

Here are key insurance claims transformation trends that are slated to shape the insurance industry:

1. AI-powered Personalization

Artificial Intelligence (AI) and its subsets have impacted all aspects of the insurance industry, and insurance claims management is no exception. AI-powered claims management systems for insurance companies can collect and analyze troves of customer information. Analyzing the data enables insurers to personalize claims experiences.

Further, by predicting the outcomes of claims, insurers can help individual customers get valuable services that suit their needs. Tailored claims experiences improve customer satisfaction and make the claims process more streamlined and efficient. As AI evolves within claims digital transformation, it infuses a personalized touch into the end-to-end claims process.

2. Blockchain for Transparency

Insurance claims processing is monotonous, complex, and time-consuming. It involves identifying the details of the claim, and assigning it to the right department for further action. As such, Blockchain technology can help refine and streamline the entire claims process.

Blockchain serves as a distributed ledger, allowing insurers to record transactions and share claims information. It enables secure, transparent, and tamper-proof transactions. The parties involved in claims processing can use the ledge to track and monitor how the claim is progressing, right from the first notice of loss to the final settlement.

Moreover, Blockchain-based smart contracts reinforce insurance claims processing automation. They can automatically execute payments to the appropriate party once some predefined terms and conditions are met. While traditionally, the time taken to settle an insurance claim could be anywhere from a couple of days to even a year, claims digital transformation backed by Blockchain allows for instant claim approval.

Ensure Quick and Accurate Insurance Claims Processing and Settlements

3. IoT and Telematics Integration

IoT and Telematics integration form the cornerstone of insurance claims transformation. These technologies enable insurers to collect real-time information from diverse sources, such as automobiles or homes. This information helps insurers make accurate and efficient claim assessments. For instance, IoT devices collect various data points, from driving behavior in auto insurance.

When integrated with advanced telematics systems, the data enables insurers to manage risks proactively and evaluate claims swiftly.IoT and telematics integration helps insurers look beyond traditional claims processing techniques and embrace automation-driven claims digital transformation.

4. Generative AI for Faster Claims Processing

Generative AI (GenAI) enhances claims management by automating key tasks. It detects fraud, assesses damages, and recommends settlements. GenAI-powered chatbots help customers file claims and get instant updates. AI-generated insights improve decision-making and speed up processing. Insurance claims transformation with GenAI makes claims faster, more accurate, and customer-friendly.

5. Intelligent Document Processing for Automation

Handling claims involves sorting through many documents. Manual processing is slow and prone to errors. Insurance claims transformation trends show the rise of Intelligent Document Processing (IDP). IDP uses AI and OCR to scan the documents, extract key data points, and verify the extracted data. This reduces paperwork, speeds up approvals, and ensures regulatory compliance. IDP makes claims processing more efficient and accurate.

6. Predictive Analytics for Risk Assessment

Predictive analytics helps insurers assess risks and streamline claims. AI analyzes past claim data to detect patterns and forecast future claims, allowing insurers to spot fraud, predict claim costs, and improve decision-making. Faster risk assessment leads to quicker claim approvals. Insurance claims transformation with predictive analytics enhances accuracy and efficiency.

7. Embedded Insurance for Seamless Claims

Embedded insurance is changing how claims are processed. It integrates coverage directly into purchases, like when buying a car or booking a trip. This ensures instant policy activation and simplified claims filing. Claims are processed faster since key details are already linked. AI and automation further enhance claim verification and payouts. Insurance claims transformation trends show embedded insurance improving convenience and reducing claim disputes.

8. Robotic Process Automation

Robotic Process Automation (RPA) is transforming claims management. RPA bots handle repetitive tasks like data entry and claim validation, reducing errors and speeding up processing. Automation allows insurers to focus on complex claims while routine ones get processed instantly. Insurance claims transformation trends show that RPA improves efficiency and lowers operational costs.

Rethinking the Role of Automation in Insurance Claims

Automation forms the backbone of insurance claims transformation. However, it offers more than just expediting claims and making claims processing more accurate. The next phase of claims automation forms the future of insurance. Apart from automating routine tasks to boost productivity and efficiency, automation now plays a critical role in augmenting human expertise. It enhances the agent’s skill set and capacity for handling customer queries while retaining a human touch.

Insurance Claims Transformation: Future Landscape

As we prepare to navigate the challenges ahead, the transformative powers of automation will continue bearing fruit. The maturation and refinement of insurance-related operations like claims, customer support, and underwriting through the power of technology will witness a combination of human intelligence and data-led decision-making to improve the customer and policyholder experience. At the same time, the resulting human-tech interface will match the ever-evolving demands emanating from customers or markets. Such holistic growth will help insurance businesses stay competitive and relevant while assisting them to earn a solid, loyal customer base.

Case in Focus

An independent insurance adjusting firm encountered several challenges with its Property Claims Estimation System. The reports generated by the systems were often inaccurate. To combat these challenges, we leveraged AI-based image analysis to transform property damage assessment. Our AI-driven solution eliminated errors, boosted productivity, accelerated claims processing, and empowered the client with agile development methodologies, culminating in enhanced services and a scalable roadmap. To know more, read the complete case study.