Providing superior customer experiences to policyholders has become a necessity for insurers to survive the competition. That said, claims processing is one area where insurance businesses can gain a substantial edge. Traditional, manual claims processes are often slow, inaccurate, and unreliable, frustrating policyholders and insurers.

As more insurance companies are digitizing business workflows, claims automation is a no-brainer. It reduces the turnaround time for claims processing and lowers the cost-to-serve. This transformative approach allows insurance companies to harness the capabilities of advanced insurance claims software and optimize the claims process.

“The first rule of any technology used in a business is that automation applied to an efficient operation will magnify the efficiency.”

– Bill Gates, Co-Founder, Microsoft

Table of Contents

What Are the Challenges of Manual Claims Processing?

What Is the Importance of Customer Centricity in Insurance Claims?

What Is Claims Process Automation?

How Does Claims Process Automation Work?

What Are the Top Five Technologies Enabling Claims Processing Automation?

What Are the Challenges of Manual Claims Processing?

In the times of “instant gratification”, insurance companies relying on manual claims processing methods are missing out on big things. These processes are not only slow, but cost insurance businesses a lot more. Here’s what is challenging in manual handling of claims:

- Slow Claims Resolutions Manual and partially digitized claims processing is time-consuming. It involves various steps, from gathering documents to verifying the details, which usually result in delayed resolution payouts.

- Inaccuracies Manual processes are more error-prone. If the majority of data entry and assessment is done manually, then it may open the doors to litigation or financial penalties.

- Inefficiencies Manual claims processing is tedious, resulting in low productivity. It often results in higher operational costs and causes dissatisfaction among employees.

- Customer Frustration Modern customers expect quick and hassle-free claims settlements. Long and complicated procedures may cause frustration and a lack of trust.

In an industry as intense as insurance, no business can afford inaccuracies, inefficiencies, or customer frustration. To make ends meet, they end up compromising on either customer satisfaction or profits. Both of these results in the insurance company losing its competitive edge. But this is not the right move. Let’s explore why customer-centricity is important in the insurance business.

What Is the Importance of Customer Centricity in Insurance Claims?

There are so many insurance providers in the digital space that customers are spoilt for choice. While this is beneficial for insureds, genuine insurance businesses often struggle to thrive in such a saturated industry. So, what’s the solution? Becoming more customer centric. Here’s why customer centricity in insurance claims is the way forward:

1. Builds Trust with Customers

One good part about the insurance sector is that it is made up of feelings and promises. Policyholders are distressed when they file claims and expect help in those moments. Having a transparent claims process reassures them, whereas delays reduce confidence. Thus, prioritizing customer needs by providing them with fast and fair resolution in those uncertain times helps build trust. Satisfied policyholders renew policies and recommend the company to their peers, doing free “word-of-mouth” marketing for insurers.

2. Improves Customer Retention

A positive claims experience increases retention. Delays in claims processing can cause policyholders to switch providers. Also, a seamless process shows commitment. Besides, the cost of retaining customers is less compared to finding and acquiring new ones. The brownie point is that the retained customer also leads to steady revenue.

3. Reduces Disputes and Complaints

One of the best parts of taking the customer-first approach is that it helps avoid disputes. Insurers can clearly communicate with customers to prevent misunderstandings and elevate their experience. Even more, a fair claims management process paired with a thorough explanation of the coverage reduces frustration and minimizes complaints. This translates to increased efficiency and customer satisfaction.

4. Increases Efficiency in Claims Processing

Gone are the days when policyholders had to wait for days and months to get claims. With every other service being provided almost instantly, they expect the same from insurance. To do so, insurers use digital tools to reduce paperwork and streamline approvals. This speeds up processing, leading to more satisfied policyholders.

5. Aligns with Regulatory Expectations

A customer-first approach helps insurers meet compliance standards and focus on fair treatment. Transparent claims processing facilitated by modern claims automation in insurance helps insurers avoid penalties. Such ethical business practices build credibility, ensuring long-term business success.

6. Helps Differentiate from Competitors

Many insurers offer similar policies. In such cases, customer service emerges as the differentiating factor. A focus on claims experience helps insurers stand out. Policyholders choose companies that prioritize them and make them feel valued. Thus, customer-focused service creates a competitive edge.

As is evident, focusing on customer-centricity is important, It helps the insurance leaders outshine the competition and carve a unique niche in the industry. Thus comes the next important question: how to do so? The answer is to adopt automated claims processing software. Let’s take a detailed look at what claims process automation is, the technologies that enable this, and how it benefits insurers.

What Is Claims Process Automation?

Insurance claim process automation is the application of technology to quickly and accurately process insurance claims. It minimizes manual labor through artificial intelligence, robotic process automation, and other digital technologies.

Automation assists insurers in verifying claims, identifying fraud, and approving payments quickly. It enhances efficiency by eliminating paperwork and human mistakes. Computer systems scan claim information, verify policy information, and uphold regulation compliance. Thus, customers enjoy quicker claims settlement and improved service.

Furthermore, automating insurance claims saves time and money for companies. It also helps streamline claims handling and increases customer satisfaction.

How Does Claims Process Automation Work?

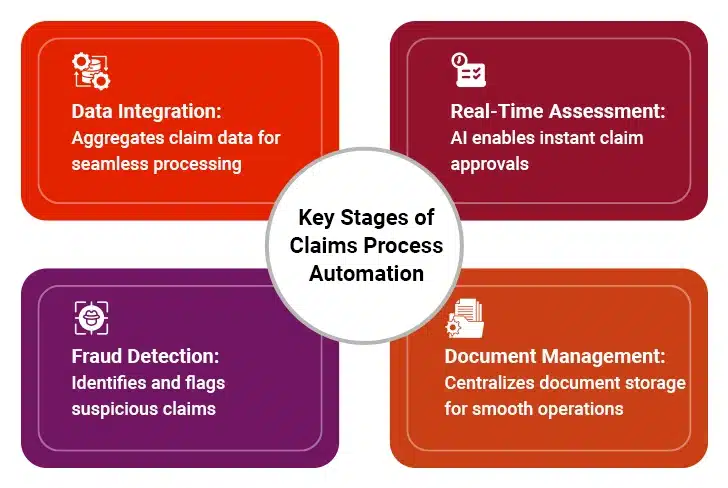

Automated claims processing helps insurers overcome various challenges and improve customer experience. Here is how claims automation works:

I. Faster Data Integration and Capture

Claims automation begins with integrating data from different sources, such as policy documentation, medical reports, and third-party databases. It ensures that relevant data is available at the fingertips.

II. Real-time Assessment

Automated claims management software solutions leverage artificial intelligence and machine learning algorithms for assessing claims in real time. This enables instant approval of simple claims and shortens the processing time.

III. Accurate Fraud Detection

Automated claims systems include fraud detection capabilities that assess past data and flag potentially fraudulent claims for further review. As a result, insurance businesses can reduce fraudulent payouts and streamline investigations.

IV. Efficient Document Management

Modern claims processing software solutions automatically capture and save documents from several sources. This creates a single source of truth for important data and improves communication across systems and departments.

V. Enhanced Customer Experience

Quick and accurate claims processing facilitated by intelligent insurance claims software improves customer experience. Claims automation provides policyholders with real-time access to claims statuses and helps insurers deliver consistent and friction-free claims experiences.

Increase Efficiency with Automated Claims Processing

What Are the Top Five Technologies Enabling Claims Processing Automation?

Insurance has always been a traditional industry. Different technologies, such as artificial intelligence, machine learning, robotic process automation, and more, jointly enable claims processing automation. All these technologies combine to help insurers reap multiple benefits. So, let’s explore these in detail:

1. Artificial Intelligence (AI) and Machine Learning (ML)

Artificial Intelligence and Machine Learning are key technologies that enable processing automation in insurance. AI quickly analyzes claims by reviewing data from multiple sources. It can detect fraud, verify documents, and suggest claim outcomes. ML improves over time by learning from past claims. This reduces errors and accelerates settlements.

Claims automation in insurance also benefits from AI-powered chatbots. These bots answer customer queries and guide them through the claims process, reducing the workload for human agents. AI can also assess claim legitimacy by analyzing policy details and claim history. This helps insurers prevent fraud and false claims.

AI-driven automation in claims processing ensures fairness. It removes human bias and ensures claims are settled based on facts. Insurers can process thousands of claims with AI, reducing manual effort. Faster processing leads to higher customer satisfaction.

Furthermore, AI reduces paperwork and improves accuracy. Insurers use AI to predict claim trends, helping them prepare for future risks. This technology transforms claims automation in insurance, making the process seamless and more reliable.

2. Robotic Process Automation (RPA)

Robotic Process Automation is a key tool for automating claims handling process in insurance. It performs repetitive tasks quickly and accurately. RPA bots can extract data, fill forms, and verify policy details without human help, reducing errors and expediting claim approvals.

One major benefit of insurance process automation is faster document processing. RPA bots can scan and extract information from claims forms, medical reports, and police records, saving time and ensuring accuracy. As a result, claims handlers do not have to spend hours on paperwork. Instead, they can focus on complex cases.

RPA also improves compliance. The bots follow the compliance rules strictly, reducing legal risks. This ensures that claims are processed according to regulations. Insurers also gain better control over claim tracking.

Another advantage of automating the insurance claims process with RPA is cost savings. With fewer manual tasks, insurers spend less on labor. This leads to lower operational costs. RPA allows companies to handle more claims without increasing staff. With RPA-led claims automation, insurance companies improve efficiency and profitability.

3. Optical Character Recognition (OCR)

Optical Character Recognition is another essential technology that helps automate claims processing in the insurance industry. It converts paper documents into digital formats and extracts important information from the digitized documents. OCR reads scanned documents and extracts key details like names, dates, and claim amounts, eliminating the need for manual data entry.

Additionally, OCR speeds up claims automation by processing documents instantly. Claims handlers do not have to type information manually. This reduces errors and makes claims processing more reliable. The system checks for missing or incorrect data before claims move forward.

OCR is also helpful in fraud detection. It compares scanned documents with existing records to find discrepancies. If a document is altered, OCR can detect it. This makes claims automation safer and more trustworthy.

With OCR, customers can submit claims faster. They can upload images of receipts, medical bills, and accident reports, and upload them. The OCR system extracts and verifies the data instantly, making claims processes seamless for both insurers and policyholders.

By using OCR, insurers improve speed and accuracy. They can easily reduce paperwork, reduce costs, and make insurance claims processing more efficient. In fact, OCR is a key part of modern claims automation in insurance.

4. Blockchain Technology

Blockchain enhances claims processing by making transactions secure and transparent. It creates a digital ledger where claims data is stored safely. This prevents fraud and ensures all parties see the same information.

A major benefit of claims automation with blockchain is data security. Once information is recorded, it cannot be changed. This protects insurers from fake claims and tampered documents and also builds trust between policyholders and insurers.

Blockchain also accelerates insurance claims automation by enabling smart contracts. These are self-executing contracts that process claims automatically. When claim conditions are met, payments are released instantly, reducing delays and paperwork.

Blockchain also improves data sharing. Insurers, hospitals, and repair shops can access the same records securely. This removes the need for multiple verifications and speeds up claims settlements.

By using blockchain for claims automation, insurance companies reduce fraud, lower costs, and enhance transparency. It helps insurers process claims faster while maintaining security.

5. Internet of Things (IoT)

The Internet of Things plays a key role in automating insurance claims processes. IoT devices collect real-time data that helps insurers process claims accurately. Smart sensors, wearable devices, and connected vehicles provide instant claim-related information.

IoT devices speeds up investigations and damage assessments. For instance, car sensors record various datapoints during incidents like accidents and send reports directly to insurers. This reduces the time needed to assess damage. In home insurance, smart devices detect leaks or fires, helping insurers verify claims quickly.

This technology also helps reduce fraud. Since data comes from real-time sensors, it is hard to manipulate, ensuring that only valid claims are approved. IoT also helps insurers create personalized policies based on actual usage.

What’s more, IoT enhances customer experience. Policyholders do not need to provide as much documentation since IoT devices send data automatically. This speeds up claim approvals and increases customer satisfaction.

Lastly, IoT reduces the costs of claims automation for insurance providers. Fewer manual inspections mean lower expenses. As IoT adoption grows, it will make claims automation faster, safer, and more accurate.

These are the key technologies that enable claims process automation. Together these technologies create a powerful solution that helps insurers become more customer centric. Let’s explore the “how” in the next section.

How Does Claims Automation Enhance Customer-Centricity?

Customer satisfaction is the key to carving a unique niche in the industry as intense as insurance. That said, becoming customer centric and addressing their needs and concerns is the first step to improving customer satisfaction. Here’s how claims management and automation solutions help insurance companies become more customer-centric:

I. More Efficient Claims Processing

Automated claims management software accelerates end-to-end claims management services. It streamlines claims processes, right from filing to settlement. By setting the record straight right at the beginning, claims automation software helps insurers minimize delays, ensure quick payouts to customers, and enhance customer satisfaction.

In fact, one of the leading motor insurers reported 46% reduction in processing time and 9% increase in customer satisfaction; all thanks to automated claims processing software.

II. Improved Claims Settlement Accuracy

Automating claims processing eliminates the risk of human error, resulting in higher accuracy and consistency in claims management. It also eliminates potential human bias that can influence claims-related decisions. The resulting accuracy ensures that policyholders receive accurate payouts, which fosters an environment of trust.

III. Improved Stakeholder Communication

Automated claims management software allows insurers to communicate with customers in real time. Timely updates on the status of the claim reduce anxiety and lend some assurance. Automating claims processing allows insurance companies to set up two-way channels of communication, making the process even more customer-friendly.

IV. Efficient Document Management

Claims automation software solutions reduce operational overheads and, hence, the loss ratio. Such savings positively impact the end-user as they no longer have to bear the costs associated with it. This makes insurance premiums more affordable and attractive, especially for the uninsured.

V. Streamlined Regulatory Compliance

Automation runs on strict AI/ML algorithms. These algorithms ensure that the claims processing does not divert from any rules or guidelines mandated by a legal or regulatory body. As a result, it maintains a high degree of compliance with prevailing norms and earns customer trust.

VI. Accessibility

With the introduction of automation in the claims process, the self-service portal can be accessed 24/7 without compromising their capabilities. As such, customers can file claims or check status anytime and anywhere. Such convenience makes insurance more customer-centric.

Conclusion

Claims automation software benefits insurance companies in multiple ways. For starters, they make insurance customer-centric. In the pursuit of such customer-friendliness, insurers foster trust into the sector, serving customers more efficiently and accurately, and imbibing the principles of transparency. As a by-product, insurance companies increase profit margins, become more sustainable, and minimize operational costs while staying scalable.

With such promise and potential, it would be safe to assume that automation is the future of insurance claims processing!

Case in Focus

A leading insurer in the USA faced challenges with inaccurate property claims estimation reports, stemming from human errors and unstructured data sources. We helped them implement advanced tools and technologies for claims processing. The AI-assisted approach enables insurers to eliminate human errors, enhance productivity, and improve time to market. For more details, refer to the complete case study.