Data is a valuable asset for businesses. Companies use data to make decisions, improve services, and understand customers. However, bad data can lead to costly mistakes. Inaccurate or outdated information causes errors, delays, and financial losses.

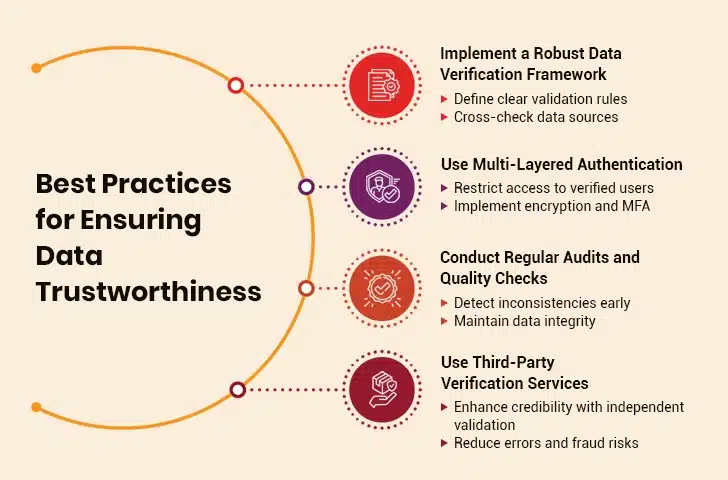

Businesses must follow data validation best practices to ensure reliable data. They need strong verification processes to confirm accuracy and consistency. Simple validation checks are not enough. Advanced data verification services provide deeper checks, improving data quality by eliminating errors and fraud.

Advanced verification helps businesses trust their data. It ensures that customer details, financial records, and system entries are correct. Verified data leads to better decisions, stronger security, and improved customer satisfaction.

This blog explores how advanced data verification and validation services enhance data trustworthiness. It explains key techniques, benefits, and best practices for ensuring reliable data.

Table of Contents

Challenges in Ensuring Data Trustworthiness

Understanding Advanced Data Verification

Advanced Data Verification Techniques

Core Components of Data Verification

How Data Verification Services Enhance Data Trustworthiness?

What is Data Trustworthiness?

Data trustworthiness refers to data being accurate, reliable, and secure. It ensures that individuals and systems can rely on the data they use to make decisions. Untrustworthy data can cause errors, misunderstandings, or even security threats.

Data trustworthiness relies on various conditions. To start with, the data must be correct. This is to say it should be free from inaccuracies, whether caused by human errors, system malfunctions, or out-of-date data. Second, the data must be comprehensive. Omitted data can cause erroneous conclusions. Third, the data has to be consistent. It ought not to exhibit disparate values in disparate locations. For instance, there is an inconsistency if a customer is 30 in one system and 40 in another.

Security is also a key consideration. Data should be shielded from unauthorized access, hacking, or leakage. Firms employ encryption, passwords, and firewalls to protect data. Data also needs to be current. Outdated data can lead to issues, particularly in the rapidly evolving finance and healthcare sectors where maintaining updated databases is crucial.

One way of guaranteeing trustworthiness is through data validation methods. These methods verify whether data is accurate before it is utilized. Format checks, range checks, and duplicate detection are some common methods.

Challenges in Ensuring Data Trustworthiness

- Data Inconsistencies and Errors

Data inconsistencies occur when the same data is displayed differently in various locations. For instance, a customer’s phone number can differ in two company databases. This can mislead employees and result in errors.

Data entry errors are another issue. Individuals can err while typing names, numbers, or addresses. A small error can create huge problems, particularly in banking, healthcare, or customer service.

Data redundancy is another problem. If the same data is entered more than once, it creates ambiguity. A firm can send a customer one email twice, making them irritable. Duplicate data occupies additional storage space and complicates analysis.

Outdated or old data is also a problem. If a company makes decisions based on old data, it may be making incorrect decisions. For instance, a business with old customer addresses may ship goods to the wrong places.

- Risks of Unverified Data

Unverified information is information that has not been verified to be correct. If companies employ unverified information, they might make incorrect decisions. For instance, a hospital employing unverified patient data might administer the wrong treatment.

Fake or manipulated data is another risk. Some people may enter false information for fraud or personal gain. Businesses must verify their data to prevent scams.

Lack of proper data validation techniques increases the risk of using the wrong data. Without format, duplicate, or range checks, errors go unnoticed. A missing decimal point or an incorrect date format can cause problems in reports and calculations.

Cybersecurity threats also affect data trustworthiness. Hackers may change or delete data, making it unreliable.

- Impact of Poor Data Quality on Business and Decision-Making

According to the State of Analytics Engineering 2024 report, poor data quality is the top concern among data professionals. 57% of respondents ranked it as one of the three biggest challenges in data preparation.

Poor data quality can hurt businesses. Wrong data leads to bad decisions. Companies using incorrect sales data may invest in the wrong products. This can lead to financial losses.

Customers lose trust in businesses with bad data. If a company repeatedly sends wrong bills or fails to update customer records, people may stop using its services.

Operational problems also arise. If employees work with incorrect data, they waste time fixing mistakes. This reduces efficiency and increases costs.

Marketing efforts also suffer. If a company’s database has wrong contact details, emails and messages may never reach customers, reducing the success of advertising campaigns.

Understanding Advanced Data Verification

Basic data validation checks if data is in the right format. It ensures that fields are filled correctly. For example, a phone number should have the correct number of digits. An email address should contain “@” and a domain name. These checks help catch simple errors.

Advanced data verification goes further. It confirms if the data is real, consistent, and up to date. It also cross-checks data across multiple sources. For example, an advanced system can verify if a customer’s bank details match government records.

Another difference is in-depth data validation techniques vs. data verification techniques. Data validation techniques check the structure and format of data, while verification techniques confirm accuracy by comparing it with trusted sources.

Advanced Data Verification Techniques

- Cross-referencing with external databases: Data is checked against government or industry records to confirm authenticity. This is common in banking and identity verification.

- Duplicate detection and removal: Advanced tools find and eliminate repeated data entries. This helps maintain consistency and prevents confusion.

- AI-based anomaly detection: Artificial intelligence finds unusual data patterns. This helps detect fraud, errors, or suspicious activities.

- Historical data checks: Data is compared with records to ensure consistency. For example, a person’s address change is verified against their previous addresses.

- Real-time verification: Data is verified instantly at the point of entry. This prevents incorrect data from being saved in the system.

Core Components of Data Verification

1. Data Cleansing

Data cleansing removes errors, inconsistencies, and duplicate entries from datasets.

One key step in data cleansing is identifying incorrect or incomplete data. Duplicate detection follows this step. If a customer appears multiple times in a database with slight spelling differences, the duplicates are merged or removed.

Automated tools help clean data quickly. These tools scan for incorrect values and fix them based on rules. Manual review is also important for complex errors.

Data cleansing is an ongoing process. As data keeps coming in, fixing errors regularly becomes crucial. A strong cleansing system helps organizations maintain high-quality, trustworthy data.

2. Data Standardization

Data standardization provides a consistent format for data across all systems. It eliminates differences that lead to confusion or errors.

Companies apply rules and automation to normalize data. AI applications identify inconsistent formats and standardize them. A standardized dataset is easier to combine, compare, and analyze.

3. Integrity Checks

Integrity checks ensure that data is complete, accurate, and consistent. They help identify missing, duplicated, or incorrect records.

One type of integrity check is referential integrity. This ensures that related data across different tables or databases stays linked correctly. For example, an order record should always have a matching customer ID. If a customer ID is missing, the data lacks integrity.

Another check is data validation. It confirms that values are within acceptable limits. For instance, an age field should not contain negative numbers. Automated systems flag incorrect values for correction.

Integrity checks prevent serious mistakes in business operations. In banking, an incorrect transaction record can cause financial losses.

4. Data Enrichment

Data enrichment improves raw data by adding more useful details. It fills in missing information and enhances existing records.

For example, a customer database may only have names and emails. Enrichment adds phone numbers, addresses, or purchase history. This helps businesses understand their customers better.

External data sources are often used for enrichment. Companies may pull demographic, social media, or geographic data to enhance their records. AI tools analyze and match data from different sources.

Enriched data is valuable for marketing and customer service. A complete customer profile allows businesses to send personalized offers.

5. Compliance and Governance

Compliance and governance ensure that data follows legal and industry rules. They protect data privacy and security.

Many industries have strict regulations for data handling. For example, healthcare must follow HIPAA rules, while financial firms must comply with GDPR. These laws ensure that customer data is collected, stored, and used responsibly.

Failure to follow compliance with rules can lead to legal penalties. Companies may also lose customer trust if data is mishandled.

6. Address and Contact Verification

Address verification ensures that customer information is accurate. It helps businesses avoid shipping delays and lost packages.

Phone numbers and emails also need verification. Fake or outdated contact details lead to failed communication. Automated tools send confirmation messages or calls to ensure that a contact is valid.

Verified contact information improves customer service. Businesses can reach customers without errors. It also reduces fraud risks by confirming user identities.

Regular verification keeps databases up to date. As people move or change numbers, businesses must update records to avoid outdated contacts. Reliable contact details improve communication and prevent wasted resources.

7. Real-Time Verification

Real-time verification checks data instantly as it is entered. It prevents incorrect data from being saved.

Address verification tools suggest correct spellings to avoid mistakes. In banking, real-time verification ensures that account numbers match valid records.

This process improves accuracy and efficiency. Businesses do not have to fix errors later, saving time and resources. It also reduces fraud by verifying identities before transactions are completed.

Real-time verification is used in many industries. Ecommerce sites use it to ensure correct delivery details. Banks use it for fraud prevention. Government agencies use it to verify personal information for official records.

8. Data Auditing and Monitoring

Data auditing and monitoring track changes in data over time. They help detect errors, fraud, and security issues.

Auditing involves reviewing records to find inconsistencies. For example, a financial audit checks if transactions match bank statements. If there is a missing entry, an investigation follows.

Monitoring what happens in real time. Automated tools scan for suspicious activities. In cybersecurity, monitoring detects unauthorized access attempts. In business, it alerts managers when unusual data patterns appear.

Boost Customer Satisfaction with Reliable Data

How Data Verification Services Enhance Data Trustworthiness?

Here are some of the ways in which business verification services contribute to enhancing data trustworthiness within an organization

- Improve Data Accuracy

Data verification services check if the information is correct. They compare data with trusted sources. Businesses get alerts when errors appear. This helps fix mistakes quickly.

Incorrect data leads to bad decisions. A wrong phone number can stop customer communication. A misspelled name may cause confusion. Verification services ensure that every detail is accurate.

Companies use automated data validation techniques and tools to check accuracy. These tools scan data instantly, flagging incorrect entries before they cause problems. Real-time verification makes sure errors don’t get stored.

Accurate data improves business efficiency. Employees don’t waste time fixing mistakes and customers receive correct information. Verified data makes operations smooth and reliable.

- Eliminate Duplicate Records

Duplicate data causes confusion. A customer may appear multiple times in a database. This leads to repeated messages, wasted resources, and poor service.

Verification services detect duplicate entries. They compare names, phone numbers, and addresses. The system merges or removes repeated records, giving businesses a clean and organized database.

Duplicate data also affects financial records. A duplicate invoice can lead to overpayments. Verification tools prevent these costly errors.

Removing duplicates improves marketing. Companies don’t send multiple emails to the same person, which keeps customers happy. A clean database also ensures smooth business operations.

- Ensure Consistency Across Systems

Data should be the same across all platforms. For example, a customer’s phone number must match in all databases. Inconsistencies cause confusion and errors.

Verification services compare data from different sources. They check if the details match in every system. If a mismatch appears, the system alerts users. This helps businesses correct errors quickly.

Consistent data improves communication. Sales, marketing, and support teams work with the same information. This prevents misunderstandings. Customers get better service because their details remain accurate everywhere.

A business with consistent data runs smoothly. Employees trust their information, resulting in improved decision-making. Verified data strengthens company operations.

- Detect and Prevent Fraud

Fraud happens when fake or stolen data enters a system. Scammers use false information to access services. Businesses lose money when fraud goes undetected.

Data verification services stop fraud before it happens. They check identities against trusted records. If the details don’t match, the system flags them. This prevents unauthorized access.

Banks use verification services to check customer identities. Online stores verify payment details before processing orders. These steps reduce financial losses.

Preventing fraud protects businesses and customers. Secure systems build trust. People feel safe when they know companies check their information.

- Validate Contact Information

Wrong addresses and phone numbers create problems. Businesses can’t reach customers. Deliveries get lost. Service requests go unanswered.

Verification services check contact details before use. They confirm phone numbers and emails in real time. If a mistake appears, the system alerts users. This helps businesses update information instantly.

Verified contact details improve customer communication. Companies send messages to the right people. Orders reach the correct addresses. Customer support teams contact clients without delays.

Correct contact details also help marketing. Emails and promotions go to real users. Businesses don’t waste money on invalid contacts. Verification services keep databases accurate and useful.

- Enhance Regulatory Compliance

Many industries follow strict data rules. Governments set laws to protect personal information. Businesses must follow these rules or face penalties.

Verification services help companies stay compliant. They ensure data meets legal standards. If information is outdated or incorrect, the system alerts users. This helps businesses avoid legal issues.

Financial firms use verification to follow KYC (Know Your Customer) rules. Healthcare providers protect patient data with strict checks. Verification ensures businesses meet industry standards.

Following regulations builds customer trust. People feel secure when businesses handle their data correctly. Compliance also prevents fines and legal trouble.

- Support Real-Time Decision-Making

Businesses need real-time data for quick decisions. Delays cause missed opportunities. Inaccurate data leads to bad choices.

Verification services check data instantly. Businesses don’t wait for manual reviews. Systems validate names, addresses, and transactions as they happen. This allows fast and informed decisions.

Retailers use real-time verification to confirm stock levels. Banks approve transactions in seconds. Online platforms verify users before granting access.

Quick decisions backed by real-time insights improve business performance. Companies act quickly without risking errors. Verified data ensures smooth operations.

- Improve Data Security

Unverified data creates security risks. Hackers use fake details to access systems. Data breaches cost businesses money and reputation.

Verification services check if data comes from trusted sources. They block suspicious entries before they enter databases. Businesses get alerts when unusual activity appears.

Secure data reduces cyber threats. Companies protect customer details from fraudsters. Employees work with safe and verified information.

Customers trust businesses that keep their data secure. A strong security system builds loyalty. Verified data keeps organizations safe from cyber risks.

- Reduce Operational Costs

Bad data increases costs and businesses spend money fixing errors. Customer service teams waste time correcting details. For instance, sales and marketing campaigns fail due to wrong contacts.

Data validation services reduce these costs. They prevent mistakes before they happen. Businesses don’t waste resources fixing errors. Employees focus on productive work instead of data cleanup.

Accurate data also improves financial management. Duplicate invoices and incorrect payments decrease. Companies save money by preventing billing mistakes.

Saving money helps businesses grow. Data validation services turn data management into an efficient process. Companies run smoother and spend less.

- Increase Customer Trust

Customers expect businesses to have the correct data. They get frustrated when companies use wrong names, addresses, or details.

Data verification services keep customer data accurate. Orders reach the right place. Support teams provide better service. Personalized offers go to the correct people.

Trust builds when businesses handle data correctly. Customers return to companies they trust. They feel valued when businesses communicate accurately.

Satisfied customers improve business success as they leave positive reviews. They recommend services to others. Verified data strengthens customer relationships.

Ensure Data Accuracy with Our Data Verification Services

Bottom Line

Every business, irrespective of size, needs a structured data verification workflow in place to prevent unnecessary mishaps and poor decision-making. Organizations can establish a solid foundation of trustworthy data by using advanced data verification services. This, in turn, improves operational efficiency, supports informed decision-making, enhances customer experiences, and enables organizations to derive meaningful insights from their data assets. However, to reap these benefits, businesses must choose the right service provider who stays abreast of data validation best practices, technological advancements, and industry trends.