Insurance brokers continually face a multitude of challenges that impede their ability to effectively manage clients and drive growth. From navigating complex regulations to grappling with cumbersome paperwork and disparate data sources, brokers encounter obstacles at every turn. Moreover, with the advent of modern technology, the paradigms of the insurance broker industry have changed.

As such, the insurance industry presents a flood of new opportunities for brokers. To adapt to this changing landscape, technological alliance with the basics of client management is essential. According to Statista, the global insurance industry is expected to reach approximately 8.4 trillion USD by 2026, thereby making it clear that brokers need innovative tools like insurance broking management systems to stay ahead of the competition.

From driving operational efficiency and reducing costs to enhancing customer experience and improving revenue growth, insurance broking management systems offer several benefits. In an era marked by change and disruption, adopting this innovative tool is crucial for future-looking brokers.

Overcoming Common Insurance Broking Problems

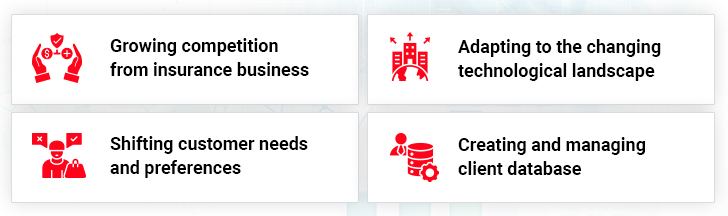

Owing to rapid technological advancements, market disruptions, changing customer behavior, and stringent regulations, brokers face a number of challenges on a day-to-day basis. Insurance brokers can mitigate a majority of these challenges by adopting digital solutions such as a comprehensive insurance broker software that enables them to transform their core processes by leveraging the capabilities of automation. These solutions allow brokers to eliminate unnecessary complexities, automate mundane tasks, connect offices, and discover opportunities.

The technological upheaval has worked well for the insurance brokers as it completes insurance analytical data handling requirements with a capable broker insurance management system. It acts as a user-friendly and customer-oriented system that helps the insurance brokers generate maximum leads with better management of the required resources and data. The all-in-one system arms farsighted and proactive brokers with the ammunition they require to conquer challenges and achieve goals.

The Need for Insurance Broker Software

Here is how insurance broker software helps brokers streamline their growth in the cutthroat competition of the market:

1. Technology that Drives CRM with Ease and Care

Customer Relationship Management (CRM) is of utmost importance for insurers, so it must be secured with maximum efficiency. Insurance brokers face challenges of keeping up with a wide client base and their varied requirements. The solution is well-implicated with CRM boosters that enable brokers to effectively manage administration, client services, and quote processing. It also offers a customer portal and configurable mobile app for automated help.

Insurance broker automation software helps in managing multiple lines of Insurance such as Property & Casualty, Life, and Health while concurrently offering flexibility to easily manage employee benefits along with enabling the brokers to automate the premium entry process.

2. Digital Document Repository for Easy Data Handling

Surpassing the conventional forms of cumbersome data storage techniques, modern Insurance broker software provides the Digital Document Repository (DDR) as an easy to use and scalable equipment that can manage and balance the load of millions of documents. It stores practically any type of file and organizes all the stored documents as well as the ones uploaded from outside the system linked to specific transactions. This provides an easy and handy way for organizations to improve security, increase compliance, streamline operations and thus provide a better framework for business comparisons while reducing the use of paper and saving both time and money.

3. Mobile Application to Fast Track Business Communications

Moving along with the technological lines of innovation, every industry has widened its approach to reach smartphones, given the huge base of smartphone users in today’s connected world. This poses a challenge for insurance brokers as most of their customers prefer using smartphones for industry-related actions and it underscores the need for a mobile-friendly mechanism for insurance brokers.

The mobile application brings the client and policy information from the Insurance broker management system to mobile devices in the forefront and lets the brokers be well-connected even when they are on the go. This eliminates the informational gap between the insurance broker and the customers as the synchronization enables the insurance broker to keep customer and policy information current and safe across systems.

Enjoy Mobile Accessibility with Insurance Broker Software

4. Automation that Supports Business Growth Prospects

The insurance broker automation software shapes the path forward for insurance brokers in a competitive industry for generating leads and helping their businesses in all possible ways. Insurance broking software provides automated solutions to various challenges faced by brokers with different modules for a single, unified focus on customer view in focus. The automation capabilities of this software and its various modules simplify the difficult and complex tasks that are a part of brokerage management. Brokers can thus achieve higher operational efficiency in their daily business processes with less effort.

5. Enhanced Security and Compliance Management

When it comes to insurance brokerage, the path for digitalization can be complex. It is marked by the need to balance tech adoption with regulatory compliance. Modern insurance broker software solutions come equipped with robust data security features such as encryption, access controls and audit trails. This not only bolsters data privacy but also ensures compliance with the regulations governing the industry.

By centralizing data within a secured environment, insurance broking software further minimizes the risks associated with manual data handling. Moreover, by investing in broker software that automates compliance monitoring, brokers can adhere to ever-changing regulatory standards with ease.

Conclusion

Easy-to-configure broker management software offers flexibility and scalability to insurance brokers. This makes it capable of working with multiple insurance companies in conjunction. Technologically equipped insurance brokers benefit from the automated mechanisms of broker software management systems, which facilitate growth beyond the traditional methods that consume significant time and resources. In today’s time, the right insurance broker software solutions offer endless growth opportunities for Insurance brokers.