In today’s fast-paced insurance landscape, staying competitive means more than just keeping up with technology—it’s about using it to transform everyday processes. That’s where intelligent automation steps in. It’s not just a buzzword; it’s a game-changer for insurers looking to streamline tasks, improve policyholder experience, and make smarter decisions. Whether it’s automating underwriting, speeding up claims processing, or enhancing fraud detection, the impact is undeniable.

As automation in insurance becomes all-pervasive, it is time to explore how it transforms industry’s business processes. In this post, we take a look at some of the practical use cases of automation in the insurance industry.

What is Intelligent Automation?

Intelligent automation in insurance is a disciplined approach to rapidly identifying, vetting, and automating as many processes as possible. What sets it apart from regular automation is the fact that it involves the orchestration of diverse technologies, tools, and platforms such as, inter alia, Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA), etc.

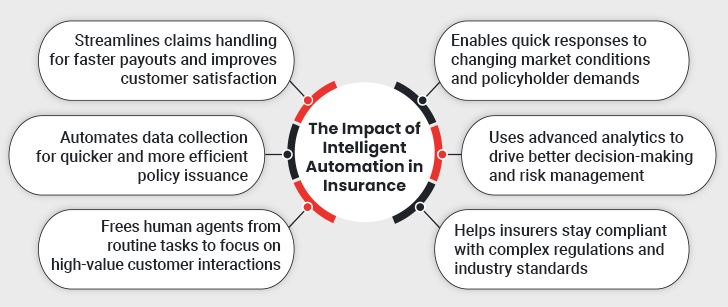

Benefits of Intelligent Automation in the Insurance Industry

The infusion of intelligent automation into insurance business processes offers the following benefits-

Key Insurance Intelligent Automation Use Cases

Any technology is only as useful as its applicability. On that note, the following are some use cases of intelligent automation in insurance:

1. Claims Processing

Claims processing is singularly the heavyweight champion of all insurance processes. It involves the review of claims-related details from disparate sources, standardization of data formats, sorting through piles of information, verifying the same, and working with it. Such a series of activities typically takes about a week – if everything is in order. This timeline could stretch up to 30 days, depending on several factors. However, intelligent automation has the potential to reduce this timeline by reducing manual effort through bots. These smart bots automatically accept, review, and verify data to approve claims. As for the one-off typical case that may show up along the way, the bot escalates it for manual processing. This helps insurers save the bulk of their time and resources.

2. Policy Management

Significant documentation is involved prior to the issuance of a policy. At this stage, the insurance agent or broker accepts all the documents, compares them, and communicates any discrepancies with the policyholder. At the same time, they also save, upload, and organize the said documents in the internal databases, systems, and platforms. While managing such hordes of data manually is complicated, the problem worsens if the policyholder wants to make changes in the policy details. These changes have to be reflected across all channels, lack of which may give rise to possible errors.

Intelligent insurance business process automation involves software that leverage Intelligent Document Processing (IDP) to seamlessly collect data from various touch points—such as emails and call transcripts—while the bots implement the requisite changes uniformly.

3. Fraud Detection

Between 10% and 20% of insurance claims are fraudulent, with policyholders committing $35.1 billion in fraud by lying on their insurance applications to get a better rate. Despite being such a pressing issue worldwide and not just in the United States, insurance fraud is a tough nut to crack. False claims, internal fraud, etc. are on the rise, and the sheer volume of claims makes it nearly impossible to handle them all manually.

Against this backdrop, the blend of intelligent automation and RPA in insurance, offers considerable relief through smart data processing. For starters, it automatically screens all claims and verifies them against their respective insurance policies. At the same time, it profiles the claimant and checks their history and activities to note any anomalies. This proactive assessment allows insurance agencies to carry out a major crackdown on potential insurance fraud. Additionally, the automation of internal processes shields it from internal manipulation and puts an end to fraudulent practices. As such, hyper-automation serves as a breath of fresh air for carriers drowning in claims.

Don’t Let Manual Processes Hold You Back!

4. Policy Underwriting

Policy underwriting is as laborious as claims processing or fraud detection. It involves the collection of large amounts of data from various sources as well as the exhaustive review and analysis of the same to make an informed decision on the risk associated with an insurance policy.

Intelligent automation streamlines policy management by deploying bots to collect key details across multiple channels and systems. The resulting information helps chart the coverage data and create reports on the claim volumes. The resulting data acts as fodder for generating an accurate risk factor for a given policyholder.

5. Document Ingestion and Data Management

Insurance is a data-intensive industry. Every touchpoint or interaction involves heavy data transfers, regardless of the platform, data format, or other variations. Hence, reading, comprehending, and analyzing this data manually and deriving insights from it is nearly impossible. Intelligent automation optimizes this process through intelligent document processing or IDP. IDP helps insurers understand data and its meaning and extract future outcomes from it. As a result, it becomes easier to extract, sort, interpret, and work with data without worrying about compatibilities. Moreover, automation carries out the entire process in little to no time as it converts all the information into its simplest form and segregates it for easier data consumption.

Closing Thoughts

If robotic process automation (RPA) in insurance brought about a revolution in the industry, then intelligent automation is ready to take it to the next level of efficiency. It also prepares the insurers for the new era of connected experiences, which is anticipated to be a prominent theme of the future. The resulting improvement in products and services reduces operational costs, mitigates risks, and enhances the customer experience in meaningful ways. As such, it puts the insurance industry on the meteoric rise to sustainable success.