The insurance industry has long been slow to embrace change, but digital transformation is now in full swing. AI and machine learning (ML) are reshaping underwriting, enhancing accuracy, cutting processing time, and improving operational efficiency.

From refining risk assessment to automating quote generation, ML enables insurers to make smarter, data-driven decisions while streamlining workflows. This blog dives into key ML applications in underwriting and their impact on businesses and the industry. Let’s explore how ML is revolutionizing underwriting.

Table of Contents

Key Drivers of Machine Learning in Insurance

- Conversational Capabilities

- Harnessing IoT Data

- Expanding Open-Source Ecosystems

- The Rise of Intelligent Automation

Underwriting 2.0: The Transition to Intelligent Underwriting

Machine Learning in Insurance Underwriting: Key Use Cases

- Automating Submission Triage

- Optimizing Submission Processing

- Enhancing Risk Assessment Accuracy

- Refining Premium Pricing

- Enhancing Coverage Recommendations

The Transformative Impact of Machine Learning in the Insurance Industry

Key Drivers of Machine Learning in Insurance

1. Conversational Capabilities

Natural language processing (NLP) algorithms are continuously evolving. AI is becoming more adept at interpreting spoken language and recognizing faces, making interactions smoother and more intuitive. Insurers are now integrating chatbots into their systems to streamline communication and optimize customer experiences.

2. Harnessing IoT Data

The rapid influx of data from the Internet of Things (IoT) is pushing the need for automation to generate actionable insights. Advanced machine learning models are key to handling this demand. To that end, insurers harness dedicated teams to oversee and refine machine learning processes, such as neural networks. As such, training systems, rather than manually programming them, have become more popular.

3. Expanding Open-Source Ecosystems

As data becomes more widespread, open-source frameworks are gaining traction, ensuring seamless data exchange. Insurers collaborate with insurtech companies to develop ecosystems that facilitate data-sharing across multiple applications while adhering to unified regulatory and cybersecurity protocols.

4. The Rise of Intelligent Automation

Insurers are increasingly leveraging advanced machine learning to streamline operations, enhance decision-making, and improve customer experiences. From automated claims processing and fraud detection to dynamic underwriting and risk assessment, AI-driven automation is transforming every aspect of the insurance industry.

Underwriting 2.0: The Transition to Intelligent Underwriting

In the insurance sector, traditional manual underwriting has long been associated with mountains of paperwork—physical and digital—and extensive back-and-forth communication between clients and agents. Underwriters spend significant time entering, verifying, and rechecking submitted information. On top of that, assessing a client’s risk profile to determine policy eligibility and conditions remains a labor-intensive and time-consuming task.

A survey by Capgemini examined the time underwriters dedicate to routine administrative duties. The results revealed that nearly half (41%-43%) of underwriters spend almost a third of their time on such tasks. Also, a quarter (25%-26%) reported that their working hours are consumed by activities involving agent/broker collaboration and sales.

Despite these efforts, manual underwriting often results in human errors, operational inefficiencies, and rising costs due to the excessive use of skilled professionals for non-strategic work. Instead of leveraging automation to optimize underwriting expertise, insurers continue to struggle with outdated processes.

However, the rapid advancement of artificial intelligence (AI) and machine learning (ML) suggests that traditional underwriting may soon become obsolete. According to the Conning Survey, 77% of insurers are in some stage of adopting AI in their value chain, and at least half believe AI and ML will be essential for the industry’s future.

This shift is understandable considering the advantages of intelligent underwriting. AI-driven algorithms allow underwriters to analyze risks more effectively, enhance pricing accuracy, and accelerate application processing. With ML and deep learning, underwriting timelines shrink from days or hours to mere minutes as most processes become automated and data-driven.

New technology enables underwriters to focus more on building and strengthening relationships in the field, often serving as the primary link between their company and the marketplace.

Predictive underwriting offers substantial benefits, but how does machine learning enhance the insurance underwriting process? Let’s find out.

Optimize Underwriting Operations With AI-ML Technologies

Machine Learning in Insurance Underwriting: Key Use Cases

Here are some common use cases of machine learning in insurance underwriting:

I. Automating Submission Triage

One of the most important applications of machine learning in insurance underwriting is automating submission triage. This involves utilizing AI-driven algorithms to efficiently sort and allocate applications to underwriters based on predefined criteria. By integrating predictive underwriting, insurers streamline workflows, ensuring that submissions are prioritized appropriately and processed more swiftly.

For instance, an ML-enhanced underwriting system categorizes applications according to their complexity and assigns them to underwriters with the necessary expertise. Another practical application involves prioritizing submissions based on the type of insurance coverage—life, health, travel, or property insurance—and directing them to specialists with the most relevant experience.

II. Optimizing Submission Processing

Reviewing large volumes of documents under tight deadlines is inefficient and error-prone when done manually. Machine learning (ML) and artificial intelligence (AI) streamline this process by automatically extracting data from PDFs, handwritten documents, and emails. Technologies like optical character recognition (OCR) and natural language processing (NLP) help insurers quickly search, retrieve, and process critical information. With ML in the insurance industry, underwriters save time and improve efficiency by automating data entry, ensuring smoother submissions.

III. Enhancing Risk Assessment Accuracy

After a submission is received, assessing its risks is crucial. ML-powered systems help by evaluating risks more accurately. Instead of relying solely on applicant-provided data, which may have errors or omissions, machine learning provides access to broader data sources like social media, banking records, and public reports. This results in a more thorough risk analysis. AI-driven systems use text classification to compare data against industry benchmarks, enhancing accuracy and operational efficiency.

IV. Refining Premium Pricing

Every risk assessment in underwriting concludes with determining the coverage amount and the premium an insurer is willing to offer—assuming they choose to provide coverage at all. Interestingly, a study highlights a case where a small business owner sought commercial insurance and received vastly different coverage quotes. Upon comparison, the premiums varied by USD 500.

Setting the right premiums in the insurance industry is no easy task. Traditionally, insurers have relied on the “cost-plus” method, which calculates risk-based pricing by factoring in direct and indirect costs and a profit margin. While this approach is functional, it has notable limitations. It fails to incorporate external pricing influences and cannot adapt swiftly to market fluctuations. When premium pricing does not align with prevailing market conditions—whether set too high or too low—the outcome remains the same: increased underwriting costs, reduced revenue, and shrinking profit margins.

Now, imagine integrating AI and ML-driven insights into underwriting analysis. Identifying optimal pricing structures in this scenario involves leveraging a far wider range of data sources, such as:

- Geospatial Information Systems (GIS)

- Predicted real estate market trends

- Geopolitical risk factors

- Climate and weather forecasting

- Real-time insights from IoT networks

- Social media analytics

- Other proprietary data sources available to insurers

Beyond achieving fairer premium pricing, insurers provide more customized quotes to policyholders. Today’s advanced AI and ML underwriting solutions adjust premiums based on individual user behavior and specific variables, such as kilometers driven or cargo transported. This shift toward AI-powered pricing models enables a more personalized and customer-centric approach to risk-based premium calculations.

Dynamic Policy Pricing: Traditional vs Intelligent

| Dimension | Traditional Pricing | AI/ML-Based Pricing |

|---|---|---|

| Pricing Vision | One-size-fits-all pricing | Differentiated pricing tailored to market conditions |

| Model Development | Complex mathematical models | Flexible model complexity |

| Data Usage | Manual, labor-intensive data input | Automated data extraction, transformation, and loading |

V. Enhancing Coverage Recommendations

In the insurance sector, the underwriting process concludes with presenting the applicant with the most suitable coverage option. AI and ML technologies are crucial in refining this step. Based on industry insights, ML-powered recommendation engines assist insurers in making informed coverage decisions. By analyzing historical insurance data and past underwriting submissions, these intelligent systems determine the most appropriate coverage for each applicant, including specific limits and deductibles tailored to their unique case.

This approach results in a more customized offering that aligns with the applicant’s needs and risk profile, ultimately boosting conversion rates and fostering long-term customer loyalty.

The Transformative Impact of Machine Learning in the Insurance Industry

Here’s how machine learning in insurance transforms underwriting and other processes:

- Enhanced Accuracy

Underwriting often involves multiple layers of review, with a single submission passing through several hands. The greater the number of manual touchpoints, the higher the chances of errors. Human fatigue and monotony lead to mistakes—something ML algorithms are immune to. By integrating an ML-driven underwriting system, insurers significantly enhance the precision of risk assessments. Moreover, ML models are adept at handling incomplete or redundant data, as they are trained on extensive historical datasets.

- Reduced Workload for Employees

Underwriting has traditionally depended on human expertise, and this will continue to be the case. However, incorporating AI and ML into underwriting processes helps ease the workload on underwriters by automating tedious and repetitive tasks. This allows professionals to concentrate on more complex and intellectually stimulating risk evaluations.

With technology and machine learning, much of human underwriting is eliminated. The proportion of insurance applications requiring human intervention will decrease dramatically—potentially from 80% to 90% down to the low single digits.

- Improved Customer Experience

Delivering exceptional customer service is a top priority in any industry, especially insurance. As discussed, AI-powered underwriting enhances efficiency by enabling faster and more precise processing. Additionally, ML introduces greater personalization to underwriting, tailoring coverage to individual needs.

Here are some specific ways ML elevates customer experience in underwriting:

- Personalized car insurance rates based on various driving metrics and individual driving behavior.

- Dynamic application forms that adjust questions based on the applicant’s responses, streamlining the process.

- More precise property insurance pricing by leveraging object recognition to assess the physical condition and materials of insured assets.

- Enhanced Fraud Detection

Machine learning helps detect fraudulent claims by analyzing volumes of data for unusual patterns. ML algorithms learn from historical fraud cases to flag suspicious activities, leading to fewer false claims and more secure insurance processes. Machine learning also continuously improves its fraud detection capabilities by adapting to new tactics used by fraudsters. Over time, the system becomes smarter and capable of identifying subtle patterns that traditional methods might have overlooked.

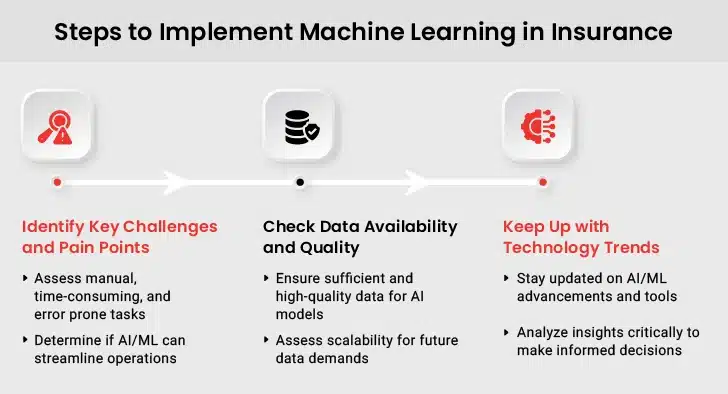

How to Successfully Implement Machine Learning in Insurance

- Identify Key Challenges and Pain Points

Before adopting AI or ML in insurance, organizations must assess their challenges. This isn’t about a quick review with optimism. An honest evaluation means digging into tasks and processes where AI or ML could make a difference. Businesses should weigh the benefits and decide if the technology is a good fit. Understanding the problem and how AI solves it is crucial. A biased view clouds the judgment and leads to poor decisions.

If done right, the evaluation offers many benefits. It highlights time-consuming manual work, complex data analysis, and error-prone tasks. Identifying these weak spots helps determine whether AI or ML streamlines operations and boosts efficiency. The goal is to free up employees for higher-level thinking—where their skills truly matter.

- Check Data Availability and Quality

AI and ML depend on data. Without data, they don’t work, and many executives overlook this. Prerequisite. The first step is ensuring data exists before considering AI or ML.

Next, organizations must verify if they have enough quality data to train these models. Having data isn’t enough—it must be reliable and representative of business processes. Poor-quality data leads to poor AI outcomes.

Another key factor is scalability. Current data systems may work now but might not handle future growth. If AI or ML implementation increases data demands, insurance businesses must ensure their infrastructure can keep up.

- Keep Up with Technology Trends

AI and ML evolve quickly, and new techniques and tools emerge constantly. Staying informed helps businesses spot opportunities and find better ways to use these technologies.

Learning from others is valuable. Read online reviews, attend webinars, and follow industry leaders for insights. Everyone has a different perspective, and some may be selling a product or idea. It’s important to analyze information critically. Still, staying updated ensures businesses make smart, informed decisions about AI and ML adoption.

Conclusion

As the insurance industry faces an overwhelming influx of data and a technological shift, more insurers recognize the value of incorporating AI and ML solutions. These tools help transform complex data into actionable insights, allowing insurers to make faster and more informed decisions. Underwriters benefit from ML-driven systems by:

- Prioritizing submissions and directing them to the right specialists

- Speeding up the document processing during application reviews

- Enhancing risk calculation accuracy

- Identifying optimal premium rates

- Offering personalized proposals to clients

By embracing machine learning in the insurance industry, insurers move beyond traditional methods, transforming risk assessment, claims processing, and customer interactions. The result is a smarter, faster, and more adaptive insurance experience that meets the demands of a rapidly evolving industry.