Artificial Intelligence (AI) finds widespread usage in several industries, and the insurance sector is not immune to its impact either. The advancements in AI, in the form of Machine Learning, Deep Learning, Natural Language Processing, Generative AI, and Convolutional Neural Networks, to name a few, are bringing about a seismic, tech-driven shift.

In fact, it is believed that insurance will soon let go of its ‘detect and repair’ approach and embrace a more futuristic ‘predict and mitigate’ focus. This dramatic transformation unlocks various avenues for AI to infiltrate the insurance sector. Hence, it should come as no surprise that the global artificial intelligence (AI) in insurance market is valued at USD 8.13 billion in 2024 and is expected to grow to approximately USD 141.44 billion by 2034, with a compound annual growth rate (CAGR) of 33.06% from 2024 to 2034.

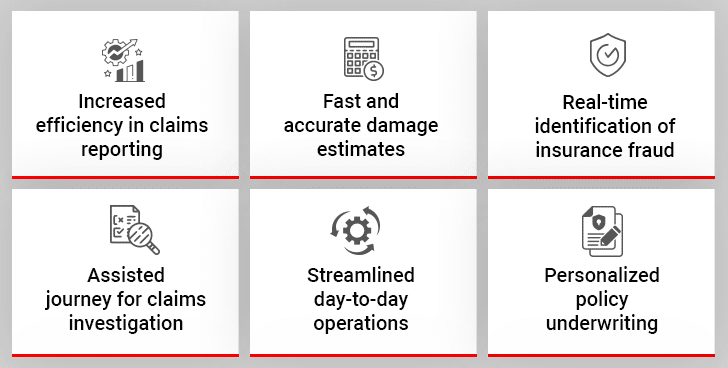

By leveraging Artificial Intelligence in insurance, the insurance players gain a host of benefits such as better productivity, enhanced customer experience, efficient claims management, reduced frauds, and more. Let us look at the role played by AI in the insurance industry and how it’s revolutionizing it.

What is AI in Insurance?

AI in insurance refers to the application of artificial intelligence, automation, and advanced technologies to enhance the efficiency and effectiveness of insurance services.

Like other financial sectors, the insurance industry relies heavily on data to make informed decisions. This data helps insurers determine the appropriate coverage for individuals and calculate premiums accurately. By leveraging AI, insurers analyze this data more effectively, enabling better decision-making, improved customer service, and optimized operational outcomes.

Role and Use of AI in Insurance

Artificial Intelligence technology plays a groundbreaking role as the leading technology trend in the insurance industry. It has upgraded how insurers carry out underwriting, adjudicate and process claims, manage policies, and detect fraud—to name just a few common AI in insurance use cases. In short, it influences the entire insurance value chain—just like predictive analytics, which is a thriving example of AI in action! Add to this the fact that companies are now swimming in data, which makes it far easier to train AI/ML models to perform efficiently across the different implementations in the industry.

Much like other emerging insurance technologies, AI is implemented across different insurance value chains. AI in the insurance industry helps play a preventive and curative role in various ways. Generative AI, a subset of Artificial Intelligence, adds a new dimension to the capabilities of AI in insurance. For instance, Generative AI models simulate different scenarios and their potential impact on insurance portfolios, enabling insurance businesses to enhance risk management.

Benefits of AI for Insurance Companies at a Glance

1. Claims Reporting: First Notice of Loss (FNOL)

Based on how advanced the AI systems are, insurers can report, route, triage, and assign claims with or without human intervention. Digital assistants, paired with Natural Language Processing (NLP) and automatic speech recognition, effectively and efficiently manage the First Notice of Loss (FNOL) reporting process. This not only enhances productivity but also makes processes lean.

There are numerous advantages of implementing conversational AI for insurance companies. Insurance chatbots an efficiently facilitate the claim reporting process.

Customers use the chatbot for reporting an incident from any place and at any time. The AI-driven chatbot thereafter disseminates the information to the concerned individual for further processing.

2. Better Insurance Claims Management and Investigation

The conventional investigation method used for identifying and detecting dubious claims consumed a lot of manual effort and time. It required thorough monitoring of claimants for suspicious activities. Due to the lack of time available to get the job done, this approach is not successful in a competitive industry like insurance. Also, increasing the staff for investigation adds up to the cost.

Insurers leverage AI tools to streamline their claims assessment and settlement process. AI regulates all processes, from data-capturing, claims creation, authorizations, approvals, and payment to recovery tracking. When paired with other applications, such as fraud detection, companies develop a streamlined, automated, and data-driven end-to-end claim processing ecosystem devoid of human error or bias. All in all, adopting AI in insurance claims management and settlement offers numerous benefits.

3. Improved Loss Estimation for Low Claims Leakage

Businesses are migrating to digital platforms to leverage various benefits, and the insurance sector is not lagging. The advent of disruptive technologies like deep learning algorithms, image recognition systems, and artificial intelligence in the insurance sector has contributed to transforming the business landscape.

By harnessing the potential of machine learning in insurance, insurers predict or assess the damage based on the photo of the damaged object. Hence, AI for claims management has proven to be the ideal technology. Implementation of AI for insurance companies helps with potential loss assessments and recommends the parts that may need to be repaired. This, in turn, makes loss estimation quick and efficient.

4. Optimized Routine Operations for Improved Efficiency

AI-driven chatbots have already gained traction in the sphere of customer service. In the insurance industry, these chatbots can enhance scalability and take the load off of human resources for more critical matters. At the same time, the chatbots can play to their strengths and cross-sell or upsell products depending on the customer profile and history. In short, AI can help tap into various thrust areas of improving overall customer experience.

AI-driven chatbots have already gained traction in customer service. In the insurance industry, these chatbots enhances scalability, relieving human resources from routine tasks so they are able to focus on more critical matters. Meanwhile, chatbots leverage customer profiles and histories to cross-sell or upsell products. In short, AI enables insurers to improve the overall customer experience in multiple ways.

5. Proactive Fraud Detection and Prevention

Insurance fraud accounts for losses amounting to approximately USD 40 billion per year. And this figure applies to the US alone. Naturally, this number is significantly higher on the global scale. Numerous surveys show that many insurance providers are turning to technology to detect and prevent fraudulent activities.

AI plays a pivotal role in finding patterns in historical data, which helps in the early detection of claims fraud and prevents it from taking place. As a result, insurance businesses perform a holistic risk assessment before offering their services.

6. Personalized Insurance Policy Underwriting

The traditional insurance policy underwriting processes relied heavily on standardized criteria and were hands-on and labor-intensive. Underwriters would manually evaluate the insurance risk of a customer, based on different factors such as income, medical history, etc. By leveraging AI in insurance underwriting, insurance businesses create personalized risk profiles for individual customers. AI algorithms assess troves of data from various resources to offer meaningful insights into customer behavior and risk propensity. Insurers also use data-driven insights to customize insurance offerings and pricing. This results in improved profitability and competitiveness in the insurance market.

Leverage AI to Fast-Track Insurance Operations

Emerging AI Use Cases in Insurance

AI-powered technologies are rapidly becoming integral to our daily lives—powering operations in businesses, homes, vehicles, and even on our person. The growing competition significantly accelerated the adoption of digital solutions, forcing insurers to adapt quickly to remote workforces, enhance digital distribution capabilities, and strengthen online channels. While substantial investments in AI may be limited, the increased emphasis on digital transformation has positioned insurers to integrate AI more effectively into their operations.

Here are five key AI use cases that are poised to redefine the insurance industry:

I. Leveraging Data from Connected Devices

Industrial equipment outfitted with sensors has been common for years, but the number of connected consumer devices is set to surge dramatically. Existing devices such as cars, fitness trackers, home assistants, smartphones, and smartwatches continue to see rapid adoption, while newer categories—like connected clothing, eyewear, appliances, medical devices, and even footwear—are gaining traction.

Experts predict an extraordinary increase in connected devices, generating a wealth of data. The global number of Internet of Things (IoT) devices is projected to nearly double, rising from 15.9 billion in 2023 to over 32.1 billion by 2030. This vast influx of information will enable insurers to understand their clients better, fostering the development of new product categories, tailored pricing models, and real-time service delivery.

II. Adopting Physical Robotics for Risk Management

The robotics sector is making significant strides, transforming how humans interact with their environments. Innovations such as additive manufacturing, or 3D printing, are expected to revolutionize manufacturing processes and commercial insurance products. Autonomous technologies, including drones, farming equipment, and surgical robots, are becoming more prevalent, while advancements in autonomous vehicle capabilities continue to reshape transportation.

As robotics become more integrated into daily life and industries, insurers must anticipate shifts in risk patterns, evolving customer expectations, and opportunities for novel products and distribution channels.

III. Building Open-Source and Data Ecosystems

With data becoming increasingly pervasive, open-source protocols facilitate data sharing across industries. Public and private entities are expected to collaborate on ecosystems that enable secure and regulated data exchange for various applications. For instance, data from wearables could be directly shared with insurers, while connected home and auto data may be accessible through platforms provided by major technology companies and device manufacturers. These ecosystems unlock new opportunities for insurers to leverage data innovatively.

IV. Enhancing Cognitive Capabilities for Analysis

Deep learning techniques, such as convolutional neural networks, which currently excel at processing images, voice, and unstructured text, are expanding into broader applications. These technologies, modeled on the human brain’s ability to learn and infer, are essential for analyzing the immense and complex data generated by active insurance products tied to individual behavior and activities. The increased availability of adaptive AI models empowers insurers to launch innovative products, enhance customer engagement, and respond to shifting risks or behaviors with unprecedented agility.

V. Generative AI for Efficiency

Generative AI is transforming insurance by automating creative and complex tasks. It drafts policy documents, creates personalized marketing, and simulates customer interactions. This technology helps insurers design tailored products, improve customer support with conversational AI, and streamline claims processing.

According to EY, 42% of insurers have invested in GenAI, while 57% plan to do so. By leveraging GenAI, insurers enhance efficiency, reduce costs, and deliver highly customized services. Its ability to generate insights from vast datasets redefines risk modeling and underwriting strategies. For instance, generative AI helps life insurers automate risk assessments by analyzing medical records and predicting health trends.

Best Practices for Implementing AI in Insurance

Adopting artificial intelligence in the insurance sector extends beyond mere technological deployment. It necessitates a meticulously crafted strategy to ensure alignment with organizational objectives while mitigating potential pitfalls.

Formulating Comprehensive Governance and Ethical Protocols

The cornerstone of responsible AI adoption lies in articulating robust governance structures and principled ethical frameworks. These mechanisms serve as a compass for decision-making and accountability, ensuring that AI applications resonate with the core values of the organization and the broader societal expectations within the insurance realm.

Promoting Lucidity in AI-Driven Outcomes

Lucidity is indispensable when leveraging AI for decision-making. Insurers must elucidate the rationale and mechanisms behind AI-generated determinations to foster confidence among customers and stakeholders. Prioritizing intelligibility allows organizations to enhance trust and demonstrate their commitment to fairness and accountability.

Augmenting Workforce Readiness Through Tailored Training

As AI tools become enmeshed in insurance workflows, equipping employees with the requisite skills becomes paramount. Structured and targeted training initiatives bridge the gap between human expertise and AI capabilities, enabling seamless integration and unlocking the transformative potential of these technologies.

Fortifying Data Safeguards for AI Systems

Given the voluminous and sensitive nature of data processed by AI, its protection becomes an imperative rather than an option. Insurers must adopt rigorous data protection measures to fortify against vulnerabilities, ensuring the sanctity and confidentiality of all information handled by AI systems.

Establishing Regular Monitoring and Validation Protocols

AI solutions are inherently dynamic and require ongoing scrutiny to ensure sustained effectiveness. Insurance organizations must eschew static approaches in favor of perpetual oversight and iterative testing. By embedding continuous evaluation processes, insurers maintain the operational integrity of AI systems and adapt them to evolving circumstances.

By adhering to these best practices, insurers navigate the complexities of AI adoption with prudence and foresight, reaping its benefits while upholding ethical and operational excellence.

Concluding Thoughts

AI in insurance brings a wave of uniformity across different market segments, industrial verticals, and service providers. As a result, insurance and claims settlement procedures are more standardized throughout. Other benefits of AI in insurance would be greater operational excellence, lower costs, and enhanced customer experience. Clearly, the future of AI-driven insurance is a bright one, and the use of AI in the insurance industry will see a massive boost in the coming future.

Case in Focus

A leading insurance claim adjusting firm based in the USA was on the lookout for digital solutions that leveraged cutting-edge technology to enhance their Property Claims Estimation System. Damco catered to this requirement with a powerful AI-powered solution that focused on eliminating human errors. The AI-assisted property damage assessment tool introduced a no-touch approach to assessing property conditions. At the same time, it integrated with the existing digital ecosystem to allow seamless data transfers. For more details, refer to the complete case study.