The life insurance industry has always found itself between a rock and a hard place. On the one hand, they would naturally want the bereaved family to benefit from the policyholder’s life insurance. But on the other hand, they simply cannot afford to skip past the due diligence required in the procedural formalities. Fortunately, InsurTech solutions are making it easier for life insurance businesses to strike the perfect balance to manage customer expectations and profitability. As a result, insurers and beneficiaries are both benefiting from the technological innovation that is disrupting the life insurance sector.

Top Technology Trends in the Life Insurance Industry

Here is a look at some top technology trends that are leading the industry in this direction.

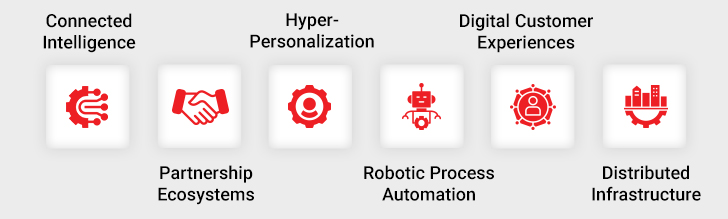

1. Connected Intelligence

Connected intelligence powered by the Internet of Things (IoT) remains one of the most revolutionary technologies. It relies on smart wearables that collect tons of customer data, especially the metrics revolving around their health and fitness markers. Such data, when paired with the already available information such as any preexisting condition, family history of diseases, comorbidities, etc., allows companies to interject in a timely manner to elongate lifespan and its quality. Insurers can even convert life insurance policies and premiums into a recalibrated usage-based dynamic policy that incentivizes healthy habits or preventive care.

2. Partnership Ecosystems

Connected intelligence has paved the way for a new technology-led transformation in the life insurance industry. It has laid the foundation for the partnership ecosystem. Such a connected space ensures that no vertical of insurance remains in isolation and multiple product or service can exist in tandem. As such, life insurance can be tied to health insurance or auto insurance to maximize value. Such cohesiveness can be highly beneficial for multi-line insurers that can push for the sale of related add-on products or services. However, small insurers can also benefit from such a business architecture as they can form fruitful partnerships and symbiotic relationships that supplement customers’ demands.

3. Hyper-Personalization

Hyper-personalization enables insurers to make their customers feel seen and heard as an individual rather than a cohort or customer segment. It enables insurers to customize their products, services, and messaging to cater to the specific requirements and preferences of every customer uniquely.

By leveraging data analytics, Artificial Intelligence, and Machine Learning, insurance businesses can efficiently analyze high volumes of customer data and gain actionable insights into their behavior, preferences, and needs. It can also accurately predict the risk parameters for the individual, which influences the policy underwriting process. On the whole, the life insurance policy enhances the value of the policyholder’s life as per their terms – and remains meaningful even beyond.

4. Robotic Process Automation

Robotic Process Automation, or RPA, allows life insurers to develop, deploy, and maintain robots that introduce automation. While at face value, this small-scale automation may not seem like a major feat, RPA solutions contribute to the grander scheme of things. They improve the overall efficiency and productivity of the organization as RPA solutions can successfully handle all routine, repeated, and redundant activities that are otherwise a drain on resources. In doing so, it injects a high degree of scalability into your business operations without soiling the customer experience.

One can even expand on this low-hanging fruit and introduce complex automated workflows that will absolutely decouple organizational performance from the number of employees or any such variables.

5. Digital Customer Experiences

The digitalization of the insurance industry has birthed digital customer experiences for all, and life insurance is no exception to this industry-wide norm. A life insurance customer’s journey now includes an assortment of digital touchpoints, from the very obvious ones like websites and emails to offbeat channels like social media or instant messaging platforms. Such digitalization of the customer experience makes the insurer highly accessible and approachable while also cutting short the sales cycle.

Even when it comes to post-sale servicing or claims settlement, digital experiences are making everything far more convenient and customer-friendly. Not to forget that digital-first customer experiences offer room to introduce personalization and other such elements to woo the customers, engage, delight, and retain them, and attract long-term benefits.

6. Distributed Infrastructure

Insurance has always been a distributed sector with the on-field agents and in-office employees – and we’re not even accounting for the brokers, agents, and other stakeholders yet. Such a distributed architecture becomes even more disparate and separated in recent times with the work-from-anywhere models becoming increasingly popular.

Against this background, technologies like cloud computing and automation led to the introduction of everything-as-a-service (SaaS, PaaS, CPaaS, etc.). Such platforms are making it easier for insurers to overcome geographical boundaries while acquiring talent or serving customers. A modular and digital-first infrastructure will impart some amount of resilience and elasticity to the business that yields results in the long run.

Modernize your Operations By Leveraging the Latest Technologies

Closing Thoughts

All in all, the life insurance industry is experiencing a tech-led revolution that is enriching the sector in more than one way. The technologies discussed above are sowing the seeds of several trends and behaviors that are set to reshape the industry. Life insurers that wish to stay ahead of the curve and derive long-term results can use the above insights to gear up for the changes to come in the future.

Case in Focus

A reputed multinational life insurance provider faced issues staying up-to-date and relevant with the latest insurance industry trends and customer expectations. Upon consulting Damco, they came to realize how their disconnected legacy systems were eroding brand reputation and profit margins. Damco’s experts set to work in modernizing the life insurance business’s infrastructure and in the process saved them a whopping $2 million. How? You will have to read this case study.