The insurance industry is changing. Traditional underwriting is being rethought. New methods use smart tools and data. Risk evaluations are faster, more accurate, and fairer, and new tech has brought big changes to underwriting. In this blog, we will explore the evolution of underwriting, the key technologies behind the change, and the many benefits of a modern approach. We’ll also look at real-world examples and future trends and by the end, you will see how the latest tools improve risk evaluation and lead to better outcomes for insurers and their customers.

In recent years, many companies have embraced insurance underwriting automation, or automated insurance underwriting. These innovations make a big difference. They not only save time but also bring clarity to risk decisions. When these systems work well, they create a smoother, faster process that benefits everyone involved.

Table of Contents

The Evolution of Underwriting Automation

Key Technologies Driving Underwriting Automation 2.0

Benefits of Underwriting Automation 2.0

- I. Efficiency and Speed

- II. Accuracy and Consistency

- III. Cost Reduction

- IV. Enhanced Customer Experience

- V. Scalability

- VI. Risk Mitigation

Challenges and Considerations

Leading Players and Underwriting Automation

Scaling AI and Data Innovation in Underwriting

The Importance of Data Literacy for Underwriters

Data Governance and Compliance in AI-Driven Underwriting

Future Trends

Summing Up

The Evolution of Underwriting Automation

Underwriting used to be slow, heavily relied on checking paper files. They used simple methods and basic rules. There was little room for error and mistakes happened quite often. This made it hard to give a fast answer.

As time went on, insurers started to use early computer systems. They built basic tools that could follow simple rules. This was the first step toward insurance underwriting automation. It helped cut down on errors and speed up the process a bit.

Then came the big shift. New systems used advanced AI and huge amounts of data. This change, sometimes called “Underwriting Automation 2.0”, was a turning point. Modern tools use machine learning to learn from past data. They can spot trends and predict risks more accurately. Today, automated systems work alongside underwriters. They help make better, faster decisions. The move from manual work to high-tech processes has transformed risk evaluation.

Key Technologies Driving Underwriting Automation 2.0

A host of new technologies drive the change in underwriting. These tools help make decisions more precise.

1. Artificial Intelligence (AI)

AI is at the center of modern underwriting. It sifts through data fast and finds patterns that a human might miss. AI looks at past claims, market trends, and even social signals. This leads to better risk assessment. The use of AI helps cut down on errors and speeds up processing.

2. Machine Learning (ML)

Machine learning lets systems learn over time. ML builds models that predict risk based on many factors. Advanced methods like deep learning and reinforcement learning add even more accuracy. Thus, companies can create an effective insurance underwriting automation process using AI tools, which improves with each case.

3. Natural Language Processing (NLP)

Underwriting often involves reading and understanding many documents. NLP turns unstructured text into useful data. This can include scanning electronic records, reports, and even social media posts. By using NLP, systems gather insights from places that were hard to use before.

4. Big Data Analytics

Today, data is everywhere. Big data analytics helps insurers use this data well. With so much information at hand, companies can spot trends and see risks more clearly. This adds another layer of precision to risk evaluation.

5. Blockchain Technology

Blockchain is new to underwriting but has great promise. It offers a secure way to share data. Blockchain ensures that records are true and unchanged. This builds trust between all parties involved. Its role is still growing, but it may soon be a key part of an automated underwriting system.

Ready for AI-Driven Claims Processing?

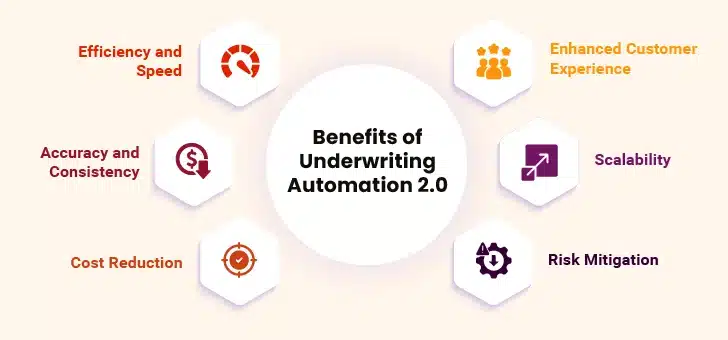

Benefits of Underwriting Automation 2.0

Modern tools bring many advantages to underwriting. Let’s look at the benefits.

I. Efficiency and Speed

Automation cuts down processing time. Tasks that once took days now take minutes. Faster decisions mean policies can be issued quickly. Insurers can handle more applications in less time. This is a clear win for everyone.

II. Accuracy and Consistency

Automated systems reduce human error. With clear data and objective models, risk evaluations are more consistent. Decisions come from data rather than gut feelings. This means that every customer gets a fairer look at their risk.

III. Cost Reduction

Automation saves money. When tasks are handled by computers, fewer staff hours are needed. This cuts operational costs. Insurers can then reinvest savings into better services for customers.

IV. Enhanced Customer Experience

A quick response is a big plus for customers. With faster processing, clients get answers sooner. This means fewer delays and a smoother journey from application to policy. Personal data insights also help create more tailored offers. This boosts customer satisfaction.

V. Scalability

Automated systems can grow with the business. When more applications come in, the system handles the extra load without a hitch. This means insurers can expand their services without major extra costs.

VI. Risk Mitigation

Advanced models predict risks better. They spot potential problems before they grow. This helps insurers adjust their pricing and manage claims more effectively. Better risk management leads to fewer losses and a healthier business.

Challenges and Considerations

No new system comes without challenges. Here are some common hurdles in the journey to full automation.

1. Integration with Legacy Systems

Many insurers use old systems that do not mix well with new tech. Integrating modern tools into these systems can be tough. Companies must invest in smooth data flow to make new systems work alongside old ones.

2. Change Management

Changing the way people work is hard. Employees must learn newer tools and adjust their working styles. Clear training and support are needed. A good plan helps everyone transition to the new process.

3. Bias in AI Models

AI systems learn from past data. If that data has bias, the AI may repeat it. Insurers need to check models carefully. They must work to remove bias and ensure fairness.

4. Data Privacy and Security

Using lots of data means keeping it safe. Insurers must protect customer information. This involves following strict rules and regulations. Data privacy and security are vital to maintaining trust.

5. Ethical and Regulatory Issues

Automated systems raise ethical questions. How do we ensure decisions are fair? How do we balance tech with human touch? Regulators are still figuring out these issues. Insurers must work with them to create fair systems.

6. The Human Element

Automation helps, but human skills still matter. Experienced underwriters provide empathy and judgment that machines cannot match. A hybrid approach is best. This means using tech to support, not replace, human insight.

Leading Players and Underwriting Automation

From life insurance to property and casualty, top companies are using automation to tackle unique challenges. Each segment benefits from faster, more accurate risk assessment. Many top insurers are already using new technology in their underwriting. Let’s look at some prime examples.

- Swiss Re: Swiss Re is a leader in reinsurance. They use AI and data analytics to increase the speed of their underwriting. Their automation system cuts down on manual work and reduces errors. They use smart tools to review what customers tell them and other evidence like lab reports and data from phones and health watches, with permission. This saves time and helps them understand risks better.

- RGA: Reinsurance Group of America (RGA) uses predictive analytics in underwriting. Their models improve risk evaluation and speed up the process. They use Big Data tools like NLP and OCR to read and sort important information from many pages of medical reports. These tools summarize the info so systems can quickly understand the risks, reducing mistakes and saving time for underwriters. Clearly, RGA’s work with automated insurance underwriting is a good example of progress.

- Hitachi Solutions: Hitachi Solutions offers technology-driven systems for insurers. Their vision includes a blend of AI, big data, and digital tools. Their work shows how automation in insurance underwriting leads to scalable and efficient processes. Hitachi’s solutions are paving the way for a new era in risk evaluation. They are quickly bringing all data sources into one data platform. This makes it easy for underwriters to access, combine, and understand data from many sources.

It is evident that both new and established players have begun using automation in insurance underwriting. Automation in underwriting is no longer an ideal concept but a real, working solution that is boosting efficiency and enhancing customer service.

Many insurers are discovering that the blend of big data and AI are opening doors to new products. Clients are able to receive policy offers that match their specific needs. With better data, companies can adjust pricing dynamically. This means fairer rates and more competitive products. In turn, this boosts trust and customer loyalty for insurance brands.

Moreover, as insurers adopt these tools, they gather more data. This creates a virtuous cycle: better data leads to better models, which in turn lead to even smarter decisions. With each new application, the system grows more capable. This cycle helps build a long-term advantage over competitors who still rely on manual processes.

Cut Down Operational Costs with Insurance Automation Solutions

Scaling AI and Data Innovation in Underwriting

Scaling up new technologies is a challenge. Many insurers must adjust team structures and invest in training. They need to build teams that focus on digital innovation and data management. This means hiring new talent and reskilling existing staff. The goal is to make sure everyone understands how to use the new systems.

Successful scaling also depends on good technology infrastructure. Companies need robust IT systems that can handle vast amounts of data. They must create a foundation where new tools can work together seamlessly. With the right support, scaling AI and data innovation becomes a key driver of growth.

Building a strong digital team is essential. This team ensures that the tools remain up-to-date and are used effectively. They work with underwriters to interpret data and improve decision-making. When people and technology work together, the results are much better.

The Importance of Data Literacy for Underwriters

Data skills are important today. Underwriters need to read and use data. They should know charts, graphs, and dashboards. Being good with data helps you spot trends and make better choices.

Training programs help underwriters learn these skills. Data storytelling and visualization are now common parts of professional development. With strong data skills, underwriters can share insights clearly. This leads to more confident choices and a proactive approach to risk.

As underwriters get better with data, automated tools become more useful. They can refine models and ensure accuracy. This mix of human skill and data creates a powerful combination.

Data Governance and Compliance in AI-Driven Underwriting

Data is the lifeblood of modern underwriting. With great data comes great responsibility. Insurers must manage data carefully. Data governance means setting up rules for how data is used and protected. Compliance with data privacy regulations like CCPA or GDPR is a must. These practices build trust and ensure that automated systems work fairly.

Good data governance also means regular audits and updates. This helps catch errors and prevent misuse. A well-run system protects both the company and its customers. It is a key part of building a reliable automated underwriting system.

When data is managed well, it also improves the performance of AI models. Accurate, clean data means more accurate risk predictions. This drives the overall success of the new underwriting process.

Future Trends

The future of underwriting is bright. Many trends point to even more innovation

I. AI and ML Advancements:

New developments in deep learning and reinforcement learning will push the boundaries further. These techniques promise even better risk assessment and more precise predictions. As these models improve, they will make the process even faster and more accurate.

II. Increased Adoption of Blockchain:

Blockchain may soon be widely used. It offers secure, transparent ways to share data. This can reduce fraud and improve trust among stakeholders. Its adoption could be a major boost for the industry.

III. More Personalization and Customization:

The future will see more personalized underwriting. Systems will use detailed data to offer customized policies. This means clients get products that fit their needs perfectly. More tailored approaches will make insurance pricing and risk assessment more relevant and fairer.

IV. Introduction of Global Standards:

As markets around the world adopt these tools, we can expect a rise in cross-border collaborations. Global standards may emerge, making it easier for insurers to work internationally. This will create a more connected and efficient industry overall.

The promise of technology is immense. Companies that invest in these new methods will lead the way in risk evaluation. The benefits include not only cost savings and speed but also fairness and customer satisfaction.

Summing Up

Automated underwriting in insurance is undergoing a major shift. The move to automation in insurance underwriting or automated insurance underwriting has transformed risk evaluation. Modern systems use AI, machine learning, NLP, big data, and blockchain to make decisions that are fast, accurate, and fair.

The advantages are clear. Insurers enjoy quicker processing, reduced costs, better risk management, and an improved customer journey. However, challenges remain. Integration with old systems, managing change, ensuring data privacy, and addressing bias are important issues that must be tackled.

A balanced approach is key. Combining technology with human expertise brings the best results. As companies scale their digital teams and invest in data literacy, they pave the way for a future where underwriting is both efficient and personal.

Looking ahead, advances in AI, increased use of blockchain, and more personalized policies will continue to change the industry. Global collaboration and smart regulation will further drive progress.

For those ready to explore these changes, now is the time to act. Embrace new tools and strategies to stay competitive and deliver better service. Work with a qualified partner with lots of experience in the insurance industry to achieve transformation of underwriting function.