The insurance industry is undergoing huge changes, where customer expectations are rising, technology is advancing rapidly, and regulatory laws are continuously evolving. As a result, traditional operations are being impacted completely.

The fact that the insurtech market size is expected to grow to USD 2.19 trillion by 2030, at a CAGR of 13%, highlights the important role of technology in the insurance sector. Insurers can use the latest technologies to refine customer experiences, optimize claims management, and streamline processes.

Based on insights from leading analysts and industry players, this blog explores the technology trends set to redefine how insurance CIOs and leaders are going to operate in 2026. From integrating digital twins to voice-activated tools and leveraging AI for real-time customer insights, these trends will shape the next chapter of the insurance landscape.

Table of Contents

What Are the Key Technology Trends Reshaping the Insurance Sector?

Why to Embrace Technology Trends in Insurance?

What Are the Barriers to Technology Adoption in the Insurance Space?

What Are the Key Technology Trends Reshaping the Insurance Sector?

Looking at the trends closely, one thing is clear that these are not mere incremental improvements. Rather, these latest trends are changing the very core of the insurance business model itself, those that empower insurers to move from being purely risk-transfer entities to becoming data-driven guides in their customers’ lives.

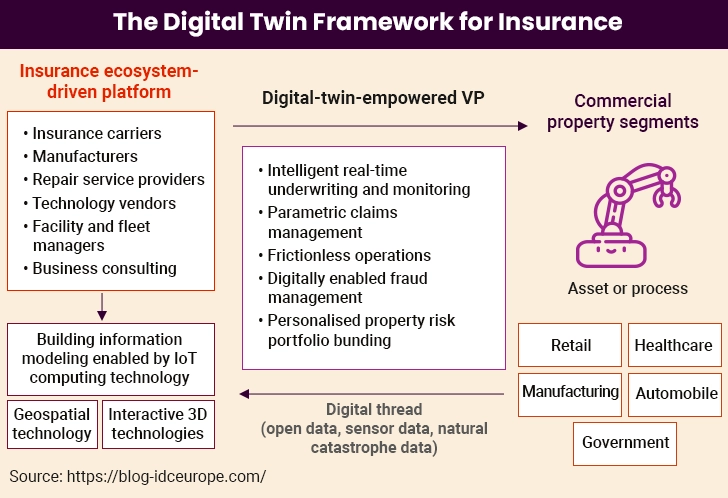

Digital twins create real-time models of insured assets, offering predictive insights. For example, insurers will be able to detect potential risks in a property’s structural integrity before damage occurs.

1. Digital Twins Revamping Risk Assessment

Digital twins—virtual replicas of physical assets—are no longer going to be futuristic concepts but operational tools transforming risk management.

Digital twins create real-time models of insured assets, offering predictive insights. For example, insurers will be able to detect potential risks in a property’s structural integrity before damage occurs.

In claims management, these replicas will allow for virtual inspections during claims processing, saving time and costs.

Digital twins improve underwriting for parametric insurance products. By using AI and satellite image analysis, insurers can detect potential loss events in a commercial property portfolio, verify coverage, and potentially automate claim settlements through straight-through processing.

For fraud management, digital twins utilize continuous IoT data streams to recreate the damage environment post-claim, helping insurers assess the legitimacy of claims.

Implications: By reducing physical site visits and leveraging predictive analytics and IoT data, insurers will be able to achieve significant cost savings while enhancing customer trust through proactive solutions. A recent industry report states that 75% of insurance companies expect to reduce costs by at least 10% by 2030 from digital transformation initiatives.

Harness New-Age Technology Trends to Drive Growth

2. API-Driven Ecosystems Enabling Friction-Free Collaboration

The rise of insurance software platforms leveraging APIs has ushered in an era of collaboration beyond traditional silos. Insurers will now be able to easily connect with digital platforms in industries such as automotive, healthcare, and real estate.

API or microservices-based architecture will enable insurers to bundle diverse services, like integrating real-time diagnostics in auto policies or health monitoring for life insurance products. For instance, through a single app, insurers can easily manage vehicle diagnostics, insurance claims, and home security.

Implications: APIs drive customer-centric innovations, opening new revenue streams and delivering convenience that meets modern policyholders’ expectations.

3. Voice-Activated Insurance Technology for Enhanced Accessibility

Voice technology is all set to simplify how customers interact with their insurers. Powered by AI, these systems are quickly going to become an essential part of insurance technology toolkits.

Policyholders can now modify policies, check claim statuses, or renew coverage using voice commands. For insurers, chatbots help reduce customer service workloads and enhance response times.

In fact, an insurance carrier utilized a 24/7 chatbot to improve its after-hours customer service. The results were even more surprising, as the insurer witnessed an 11% increase in the number of prospective customers who ended up buying policies.

Implications: With voice technology, insurers will be able to cater to the tech-savvy demographics seeking fast, seamless solutions, ultimately boosting customer loyalty.

4. IoT and Telematics for Proactive Risk Management

IoT devices and telematics are expected to shift the insurance practice from reactive to proactive. The global usage-based insurance market is projected to grow from USD 46.95 billion in 2024 to 70.46 billion by 2030, at a CAGR of 7.0%.

Key factors driving this growth include lower premiums compared to traditional automotive insurance, government mandates for telematic devices, increased sales of connected cars, and more on-road vehicles.

- Auto Insurance

Telematics devices monitor driving habits and offer custom premiums for responsible drivers. - Property Insurance

Smart home devices alert homeowners and insurers about risks, such as water leaks or kitchen fire. - Health Insurance

Wearables encourage healthier lifestyles with rewards when insureds meet the set fitness goals.

Implications: Insurers using IoT solutions can reduce claim occurrences, improve policyholder engagement, and develop sustainable risk models.

5. Drones and Robotics for Inspections

Drones and robotics are becoming essential for aerial inspections, especially in challenging environments. They are now commonly used to survey properties, providing detailed imagery and data for better risk assessment and underwriting.

I. Risk Assessment and Underwriting

Drones are now rapidly being used to survey properties, offering detailed imagery and data for better risk evaluation. This method allows insurers to assess difficult-to-reach areas without risking human inspectors, leading to more accurate underwriting and fairer policy pricing. They enable insurance workers to inspect dangerous areas without physical risk, improving workplace safety.

II. Cost Reduction

Replacing manual inspections with drones, especially in hazardous or hard-to-reach locations, can greatly reduce costs.

III. Claims Processing

Post-disaster or accident, drones can quickly assess damage, providing insurers with rapid and comprehensive visual data. This speeds up claims processing, enabling faster payouts and better customer satisfaction.

IV. Fraud Detection

Drones capture detailed images and data that potentially help insurers identify fraudulent claims by comparing accurate before-and-after property images, checking the extent and cause of damage.

Implications: These tools reduce operational risks, cut inspection costs, and improve the speed and accuracy of claims processing.

6. Blockchain for Secure and Transparent Transactions

Blockchain technology offers a paradigm shift for insurance by creating a single, shared source of truth, thereby reducing fraud, streamlining complex processes, and building unparalleled trust.

- Fraud Prevention and Simplified Claims: An immutable ledger creates a tamper-proof record of policies, assets, and claim history, making it extremely difficult to submit fraudulent or duplicate claims.

- Smart Contracts for Parametric Insurance: Expanding on parametric models, blockchain-based smart contracts can trigger automatic, instantaneous payouts the moment pre-defined parametric conditions (e.g., flood levels, wind speed) are met, eliminating lengthy claims processes.

- Streamlined Reinsurance: The technology can automate and transparently manage the settlement and reconciliation processes between insurers and reinsurers, reducing administrative overhead and disputes.

Implications: Blockchain reduces friction and cost in the most complex insurance transactions while providing a powerful deterrent to fraud.

7. AI and ML for Enabling Hyer-personalization at Scale

Artificial intelligence and machine learning are the central nervous system of the modern insurer, moving beyond siloed applications to become the core of operations and customer engagement.

- Fraud Prevention and Simplified Claims: Hyper-Personalized Pricing and Products: AI enables dynamic, real-time policy adjustments based on live data feeds. For instance, agents can design life insurance premium that rewards policyholders for healthy habits. Or, an insurer can curate auto coverage that offers a temporary discount for a month of safe driving.

- AI-Powered Underwriting: Using non-traditional data sources, such as satellite imagery and cash-flow, AI can create more accurate, fair, and inclusive risk models. This opens up underserved markets for insurers to tap into.

- Intelligent Process Automation: Beyond simple automation, AI-powered bots can handle complex, judgment-based tasks in claims triage, document verification, and compliance checks. This frees human experts for higher-value work.

Implications: Insurers who master AI will lead in product innovation, operational efficiency, and delivering the personalized experiences that today’s customers demand.

So, these are some of the trends that are redefining the very core of insurance operations. Moving on to the next, let’s see what these trends bring to the table for insurance companies in the next section.

Why to Embrace Technology Trends in Insurance?

It is very obvious that leaders need to know what’s in store for them before investing in any technology or adopting any solution. And insurance is no exception here. That said, let’s make this task simple for you by stating what these technology trends offer:

- Increased Efficiency

Teams can focus on core tasks while automating manual ones. - Improved Customer Satisfaction

Faster service and personalized experiences enhance loyalty. - Cost Optimization

Tools like drones and AI minimize operational costs. - Proactive Risk Management

IoT and digital twins prevent claims by addressing risks early. - Expanded Market Reach

API-driven ecosystems enable diversified offerings and new revenue streams.

“Insurers spend significant sums on major technology projects, such as modernizing their core underwriting systems, for example. A lot of investment flows into emerging technologies, often with mixed results in terms of true efficiency and effectiveness.”– Matthew Smith, Global Lead for Insurance Strategy and Transformation, KPMG

So it is quite evident that insurance technology is immensely beneficial. Yet, it is not without its challenges. Issues like integration complexities, data privacy concerns, budget constraints, etc., prevent insurers from making the move. Let’s explore these in the next section.

What Are the Barriers to Technology Adoption in the Insurance Space?

While promising, implementing these technologies in insurance comes with hurdles. Leaders must know all of these to address them effectively, make the most of their technological investments, and remain competitive. Here’s a closer look:

- Data Privacy Concerns

Ensure robust compliance with regulations like GDPR and CCPA. Non-compliance results in huge fines, lawsuits, and reputational damage, which initially took years to build. - Integration Complexities

Invest in cloud-native solutions to simplify integration. Integrating new technologies with existing processes and workflows is essential to ensure the smooth functioning of the insurance business. - Skill Gaps

Upskill teams through targeted training on emerging technologies. Because if the end users don’t know how to use the technological solution optimally, how will insurers get to know if it really adds value to their business. - Cost Constraints

Begin with pilot projects to demonstrate ROI before scaling. This helps businesses be doubly assured that the investment in insurance technology is worth every penny spent and is feasible to further scale the operations.

By tackling these challenges strategically, insurers can fully unlock the potential of emerging technology trends.

Summing Up

These technology trends are not mere shiny innovations but a definite shift in the insurance industry’s approach to delivering lasting value. For insurance CIOs, this is an opportunity to not only embrace these trends but to excel at them, transforming operations, enhancing customer relationships, and driving measurable growth.

By adopting a forward-thinking approach to new-age technologies that make a big impact in insurance, leaders can stay relevant and achieve profitable growth in a competitive market. The future of insurance goes beyond managing risks; it’s about developing solutions that meet the evolving needs of the masses.