Did you know that the majority of insurance customers start their journey by running a search before even scheduling an appointment? With buyers turning to online research, the digital landscape is where your potential customers begin assessing their insurance options. While most customers are ready to get quotes online, phone calls remain the preferred channel for conversion. This is because insurance is perceived as complex, lacking the intuitive and informative marketing that drives direct conversion.

Table of Contents

In this guide, we will give you all the tools required to build a strong digital marketing strategy and launch a lead generation plan designed for outcomes. You will walk away with a deeper understanding of today’s customers, and how digital marketing helps you turn them into lifelong customers.

The first hurdle to overcome when marketing insurance on digital channels is to cut through the online noise and garner attraction. Today’s consumer does not want aggressive messaging pushing them to buy. The customers want to do their own research, compare policies, and weigh every option before taking a decision.

So how do you approach this modern, skeptical buyer? How do you provide all the information required, while keeping it simple?

Here are eight best practices to follow to win the digital marketing game in insurance.

- Start with your website

- Invest in search engine optimization (SEO)

- Put time and effort into blogging activities

- Make use of PPC advertising

- Plug in social media

- Outline a video marketing strategy

- Actively solicit reviews from your customers

- Embrace the latest marketing technology

Start with Your Website

The website is the first touchpoint for online visitors, and you should engage them under 10 seconds; otherwise, they will likely move to another provider. Make sure your website is:

- Fast (Google AMP optimized)

- Secure (via HTTPS encryption)

- Mobile-friendly (has a responsive design)

- Don’t overcrowd with too many choices; focus on what’s relevant

- Offer a comprehensive “insurance 101” resource or an interactive guide

- Embed a quote comparison tool (and heavily promote it via paid ads)

- Create video snippets explaining the different types of insurance coverage

- Showcase recognition in the form of awards, reviews, and testimonials on the landing page

Besides these three principles, ensure that you:

Here is a responsive design example

As mentioned, your website needs to be extremely fast as users expect quick loading times and seamless browsing experiences. Below is a sample insurance website’s speed and usability test.

If you’re looking for more ways to dress up your site, it is a good idea to have contact information in the top right corner, which is scientifically proven to garner the most attention.

You may also implement actionable features like contact forms, AI-powered chatbots, and location-based recommendations to boost engagement.

Invest in Search Engine Optimization

Organic traffic makes up a big portion of your user base, which means the website should be easily searchable on Google. Remember, most online experiences begin with a search engine, making it essential that you rank high in the list of the available options.

Follow these principles to help your insurance website appear in the first couple of pages of Google search:

- Incorporate SEO into title tags and meta descriptions

- Opt for HTTPS instead of HTTP

- Add schema markup so that Google understands your domain

- Provide high-quality content with plenty of backlinks

- Optimize images with detailed alt-tags

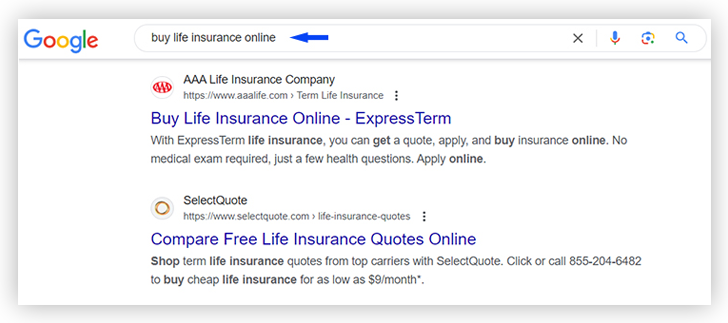

Here is a screenshot of Google SERP for a commercial intent-based keyword:

Google assesses over 200 factors when determining search positions, and the results would take approximately a week to be implemented. Keep these in mind when adapting your website for SEO.

Put Time and Effort into Blogging Activities

Businesses often ignore the need for a blog section, especially in their initial years. Blogs boost website traffic and establish your authority in the domain, build trust, and convert you from being a service provider to a “go-to partner”.

For insurance, this is even more important as your blogs give customers the required information before making a purchase. Effective blogging is also integral to a larger digital transformation strategy, helping your business stay relevant in the ever-evolving digital landscape.

If you are confused about what to write, here are a few suggestions, depending on the reader’s position in the marketing funnel:

Attract

- 3 Things Every New Homeowner Must Do ASAP

- Why You Need to Start Preparing for Your Child’s Future Today

- How to Create a 360-Degree Personal Financial Calendar

Engage

- 5 Reasons Why You Need Life Insurance

- 6 Things to Remember When Choosing Your Provider

- Are You Eligible for X? (insert context-specific question)

Convert

- How to Read Between the Fine Lines of Your Workplace Insurance Policy

- Is Your Medical Insurance Coverage Enough?

- Don’t Put Off Renewing Your Auto Insurance Policy

Launch Your Winning Digital Marketing Strategy

Make Use of PPC Advertising

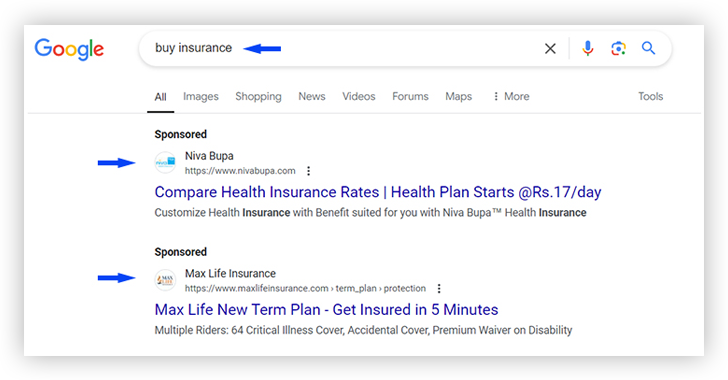

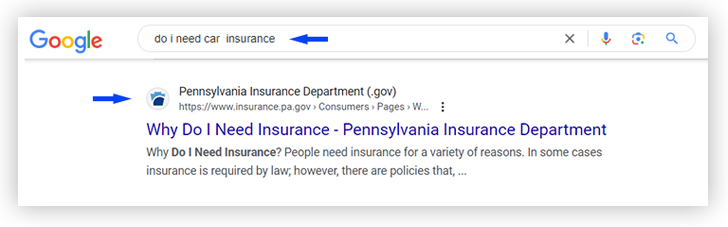

While a lot of your traffic comes from organic sources (making SEO critical), paid ads are also important, especially when prospects google phrases like “buy insurance” or “buy insurance at low cost”. For high-intent searches like these, ads take up most of the search engine real estate, while for low-intent searches such as “do I need insurance”, no ads appear.

| Examples of Commercial Intent Keywords | ||

|---|---|---|

| Keyword | Avg. Monthly Searches (US) | Competition |

| buy health insurance | 50000 | Medium |

| buy car insurance online | 50000 | Medium |

| buy dental insurance | 50000 | Medium |

| buy life insurance | 50000 | Low |

| buy health insurance | 50000 | Medium |

| car insurance quotes | 50000 | Medium |

| life insurance quotes | 50000 | Medium |

| car insurance quotes online | 50000 | Medium |

| insurance quotes online | 50000 | Medium |

| home insurance calculator | 50000 | Low |

| life insurance quotes online | 50000 | Medium |

| travel insurance quote | 50000 | Medium |

| car insurance calculator | 50000 | Medium |

| health insurance cost calculator | 50000 | Medium |

| life insurance cost calculator | 50000 | Medium |

| health insurance quotes | 50000 | Medium |

| home insurance quotes | 50000 | Medium |

| need a quote for car insurance | 50000 | Medium |

| auto insurance quotes | 50000 | Medium |

Sample Search Results

While a huge number of people click on these ads, the insurance industry has the highest average cost-per-click. You should work with an experienced PPC professional to ensure your investments are maximized.

When it comes to advertising content, we recommend focusing on renewals rather than new policies, as this is often when customers are most motivated to save money.

| Examples of Generic – ‘Information Seeking’ Insurance Keywords | ||

|---|---|---|

| Keyword | Avg. Monthly Searches (US) | Competition |

| what Is life insurance | 50000 | Low |

| what is commercial insurance | 50000 | Low |

| what is health insurance | 50000 | Low |

| what is travel insurance | 50000 | Low |

| what is term life insurance | 50000 | Medium |

| car insurance | 50000 | Medium |

| health insurance | 50000 | Medium |

| travel insurance | 50000 | High |

| general insurance | 50000 | Medium |

| home insurance | 50000 | Low |

| travel medical insurance | 50000 | Medium |

| vehicle insurance | 50000 | High |

| life insurance | 50000 | High |

| why is health insurance so expensive | 50000 | Medium |

| do i need rental car insurance | 50000 | Low |

| do i need flood insurance | 50000 | Low |

| globe life insurance | 50000 | Medium |

| best insurance companies | 50000 | Medium |

| life insurance companies | 50000 | Medium |

Sample Search Results

Plug in Social Media

A common mistake many insurance businesses commit is failing to measure the impact of their social media campaigns. Posts should not be random or irregular, and the same message shouldn’t be shared across Facebook, Twitter, Instagram, LinkedIn, and Snapchat without considering the best practices for each platform. Partnering with a social media expert helps you better target your content and reach your audience more effectively.

Strategize Your Content

For ideas on the type of content you could post on social media, consider:

- Tips on reducing insurance costs

- Infographics on insurance buying procedures

- “How to” videos related to your industry

- Customer stories and testimonials

- Updates on events and webinars

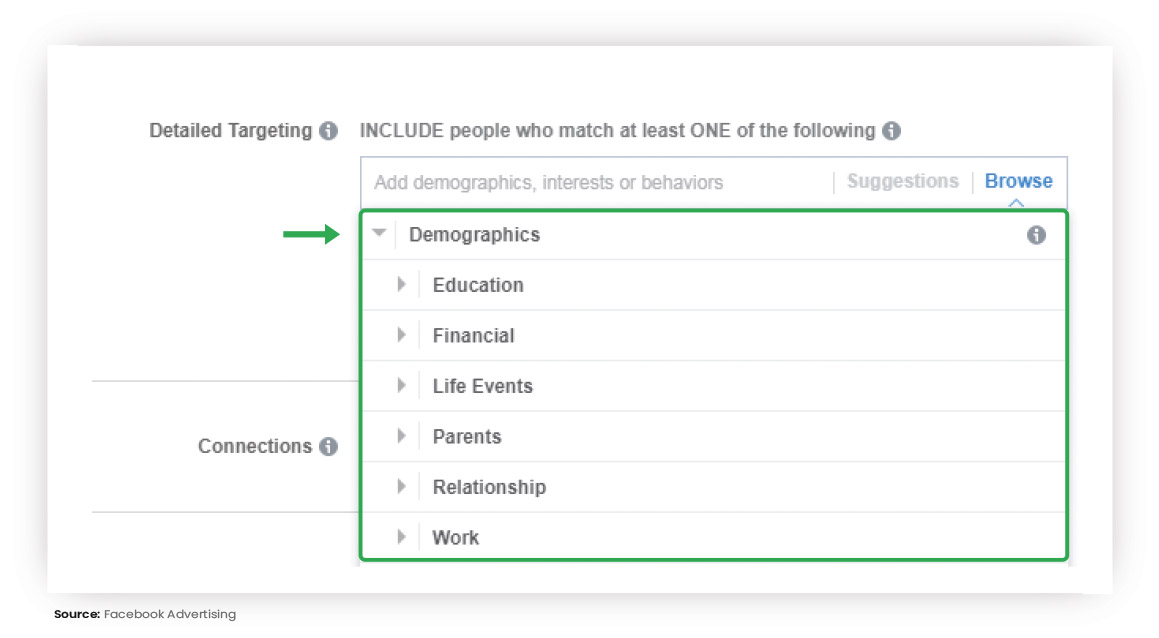

Target Your Audience

For ideas on the type of audience you could target on social media, consider:

- Demographic Targeting

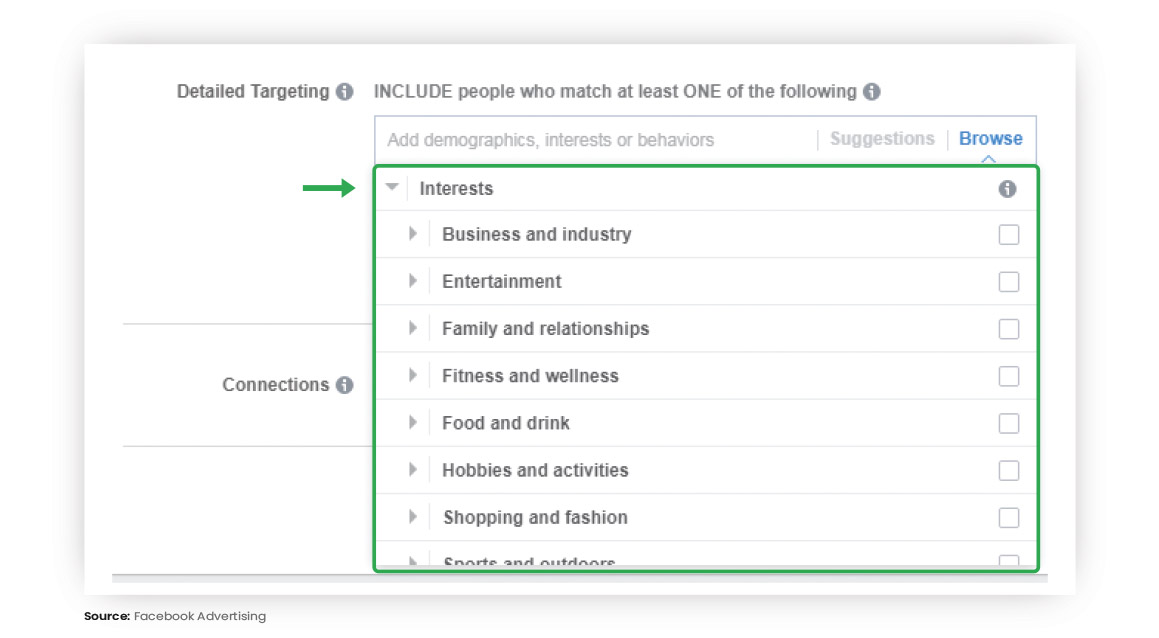

- Interest Targeting

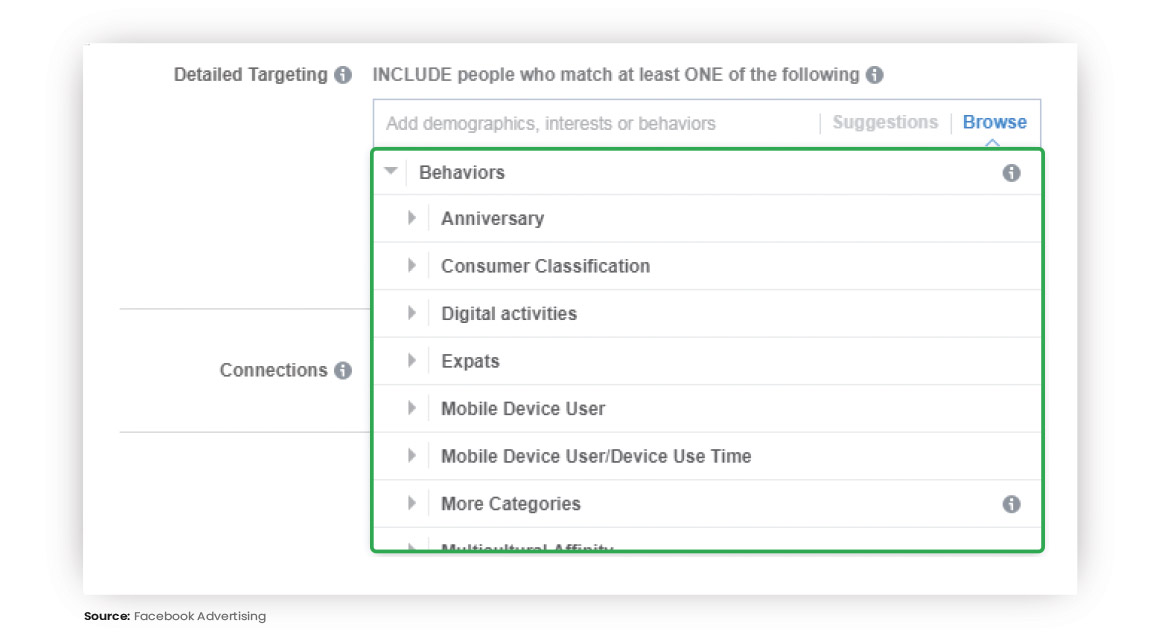

- Behavior Targeting

Demographic Targeting

Interest Targeting

Behavior Targeting

Outline a Video Marketing Strategy

93% of businesses rate video as an important part of their marketing strategy. For insurance companies, incorporating video can be a powerful way to explain complex policies, build trust with clients, and engage potential customers.

Here are our recommendations along with some examples you could look at:

Informative videos explaining how to find the best insurance rates, how to inspect a house for cracks, how to take care of automobiles, and more—the possibilities are endless.

Policyholder testimonials illustrating your brand values and also product efficacy.

CSR content showing your commitment to society, a major part of any insurance business.

Actively Solicit Reviews from Your Customers

Research has continuously shown that buyers are much more likely to be swayed by reviews than ads. With 49% of online buyersconsidering reviews as valuable as a friend’s recommendation, this is a great opportunity for you to push conversion.

To create a repository of reviews for your products, you should:

1. Email buyers and politely ask for a review

2. Make it a part of the after-sales process for new policyholders

3. Adopt dedicated software such as Review Us Now

4. Cross-link social media comments to the review platform

5. Embrace the latest marketing technology

Once you have the larger lead generation and conversion strategy in place, it is time to select a marketing technology stack that fits your business needs. Begin with email marketing and create a regular line of communication with policyholders.

Email marketing covers the following topics:

- Seasonal guides for insurance purchases

- Referral contests for existing customers

- Automated follow-ups, renewals, and tips

- Reminders and updates on loyalty programs

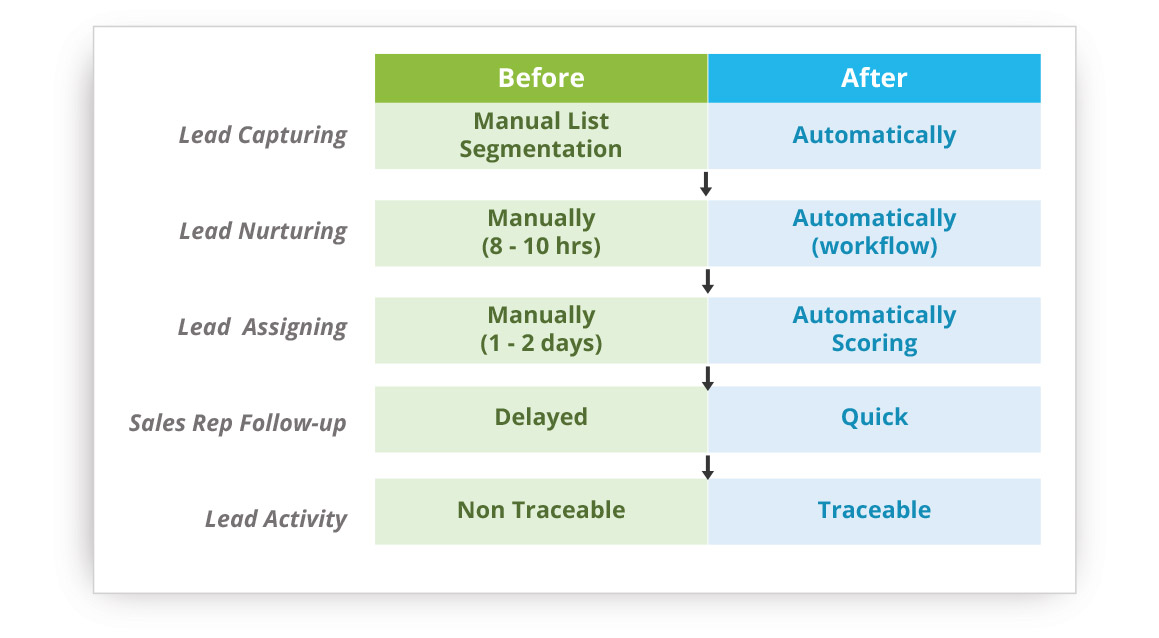

By automating the email marketing process as well as other steps in your marketing strategy, you significantly reduce time-to-convert as well as the cost of new customer acquisition. Marketing automation links the entire top-of-the-funnel to mid-funnel and bottom-of-the-funnel communication process, reducing friction across the buying journey and giving you full visibility. For insurance, which has traditionally been an agent-dependent industry, this goes a long way in reducing marketing costs while increasing leads.

Final Words

In the hyper-competitive insurance market, a robust digital marketing strategy is key to staying ahead. By focusing on the aforementioned points, you can build a comprehensive approach that attracts and converts modern customers. Remember, the key to success lies in understanding your audience, delivering value through personalized experiences, and continuously refining your strategies based on data and feedback.

For a more detailed guide, check out this comprehensive playbook on insurance lead generation and conversion.