The Dramatic Rise of Chatbots in the Insurance Sector- Why so Important Today?

Today, Chatbots play an integral, value-driven part across the insurance value chain, including pre-purchase, purchase, customer service, and back-end operations. The mechanism to resolve thousands of queries simultaneously without any human intervention eases the complexity of insurance transactions, forever dominated by traditional characteristics like manual form-filling, time-consuming background checks, cumbersome customer service, and so forth.

How Insurance Chatbots benefit customers

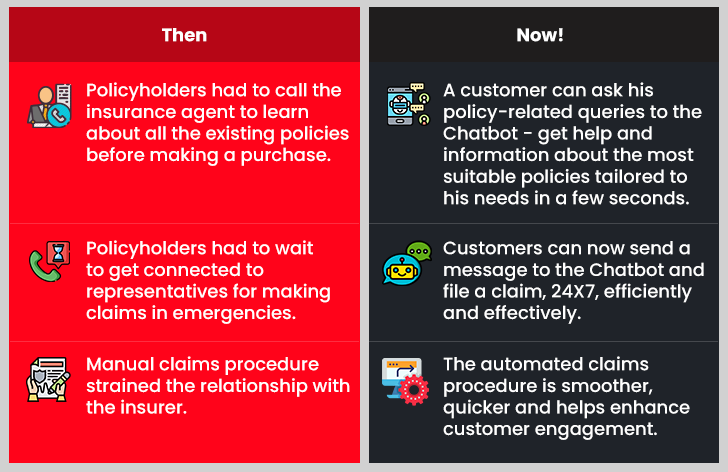

Previously, a user had to get on a call with an already burdened workforce to buy, renew and file claims manually. This often led to delays, unsatisfied experiences, and in turn, sheer exasperation- never a good sign for any business. But thanks to AI-powered Chatbots, Insurance carriers have been able to sell policies, assist customers quickly and deliver information in real-time, increasing overall customer satisfaction.

How Insurance Chatbots Benefit Businesses

It’s estimated that the evolution of chatbot technology will force a total reimagining of insurance over the next decade. The wave has already begun with one of the new reports by Grand View Research, Inc stating that the global chatbot market size would reach USD 2,485.7 million by 2028.

Consider the following scenarios:

Scenario A

The company “AW Insurance” has five accomplished customer care representatives. One fine morning, multiple customers queued up for filing claims but had to wait in line for more than hours- someone had met with an unfortunate accident, another had lost his car, the third person’s house caught fire, and so on. While the company’s insurance agents tried their best to address, sympathize and resolve the queries and help customers file the claims, it wasn’t enough.

Scenario B

Another business, “Mark Insurance,” also has five talented customer care representatives overseeing essential tasks of the day. But unlike AW Insurance, Mark Insurance has deployed an AI-powered Chatbot system on their website, apps, and other interfaces. Here, as soon as a customer’s car meets with an accident, he gets a call from Mark Insurer’s Chatbot, instructing him to click a few pictures of the rear bumper area and the surrounding area. When the customer returns to the driver’s seat, his digital assistant notifies of the damage and confirms that the claim has been approved. Similarly, the customer with the stolen car and the person whose house caught fire filed their claims successfully with the help of chatbots- all without contacting the brokers.

While the latter scenario may seem a bit far-fetched, chatbot technology intends to provide for the insurance businesses just that- improved efficiency and productivity, better customer satisfaction rate, and centralized communication system which the manual process just can’t do. Therefore, the insurance businesses who haven’t deployed this technology may need to reconsider their approach.

Saving Costs

Insurers can save costs on human custom support. As the chatbots will help provide the same information to the consumers, albeit quickly and error-free. There is a significant reduction in the process cost, by at least 30%.

Reallocate employee workload

Chatbots in the insurance sector can also free up employees who may otherwise be answering phone calls or replying to emails, saving both time and money. They can instead focus on providing personalized services to the prospective clients.

Digitizes FNOL and reduces TAT

Since chatbots work like an instant messaging service, claims can be filed immediately. The intelligent software bots can easily extract appropriate details from uncategorized documents flowing in through different sources and feed the data into appropriate systems. The end result is that the insurers will receive the first notification of loss quickly, making the process hassle-free and reducing the turnaround time.

Generating leads for your business

A new customer arriving at your website may leave without contacting you for the information. With an integrated chatbot, customers may feel it easy to interact and fill in basic contact information such as name and email address.

Conclusion

Insurance is a serious and complex subject— often perceived as an opaque maze of quotes, long legal framework, terms and conditions, and claims processes. This makes many customers hesitant to invest in it, not due to the wrong policies but because they are somewhat hard to decode and don’t specify benefits. Therefore, it may only seem customary for businesses to assist their customers. However, it’s not coherent for the insurers to attend to zillions of new queries and comments each day while also making dividends.

To succeed in the modern insurance marketplace, carriers must meet the evolving customer demands and offer information they want quickly and efficiently. With Chatbots, insurers can make every policy-related information available to their customers at their fingertips, meet their expectations, and deliver the service they expect to get.

Get a free Insurance Chatbot development consultation from our technology experts today!