In our last blog, we discussed the important factors to bear in mind before transforming insurance claims operations. In this post, we will uncover how data analytics can streamline insurance claims workflows.

A digitized Insurance claims processing is an resource-centric intense and critical process in insurance. It spans a variety of tasks and activities, from data collection and processing to claims approval or rejection. Given its data-centric nature, claims processing is the first and most impacted beneficiary of introducing data analytics in insurance. It promises the enhancement of claims processing speed and efficiency. Such advantages allow insurance companies to improve employee and policyholder experiences, a two-fold result that catalyzes growth.

Ways Insurers Can Use Data Analytics to Streamline Claims Management

Here’s a look at how insurers can use data analytics to simplify and streamline claims processing.

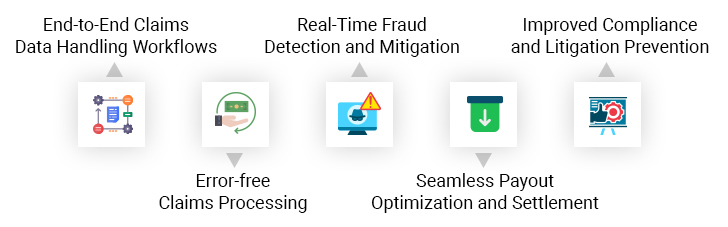

1. End-to-End Claims Data Handling Workflows

To visualize how data analytics assists on this front, let’s start by considering the individual tasks. When it comes to insurance, data originates from disparate sources, such as claims forms, onboarded customer details, policy management platforms, medical records, and other such documents. Insurers can capture this data manually or automate it depending on the resources available. Once all the data is collected, it needs to be vetted, validated, and organized. After the logical organization of data, insurers need to centralize the resulting data repository to establish a single source of truth and to ensure that the data is accessible to all.

Data analytics tools come with powerful data management systems. These help in storing, sorting and organizing data, which helps with data handling and management. It can automatically capture data, measure its recency, delete duplicate or obsolete data, and identify patterns and trends surrounding data fidelity.

Once insurers work with high-quality data, they will enjoy high-quality results and outcomes.

2. Error-free Claims Processing

Even if insurance companies have perfected and automated claims processing, it will always have room for improvement. Data analytics acts as a lens to analyze existing processes and their performance. It helps insurers identify trends and patterns that correspond to streamlined processes or bottlenecks so that they can gain greater visibility of how they process claims. For instance, data analytics tools can shed light on common errors cropping up during claims data collection, such as incomplete information or inconsistent data. Upon identifying this issue, insurers can work towards improving data hygiene and enhance the overall claims-related data collection process.

Data analytics can also help in identifying instances of internal and external fraud during claims processing. It could take the form of unusual billing or multiple claims. The ability to identify such patterns and related trends can empower insurance companies in shielding themselves from fraud. The resulting elimination of fraud allows data analytics to incorporate more value into claims processing.

Unlock Actionable Insights With Our Claims Management Software

3. Real-Time Fraud Detection and Mitigation

Speaking of insurance fraud, insurance fraud costs revenue losses to the tune of USD 308.6 billion annually. It is a pressing issue that requires immediate redressal.

Fortunately, data analytics can help in detecting and mitigating fraud proactively through a myriad of smart strategies. As seen previously, it can help identify patterns pointing towards fraud and flag such events for immediate action. Similarly, it maintains a log of claims-related data and highlights any outliers to safeguard the policyholder’s interests. By protecting insurers and policyholders from fraud, data analytics fosters an environment of trust.

Fraud prevention techniques powered by data analytics are highly potent in detecting fraudulent claims in real-time. More importantly, the iterative learning capabilities of data analytics equip it with relevant insights on keeping up with the advancements in fraudulent practices and dampening their effects.

4. Seamless Payout Optimization and Settlement

Claims processing is one of the linchpins of perfecting customer experiences in insurance. A smooth and hassle-free claims processing experience would establish an insurer as a reputed brand. Given this background, insurers often face immense pressure to settle claims quickly and accurately which drive higher customer experience. While doing so, claims processing should have minimal cost overheads.

Data analytics helps insurers strike the perfect balance between the various requirements. In addition to ensuring transparent, speedy, and fair claims settlements, data analytics can also help identify trends and forecast claims-related costs. Such insights are particularly useful while handling and settling long-tail claims. It can, in fact, pave the way for claims process automation which will improve customer experiences, estimate and cap payout limits, and maintain cash reserves for future claims. With such promising opportunities, businesses should actively seek insurance technology platforms powered by data analytics.

5. Improved Compliance and Litigation Prevention

Claims can be a major bone of contention between insurers and policyholders.

When it comes to individual products, claims dispute lodgement ratios touch nearly 80 to 90% – and that’s just for life insurance. Such high dispute lodgements are a symptom more than a problem for claims processing. Additionally, they leave room for compliance failure and subsequent litigations.

With such a looming threat on the horizon, businesses should naturally focus on improving their claims processing activities to ensure that everything conforms to the terms and conditions of the insurance policy. The use of insurance technologies, such as data analytics, can also help maintain an auditable and traceable record of all business decisions, along with the journey of how one got there.

Data analytics can even come in handy while computing the probability of a claim being contested in court. Knowing the possibility of litigation will push insurers into prioritizing such claims and settling them faster and more carefully at a lower cost to avoid ruffling legal or regulatory feathers.

Conclusion

Data analytics forms the backbone of effective claims management software or process. It can help with data collection and management, making claims processing more efficient, detecting and preventing fraud in real-time, optimizing payout and settlement, and improving compliance. In short, it enriches the entire claims-related insurance value chain. Use it wisely to streamline and simplify the claims processing cycle and improve the stakeholder experience.

Case in Focus

An independent multi-line insurer lacked an insight-based decision-making system, especially when it came to claims-related decisions. This gap affected workforce productivity and soiled policyholder experiences. They turned to InsuranceNXT to revamp claims processing and make it faster and more data-driven. With InsuranceNXT – a suite of technology services, the insurer witnessed a 95% reduction in fraud detection time, which helped plug revenue leakages. More details about how the company reached there can be accessed in this case study.