Consumers in the financial services industry today have increasingly higher standards, expecting outstanding experiences, convenience, and personalization. To meet these needs, financial institutions are putting great effort into improving customer experience and making huge investments in their digital transformation journeys. One of the key steps that multiple organizations in this sector take is improving customer service proactively. This is where CRMs like Salesforce and its products Salesforce Service Cloud become drivers in enhancing the customer experiences of well-established and newer businesses in the finance industry. By utilizing this powerful product from Salesforce, they aspire to centralize their data within Salesforce and receive a 360-degree view of their customers. This empowers financial services companies to outperform competitors and deliver exceptional value.

In this blog post, we will understand the transformative impact of Salesforce Service Cloud implementation, highlighting the crucial role played by Salesforce certified consultants and trusted cloud service providers in attaining success. .

Table of Contents

Salesforce Service Cloud: A Holistic Approach to Customer Relationship Management

- What is Service Cloud?

- Efficient Case Management

- AI-Powered Customer Support

- 360-Degree View of Customers

- Workflow and Process Automation

- Streamlined Compliance and Security

Driven by Salesforce Certified Service Cloud Consultants

- Tailored Financial Services Solutions

- Performance Optimization for Maximum Impact

- Training and Change Management Support

But What Are the Ways to Choose the Right Salesforce Service Cloud Provider?

- Industry-Specific Knowledge

- Ability to Offer Scalable Solutions

- Verified Success Record

Salesforce Service Cloud: A Holistic Approach to Customer Relationship Management

What is Service Cloud?

Salesforce Service Cloud is a powerful Salesforce customer service platform that helps streamline customer service and transforms the way financial services firms interact with their customers. Its primary competencies lie in features that go beyond standard customer service, offering a comprehensive approach to customer relationship management.

Here are some vital Salesforce Service Cloud features:

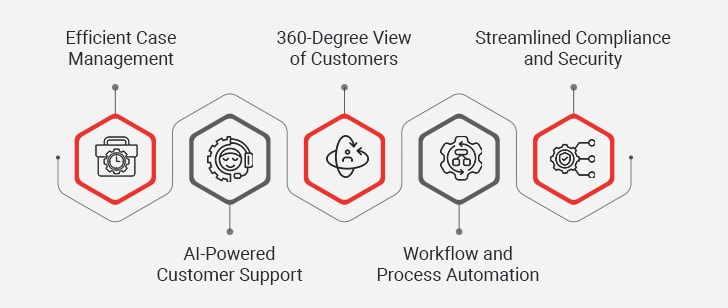

1. Efficient Case Management

One of the best features of Salesforce Service Cloud Implementation is its efficient case management system. Financial services firms deal with multiple customer inquiries, service requests, and complaints daily. Service Cloud streamlines this process by offering intelligent case routing, AI-powered chatbots, and automated responses that improve resolution times. Clients expect quick resolutions of their complaints, and Service Cloud ensures no query is left unattended. With features like macros and quick text responses, customer service teams can handle common concerns speedily, reducing the load on agents and improving response times.

2. AI-Powered Customer Support

Every financial services firm aims to resolve customer queries faster while upholding accuracy. Service Cloud offers AI-powered capabilities that make case management more efficient and responsive. AI-powered case deflection helps minimize the need for human intervention. By analyzing past query resolutions, Service Cloud also suggests relevant articles or FAQs to customers before they submit a support request.

The platform uses Einstein AI, Salesforce’s in-built intelligence tool, to classify and assign cases automatically. Based on complexity, urgency, and customer sentiment, cases are forwarded to the right agent, minimizing delays. Automated follow-ups ensure no customer inquiry gets lost in the incoming query volumes. This leads to consistent front-end engagement and avoids client frustration arising from unaddressed issues.

3. 360-Degree View of Customers

An in-depth understanding of customers is critical to offering targeted and personalized services. Salesforce Service Cloud offers real-time data unification, integrating information from emails, phone calls, chat history, and social media interactions. This not only helps in personalization but also activates predictive support, where agents can anticipate and proactively address potential concerns. Salesforce Service Cloud thus provides a 360-degree view of each customer by consolidating data from multiple touchpoints. This comprehensive view enables financial services professionals to anticipate customer requirements, tailor interactions, and develop stronger, long-lasting relationships.

Workflow and Process Automation

Automation is the foundation of all Salesforce Service Cloud features. By automating everyday tasks and workflows, financial services firms can significantly improve operational efficiency. By utilizing the platform to automate case assignments, follow-ups, and escalations, service teams can focus on high-value tasks that need human expertise.

This helps save time and also boosts overall productivity, allowing organizations to outperform competitors in service quality and responsiveness.

Streamlined Compliance and Security

In financial services, compliance and data security are non-negotiable. Service Cloud ensures organizations stay ahead of regulatory requirements while maintaining high levels of automation.

- Automated compliance monitoring identifies potential risks before they become violations. Financial institutions can set up predefined rules that ensure customer interactions comply with industry standards.

- End-to-end encryption and role-based access ensure that only approved employees can access sensitive financial data.

- Service Cloud integrates with fraud detection systems, helping businesses respond immediately to any potential security threats.

Transform Financial Services with Salesforce Service Cloud

Driven by Salesforce Certified Service Cloud Consultants

The financial services industry deals with complex customer journeys that involve many touchpoints across different communication channels. Businesses must ensure a smooth, friction-free experience to retain customers and drive satisfaction. Salesforce Service Cloud features provide intelligent solutions that unify customer interactions into a single, continuous workflow.

The advantages of Salesforce Service Cloud are indisputable, but using it successfully depends on having the right knowledge. This is where Salesforce certified service cloud consultants come into the picture. Their certification indicates that they have a thorough understanding of the intricacies of the platform along with the ability to customize it to the needs of financial services companies.

1. Tailored Financial Services Solutions

Salesforce certified service cloud consultants contribute industry-specific expertise. They comprehend the specific challenges faced by financial services companies, such as compliance requirements, security concerns, and complex business processes. This expertise helps them create customized solutions that can exceed the expectations of clients in the financial services sector.

2. Performance Optimization for Maximum Impact

Implementing Salesforce Service Cloud is not only about setting up the system but also about optimizing its performance to offer maximum impact. Certified consultants have a deep knowledge of the capabilities and configurations of the platform. This allows them to fine-tune the implementation, making sure that it aligns easily with the current IT infrastructure of financial institutions. This leads to a high-performance system that offers speed, reliability, and overall efficiency.

3. Training and Change Management Support

Achieving a successful implementation involves more than just technical concerns; it also includes making sure that end users can effectively utilize the platform. To help employees with a smooth transition, Salesforce certified service cloud consultants provide training courses and continuous assistance. Owing to their emphasis on change management, financial services organizations are less likely to encounter resistance while implementing new technologies, which allows them to reap the advantages of Salesforce Service Cloud quickly.

But, What are the Key Considerations to Choose the Right Salesforce Service Cloud Provider?

Successful implementation depends on more than simply hiring skilled consultants. Choosing the right Salesforce service cloud provider is equally essential. A trustworthy provider with a solid track record in the financial services sector can have a significant impact. Choosing the right Salesforce customer service platform provider is a crucial decision that impacts business efficiency and customer satisfaction. Firms should assess potential service vendors thoroughly based on clear performance indicators.

Here are some important things you need to look for while selecting the right Salesforce service cloud provider:

1. Industry-Specific Knowledge

The financial services sector has its own set of regulations and challenges. Financial institutions operate under strict regulations like GDPR, CCPA, and industry-specific compliance rules. A Salesforce service cloud provider with financial industry-specific expertise comprehends these nuances and can customize the implementation to meet multiple compliance needs. This makes sure that financial services companies not only meet industry standards but also get a competitive advantage by staying ahead of regulatory changes.

2. Ability to Offer Scalable Solutions

Financial services companies need scalable and flexible solutions because they are dynamic organizations. Cloud-based solutions allow businesses to scale as they grow, handling increased customer interactions without involving any performance issues. Multi-channel support, from emails and calls to social media and live chats, ensures a trouble-free experience for end customers.

A dependable Salesforce service cloud provider provides solutions that can grow and evolve with the organization. Scalability guarantees that the platform can handle increasing volumes of data and user loads, while flexibility makes way for easy customization to accommodate evolving business needs. A service partner should have experience customizing Service Cloud to match regulatory, security, and business-specific requirements. A top-tier provider always ensures seamless upgrades and feature expansions.

Leverage Certified Expertise to Maximize Impact!

3. Verified Success Record

Prior to committing to a customer service cloud provider, it is important to assess their track record. Leading providers share client testimonials, case studies, and measurable success metrics from past implementations. All these inputs offer insights into the ability of the provider to deliver promises. A provider that has successfully implemented Salesforce Service Cloud in the financial services sector in the past is more likely to be familiar with the unique challenges and demands of the sector. Businesses should look for references from similar financial institutions to verify the provider’s expertise.

Summing Up

In conclusion, using cutting-edge technologies like Salesforce Service Cloud Implementation is vital to surpass the competition in the financial services industry. With its emphasis on effective case management, a 360-degree customer view, and automated workflows, this powerful platform sets up financial services companies for success in the digital age.

Nevertheless, the true potential of Salesforce Service Cloud features can only be unlocked via collaboration with Salesforce certified consultants and trusted cloud service providers. Certified consultants offer industry-specific knowledge, guaranteeing customized and optimized implementation, while dependable cloud service providers provide the scalability and reliability required to stay ahead in a competitive landscape.

As financial services companies continue to evolve, those that invest in innovative technologies like Salesforce Service Cloud, combined with the expertise of certified consultants and cloud service providers, will not only meet but exceed customer expectations, thereby outperforming the competition and taking the lead in the industry.