The world of technology is in a constant state of flux. New innovations and digital technology solutions are introduced in the market almost every day. They come with the promise of getting the work done faster, more efficiently, or affordably – or in a combination of all. Some assist with niche problems or help meet customer expectations. Accordingly, businesses identify the products that match their organizational goals, add value, and work out a roadmap to implement them across the processes. Typically, the roadmap to introducing change within a business takes years. However, in recent times, change is being injected in a matter of just a few months or weeks – or even days!

In simpler words, the pace of introducing change has now been ramped up tremendously, marking the recent decade as the era of accelerated change. Take the digital transformation in the insurance industry as an example. Insurers that once heavily relied on paper-based forms to manage policies have now undergone a complete insurance process transformation – from policy underwriting to claims adjustment! Almost every segment of the insurance industry has undergone rampant changes.

Adding to this, high inflation and the threat of recession will drive insurers to accelerate their digital transformation programs in the coming year. Insurers are facing a “perfect storm“ of declining premium income, growing operating costs, emerging competition, rising climate and cyber risk, and an ever-tightening regulatory environment forcing them to accelerate changes to their business models. They are investing aggressively in digitally focused business models to create more opportunities for growth and are turning to technology solutions and partnerships in the technology sector to help them achieve their DIGITAL NEXT in their transformation journey.

Tips to Help You Keep Up With Insurance Digital Transformation

If you find yourself still ‘getting there’, then here are some practical tips on matching your digital transformation speed with the accelerated change:

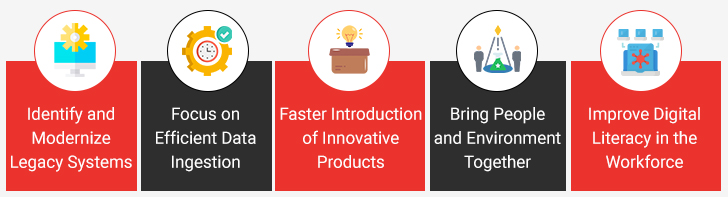

1. Identify and Modernize Legacy Systems

Regardless of the speed, the first step of every digital transformation initiative involves auditing your existing business processes. As such, you must take stock of the core insurance activities and the corresponding ecosystem to identify the bottlenecks. Thereafter, you need to prioritize the legacy systems that are coming in the way of achieving your business goals including scaling up your business or addressing new business requirements.

For instance, an insurer notices that paper-based claims settlement is tedious and time-consuming. At the same time, they also observe that customer support operates on a different ticketing system. While both client-facing processes hold their respective importance, the former could have a greater impact on the customer satisfaction score than the latter. After all, the sense of urgency while raising a claim would generally be higher. Accordingly, the business may assign it a greater priority while streamlining processes and modernizing the legacy systems through digital transformation programs. Such an approach to insurance legacy system transformation unlocks the potential for continuous improvement, which will enable businesses to ease into accelerated change. The modernization of legacy systems can also help insurers lower the system maintenance support cost and address the challenge around scarce talent related to a specific technology while improving the scope of integration with other systems to improve business functionality.

2. Focus on Efficient Data Ingestion

When it comes to a data-heavy sector like insurance, efficient data management, and governance is the key to a successful insight-driven business. From capturing and scoring leads to managing policy details to maintaining claims records – everything hinges on data. After all, data is the lifeblood of a digital ecosystem. As such, all efforts towards digital transformation for insurance companies should begin by focusing on effective data handling to maximize gains.

While data volume is hardly an issue with technological innovations like the Internet of Things (IoT), insurers would need at-par digital solutions that enhance the quality and usability of the first and third-party data sets. Centralized data management can break through organizational siloes and establish a single source of truth. In addition to logically organizing data, insurers would also need an efficient data ingestion framework that can interpret useful data across functions and translate them into actionable insights – preferably in real-time. Such a two-fold data-first system imparts a high degree of business resilience and flexibility that comes in handy while in the midst of accelerated change.

Drive and Accelerate Digital Transformation in your Organization

3. Faster Introduction of Innovative Products With Developers

In order to differentiate themselves, insurers will have to introduce newer products faster in the market that can meet the ever-changing demand of customers and the fast-changing business environment and regulations. With technology becoming an integral part of insurance processes, businesses will have to curate rewarding, meaningful, and engaging experiences with it – not just for their customers but also for the employees, agents, brokers, etc. It is only possible to achieve such results when businesses work closely with the technology developers responsible for creating the required digital platforms and solutions at a faster pace.

Unfortunately, not every insurance company has pockets deep enough to hire a team of experienced in-house developers who can build innovative bespoke solutions to cater to their specific needs. However, the market is bustling with cutting-edge InsureTech solutions that carry modular and customizable capabilities and accelerators. In such cases, you have the option to bank on reliable tech partners to lead the way who can support you in developing an insurance product of high quality on time and under budget. Fortunately, you won’t have to look too far on this quest. Damco possesses the requisite experience and exposure in this area to uphold your best interests. We can help insurers of all sizes and market segments to build the “Next” in their business with Insurance technology experts and software development teams.

4. Bring People and Environment Together

Digital transformation in the insurance industry is not a “set it and forget it” program. It is an ongoing process, especially in the face of accelerated change. As such, you will have to improve the stickiness of every innovation or digital solution that you introduce. Here’s where the human element creeps in to drive a successful change management program.

Stakeholders need to be sensitized to the impact and expectations tied to such an ambitious drive. Only when they realize the value and potential that it holds in changing how they work, would they feel motivated to embrace this change? Start by creating a compelling case for the changes you propose, and justify how they will attract positive results in the short and long term. Thereafter, put together a team of advocates who champion this move and encourage others to get on board. Once the results start to trickle in, you would automatically notice the steep rise in technological uptake.

5. Improve Digital Literacy in the Workforce

Nowadays, future-looking insurance executives are recognizing the role of innovation for accelerating the pace of change. As technology continues to reshape the insurance industry, insurers must invest in improving the digital literacy of their workforce. For starters, digital literacy enables employees to understand their role in the insurance company’s digital transformation. It also ensures that the employees are adept at leveraging the digital tools and technologies to their full potential. Conducting training programs empowers employees to become tech-savvy and fosters a culture of digital curiosity and innovation. In the dynamic digital environment, having a digitally adept workforce will help you make the most our of your insurance digital transformation initiatives.

In Conclusion

Even though the world around us is changing at an accelerated rate, the right insurance digital transformation strategies can help insurers keep in step with the pace of change. Many such decisions will not only produce immediate results but will sustain and compound in the time that comes. All you need to do is stay committed to implementing changes through digital transformation in insurance.

Case in Focus

A reputed general insurer struggled with efficient resource and data management. Damco helped them commence their insurance digital transformation journey through a centralized insurance management platform – InsureEdge. With InsureEdge, the company overcame disparate systems and human error while also streamlining complex and slow processes. InsureEdge gave the company the flexibility to choose its own rate of digital transformation and prioritize those processes that were in dire need of a systemic overhaul. At the same time, its ability to integrate with other third-party applications offers room for future developments. A detailed case study about the same is available on our website.