The life insurance segment of the insurance sector has always stood at a saturation point. After all, there is not a lot of room to enhance the products – and one can say the same for the services as well. However, the advent of insurance technologies has challenged this status quo by unlocking different avenues for product or service innovation. The resulting digital transformation wave has propelled the industry forward and brought it up to speed as per the rising tides and changing customer expectations. It has also resulted in a positive feedback loop where the outcomes of one generation of technological implementation have a compounding effect on the subsequent generations. The resulting avalanche of results is building momentum to a point where insurance technologies have become the mainframe of the life insurance lifecycle.

How Insurance Technologies are Transforming Life Insurance Lifecycle?

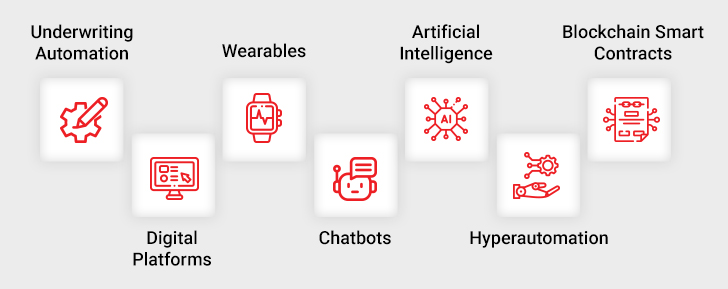

The following are some forms that insurance technologies have assumed to incentivize the life insurance industry.

1. Underwriting Automation

Underwriting is the foundation of the entire life insurance sector. Traditionally, the underwriting process was manual and cumbersome, and on average took four to six weeks to complete. However, with insurance underwriting automation, life insurers can significantly reduce processing time from weeks to a mere few minutes! Such powerful underwriting systems allow insurers to leverage data-driven algorithms to assess the risk of individual applicants in real time and make accurate predictions while accounting for all variables. As a result, insurers can eliminate repetitive tasks or guesswork to make better decisions. All the while, underwriters can focus their time and efforts on more complicated cases.

2. Digital Platforms

Digital platforms are transforming every industry that is subject to direct customer exposure, and life insurance is no exception. The use of digital platforms has revolutionized how life insurance policies are marketed, sold, and serviced. For one, prospective buyers can use digital platforms to explore the many options available and even digitally fill out forms, thereby eliminating paper-based applications. These platforms also streamline the application process and improve data accuracy and visibility. Further, with the help of digital platforms, life insurers can enhance the customer service experience. These platforms enable life insurers to offer customer service through different channels such as online chat, email, and social media and enable insurers to get a better understanding of customer behavior across different channels.

Create New Value-Added Opportunities With Insurance Platform Services

3. Wearables

Smart wearable technology has become increasingly popular, and it is now being used in the health and life insurance industry. Insurers can leverage insurance technology to collect data on the health status and fitness activities of policyholders. As such, insurers can offer personalized policies based on the data-backed assessment of the customer’s health risks. It also allows them to identify policyholders who are at a higher risk of developing certain conditions or chronic diseases and accordingly offers preventative health services. Additionally, life insurers can leverage this technology for incentivizing healthy behavior and habits.

4. Chatbots

Chatbots have become increasingly popular in the life insurance industry due to their ability to deliver quick, efficient, and on-demand customer service. They can assist customers with basic queries related to policy-related terms and conditions, premium payments, and claims processing. Chatbots can also help customers through the application process by guiding them through the necessary steps and providing answers to any questions they may have.

Additionally, chatbots can assist agents and brokers by providing them with real-time customer data and insights that can help them personalize their sales pitches and improve customer engagement. All in all, chatbots play a crucial role in optimizing the customer experience and improving operational efficiency in the life insurance industry – from the inside out, and vice versa.

5. Artificial Intelligence (AI)

Artificial Intelligence and its subset technologies such as Machine Learning (ML), Deep Learning, and Natural Language Processing (NLP) are increasingly being adopted by future-looking life insurance businesses. AI enables insurers to enhance underwriting processes, streamline claims management, and improve customer experience. ML and deep learning allow them to learn from historical data to make accurate predictions.

Armed with data analytics and AI-driven algorithms, life insurers can analyze vast amounts of data and identify patterns that can help them make more accurate risk assessments, set premiums, and design personalized policies.

6. Hyperautomation

Hyperautomation is an emerging insurance technology that integrates machine learning, artificial intelligence, and robotic process automation (RPA) to automate complex and repetitive tasks. In the life insurance industry, this technology plays an important role in optimizing processes, cutting costs, and enhancing efficiency. For instance, hyperautomation can be used to automate the underwriting process. It extracts meaningful data from multiple sources, analyzes it, and provides underwriters with accurate risk assessments. It can also be used for automating claims processing by automatically verifying claims, calculating payments, and even making payments without human intervention. Lastly, hyperautomation also improves customer experience by automating customer support tasks. By combining speed and scalability, hyperautomation makes your life insurance business virtually infallible.

7. Blockchain Smart Contracts

Increasing costs, growing customer expectations, and tech-led disruption are some of the key challenges faced by life insurers. Blockchain technology can potentially resolve these issues and unlock a sea of opportunities for insurance companies. Smart contracts can automate and streamline various aspects of the life insurance process. For starters, they can be used for streamlining claims management, allowing for faster and more efficient claims adjudication. This can help reduce the time and cost of claims processing and improve customer satisfaction. Smart contracts also offer a transparent and tamper-proof way to store and share data, thereby enhancing security and accuracy while reducing the risk of errors and fraud. Lastly, they can be tailored to meet the specific needs of customers, allowing for more flexibility in policy design and pricing.

Closing Thoughts

The above insurance technologies are simply stepping stones into the future of life insurance. Businesses that wish to remain future-forward can embrace such technologies and prepare for the disruptions to come. Naturally, such technologies will eventually take root only to later branch into newer subdivision offshoots too. Thus, the cycle continues where technology breeds innovation, and innovation births technology.

Case in Focus

A full-service life insurance company with nearly six decades of experience wanted to make the switch from legacy systems to a centralized digital ecosystem. Although the company made use of tools like Excel, it lacked the desired scalability to keep up with the changing business needs. Thereafter, we accounted for their business requirements to build an all-in-one Sales Performance Dashboard using Tableau Desktop. Soon enough, the business could finally gain visibility of its data and capitalize on it meaningfully to expand even further. Read our detailed case study to discover how the insurance company achieved this.