With business data growing at a quick pace, the role of data analytics in the finance sector has assumed greater importance. The need for organizations to make data-led decisions has made integration of data analytics into accounting domain very essential. This blog explores in detail how data analytics is helping finance and accounting professionals in offering superior quality services to their business leaders.

Understanding Data Analytics in Accounting

Data Analytics refers to the practice of analyzing massive data sets to find underlying patterns, correlations, and insights. To find trends, make good decisions, and improve financial performance, accounting professionals use data analytics in examining accounting and financial data.

The development of data analytics in accounting has been accelerated by cloud computing, artificial intelligence (AI), and machine learning. These technologies allow accountants to swiftly and precisely evaluate enormous volumes of data, leading to better-informed judgments.

Here are some common technologies used in data analytics

- Data visualization tools that assist accountants in producing visual data representations, which facilitate the identification of patterns and trends.

- Predictive analytics, which helps accountants in making proactive decisions by forecasting future events using historical data.

- Machine learning algorithms enable the analysis of large sets of data and the discovery of patterns that human analysts might not notice immediately.

The Role of Data Analytics in Financial Decision-Making

By using data analytics, accounts and finance teams can gain deeper insights into their organization’s financial health and make more informed decisions.

- Improving Financial Planning and Analysis: Finance teams can provide more precise financial projections and budgets thanks to data analytics. Finance experts can create more reliable financial strategies by examining past data and spotting trends. This helps businesses to meet their financial objectives and more efficiently allocate resources.

- Better Forecasting and Budgeting: By using predictive analytics in finance for processing historical data, it becomes easier to forecast financial performance in the future. As a result, finance teams are better equipped to foresee potential challenges and opportunities and make proactive decisions. For instance, predictive analytics can assist in spotting potential cash flow challenges early thereby helping businesses to take remedial steps before a crisis happens.

- Real-Time Data Processing for Timely Decisions: Finance professionals can access the latest financial information, and make swift business decisions, thanks to real-time data processing. This is especially crucial in today’s fast-paced business world, where making decisions too slowly can have serious repercussions.

Improving Operational Efficiency with Data Analytics

Data analytics improves operational efficiency in accounting by streamlining processes, minimizing errors, and automating routine tasks.

- Automating Routine Accounting Tasks: Repetitive accounting activities like invoice processing, data entry, and reconciliation can be handled by automation tools, such as Robotic Process Automation (RPA) and AI technologies. This improves the overall productivity of accountants as they are able to focus on more strategic tasks.

- Streamlining Financial Closing and Reporting Process: Data analytics can streamline the financial close process by automating data collection, validation, and reporting. This saves enormous time often spent by account teams closing the books, giving finance teams additional time to analyze financial results and offer valuable insights to management teams.

- Enhancing Accuracy and Minimizing Errors: Thanks to more sophisticated analytical tools, organizations can not only cut back on mundane tasks but also lower the risk of mistakes in financial numbers. This improves the accuracy of financial reports and ensures that decision-makers have access to reliable information. This ensures a higher level of integrity in the organization’s financial reports and provides the management leaders with the right insights to base their business decisions.

Enhancing Audit and Compliance

By helping auditors spot irregularities, ensuring regulatory compliance, and increasing audit accuracy, data analytics is revamping the audit and compliance landscape.

- Strengthening Modern Auditing Practices: Auditors can now analyze large datasets efficiently and quickly, identifying data discrepancies and patterns with potential issues. This improves the overall effectiveness of the audit process.

- Identifying Irregularities in Financial Transactions: Anomalies in financial transactions such as unexpected spikes in revenue or expenses are easier to spot using advanced analytics tools. Auditors can thus address potential frauds ahead of time and ensure the integrity of financial documents.

- Ensuring Compliance with Regulatory Standards: Adherence to established regulatory standards, such as the General Data Protection Regulation (GDPR) and International Financial Reporting Standards (IFRS) is also handled better by data analytics tools. Organizations can take remedial action to avoid regulatory fines by conducting a timely analysis of financial data and identification of potential compliance challenges.

Elevating Risk Management

Detecting and minimizing financial risks, spotting fraud, and performing scenario analysis all depend heavily on data analytics.

| Mitigation and Prevention of Financial Risks | Scenario Analysis and Stress Testing |

|---|---|

| Organizations can detect potential risks like market volatility or liquidity challenges by a rigorous analysis of financial data. This helps accounting teams protect an organization’s financial health by adopting a proactive risk mitigation approach. Advanced analytics technologies, for instance, can spot unusual transactions in expense reports that might point to an existing fraud. | The techniques of scenario analysis and stress testing are reliable tools to dig up risks that go unchecked during standard risk assessments. Scenario analysis involves designing various financial scenarios such as those for inflation levels, growth rates, etc., and assessing the potential impact of each scenario on the organization’s performance. This helps teams be in a state of readiness for various contingencies and plan strategies to minimize potential risks. |

Personalizing Customer Experiences in Accounting

By analyzing consumer behavior, customizing financial services, and increasing customer satisfaction, data analytics helps businesses in personalizing customer experiences.

- Understanding Customer Behavior: Organizations can learn more about their customer’s needs, preferences, and behaviors by a thorough analysis of customer data. This makes it easier for finance teams to develop more personalized and targeted financial services.

- Tailoring Financial Services to Meet Customer Needs: Data analytics allows financial organizations to customize their financial services to meet the specific needs of their clients. For instance, using data analytics, banks can categorize customers who can benefit from a particular financial product and provide personalized recommendations.

- Enhancing Customer Satisfaction and Loyalty: By offering tailored financial services to their clients, banks and financial institutions can build stronger relationships with them and grow customer loyalty, engagement, and satisfaction.

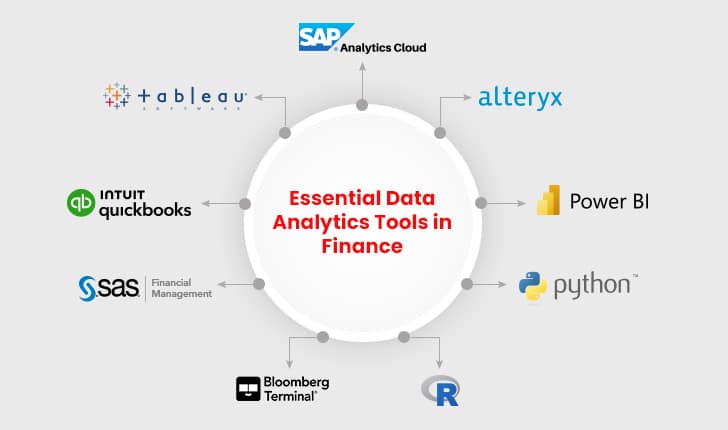

Essential Data Analytics Tools in Finance

Let’s explore some primary Data analytics tools and their main features and benefits useful for accounting and financial professionals.

| Tools | Overview | Key Features | Benefits |

|---|---|---|---|

| Tableau | This powerful data visualization tool helps finance teams to create dynamic reports and dashboards. | Real-time data analysis, interactive dashboards, and integration with multiple data sources. | Enhances data visualization and makes complex data easier to understand and easier to access. |

| QuickBooks | This accounting package provides financial data analysis capabilities. | Automated balance sheet generation, customizable financial reports, and cash flow analysis. | Simplifies financial management for small and mid-sized businesses. |

| SAS Financial Management | It’s a comprehensive tool for budgeting, financial planning, and consolidation. | Predictive analytics, scenario planning, and real-time financial reporting. | Provides advanced analytics and reporting capabilities for strategic financial management. |

| Bloomberg Terminal | A robust and flexible tool used by finance professionals for accessing real-time financial data, news, and analytics. | Financial modeling, real-time market data, and deep analytics. | Offers exhaustive financial information and analytics for informed decision-making. |

| R | An open-source programming language, it offers advanced statistical capabilities for processing financial data. | Statistical modeling, data visualization, and machine learning algorithms. | Ideal for complex data analysis and statistical computations with elaborate libraries like dplyr, quantmode, tidyr included. |

| Python | It’s a versatile programming language used in finance for data analysis and automation. | Data manipulation (Pandas), statistical analysis (SciPy), and machine learning (scikit-learn). | Provides useful libraries like NumPy, Statsmodels, Quandl, Zipline, Matplotlib etc. for financial modeling and analysis. |

| Power BI | Power BI is a business analytics tool from Microsoft that offers interactive visualizations and business intelligence capabilities. | Data integration, customizable dashboards, and real-time analytics. | Enriches financial data reporting and data visualization for better insights. |

| Alteryx | This data analytics platform is used by finance professionals to prepare, combine, and analyze data. | Data preparation, integration with various data sources, and predictive analytics. | Simplifies data analysis and increases productivity. |

| SAP Analytics Cloud | It’s an integrated analytics solution that combines business intelligence, planning, and predictive analytics. | Real-time analytics, collaborative planning, and advanced data visualization. | Provides an advanced platform for data-led decision-making. |

These tools are essential for leveraging data analytics in finance, empowering finance professionals to make informed decisions, improve efficiency, and drive growth. By using these tools, organizations can gain valuable insights into their financial performance and enhance their strategies.

Building a Data-Driven Culture in Accounting

Developing a mindset that prioritizes data-driven decision-making, training and upgrading accounting teams, and promoting collaboration and data sharing are all part of creating a data-driven culture in accounting.

- Importance of a Data-Driven Mindset: Harnessing the full potential of data analytics in accounting requires a data-first approach. This entails using data as a primary resource and basing decisions on data-first insights rather than just gut feeling or prior experience.

- Training and Upskilling Accounting Professionals: Organizations must allocate funds for upskilling and training their accounting teams to successfully seed a data-driven culture. This entails establishing a culture of ongoing learning and offering instruction on data analytics technologies and methodologies.

- Promoting Data Sharing and Collaboration: Two essential elements of a data-driven culture are mutual collaboration and data sharing. Cross-functional teams should be encouraged by organizations to collaborate and exchange data insights. This encourages an environment of teamwork where a variety of viewpoints can lead to more insightful decisions.

Upcoming Trends in Data Analytics for Accounting

The future of data analytics in accounting is expected to be shaped by a number of new technology trends.

- Advancements in Machine Learning: It is anticipated that machine learning will play an even bigger role in data analytics. As machine learning models grow more complex with integration of deep learning and ensemble methods, understanding their prediction processes would become more difficult. The need for Explainable AI will rise as accounting businesses and global regulators would aim to ensure transparency and accountability in AI systems. Explainable AI techniques will help data scientists clarify the reasoning behind model-based decisions, building trust among business users and ensuring compliance with ethical and regulatory norms.

- The Growing Importance of Data Privacy and Security: Data security and privacy will become even more important as data analytics becomes more widely used by financial and accounting teams. To protect sensitive financial data, organizations must establish strong data governance procedures and guarantee adherence to data protection laws.

- Expansion of Real-Time and Predictive Analytics: It is projected that the need for predictive and real-time analytics in finance will increase. While predictive analytics can help in anticipating future trends and problems, real-time analytics will allow finance professionals to make quick decisions based on existing facts.

- Predictions for the Next Decade: Data analytics is anticipated to be more deeply embedded into accounting processes throughout the course of the decade that follows. Blockchain and other emerging technologies might also contribute to improved data security and transparency. Businesses that adopt these trends and make data analytics investments will be in an excellent position to maintain their competitiveness and fuel business expansion.

Key Takeaways for Finance and Business Leaders

By facilitating individualized client experiences, increasing operational efficiency, and boosting financial decision-making, data analytics is reshaping accounting operations. Finance leaders should train their teams, invest in data analytics tools, and establish a data-driven culture to fully utilize the full potential of data analytics.

Summing Up

Today, the majority of accounting firms and various businesses are making data analytics an essential part of their business model in order to stay ahead of the competition. Data analytics is fast reshaping financial and accounting function by helping financial teams make faster and better decisions backed by data and actionable intelligence. From minimizing errors in financial reporting to developing predictive models for risk mitigation and using real-time analytics, businesses are poised to unlock the full potential of data analytics. If you’re planning to implement the data analytics capabilities in your accounting organization, it’s wise to seek end-to-end consultation from a reliable partner who specializes in data analytics in accounting and finance.