Insurance has always been a highly personalized industry, where customers expect a direct, one-on-one connection with their agent. When disaster strikes and they need to file a claim, they want to be treated like family. However, the digital era has strained this relationship, with most customer interactions now happening remotely instead of in person. Those seeking reassurance may find themselves stuck in long queues, waiting for a service.

Personalization is a critical challenge to address. Insurers rely on personalized customer data for decision-making. However, they often overlook personalization in customer service interactions. So, how can customer support be enhanced to ensure personalization and reassurance? The answer lies in Conversational AI- an umbrella term for various tools and technologies that help machines understand and replicate human interactions.

From estimating customer intent to answering voice commands – conversational AI in insurance offers a rich suite of functions, allowing users to enjoy meaningful and engaging conversations. Hence, it’s not surprising that the global insurance chatbot market size is expected to reach USD 4,498 million by 2033, growing at a CAGR of 23.5% during the forecast period of 2024-2033. Such resounding success may make one wonder about the use cases of conversational AI for insurance business. Let’s take a look!

Table of Contents

What is Conversational AI in Insurance?

Benefits of Conversational AI in Insurance

- Automates Workflows

- Enhances Efficiency

- Improves Customer Engagement

- Delivers Omnichannel and Multichannel Support

Key Conversational AI Use Cases in Insurance

- Identification and Verification

- Claims Automation

- Quotes Generation

- First Notice of Loss (FNOL)

- Appointment Scheduling

- Digital Agents

- Content Marketing

- Data Analytics

Best Practices for Implementing Conversational AI in Insurance

Conclusion

What is Conversational AI in Insurance?

While conversational AI is typically associated with automated chatbots, its scope extends beyond just text. It subsumes voice, text, behavioral cues, and all other aspects that make interactions human-like. Hence, when you talk about chatbots, voice assistants, and virtual agents, they’re all conversational AI solutions!

Such a holistic approach to communication is achieved by amalgamating different technology components, such as:

- Deep Learning: A subset of machine learning (ML) on algorithms inspired by the functioning and composition of the human brain.

- Natural Language Processing (NLP): A combination of computer science, artificial intelligence (AI), and linguistics to help computers understand human language.

- Natural Language Understanding: A subfield of NLP that involves the comprehension of the structure and meaning of human language.

- Voice Recognition: Also known as speech recognition technology, it uses machine learning and deep learning to help machines understand and respond to spoken words.

- Cognitive Computing: An automated framework that simulates human thought processing paired with self-learning and self-training modules.

As a result of these interdisciplinary and cross-sectional technologies, conversational AI manages to rake in various benefits.

Benefits of Conversational AI in Insurance

Conversational AI agents bring significant advantages to insurance, directly impacting key business areas and overall growth. While insurance has unique requirements, many customer service needs align with other industries, making these benefits widely applicable.

Automates Workflows

Customer service interactions often begin with identification and verification. In insurance, strict verification is required before most interactions take place. Traditionally, this is a slow, manual process handled by human agents.

Conversational AI and ML streamline these tasks. They automate ID&V, collect essential information, and gather documents or images for claims processing. This reduces manual work, speeds up response times, and enhances customer satisfaction.

Enhances Efficiency

AI sometimes causes concern among support staff, but it shouldn’t. In insurance, human employees should step in only when necessary. They shouldn’t waste time asking repetitive ID&V questions or handling manual verifications that frustrate customers.

Conversational AI handles these routine tasks, allowing human agents to focus on complex issues. This not only improves efficiency but also leads to greater job satisfaction. Since AI handles the initial inquiry, it provides all relevant details to the human team. Agents no longer need to ask for basic verification and policyholders don’t have to repeat themselves.

Improves Customer Engagement

AI agents aren’t just reactive—they also reach out to customers proactively. They send reminders about upcoming policy changes or renewal deadlines without adding extra costs or workload for human employees.

Using an AI agent for outreach is often more effective than email campaigns. When customers receive a renewal email, they must open a new page and complete verification before taking any action. With conversational AI, insurance agents simply confirm the renewal or ask questions within the same conversation. The AI further processes the payment and finalizes the request.

Delivers Omnichannel and Multilingual Support

Customers engage with businesses through multiple platforms. They may call, send emails, use social media, or message via WhatsApp or iMessage. It is challenging to meet these varied preferences. Expanding support to different channels requires major adjustments. It often involves hiring more staff, restructuring teams, and assessing security and privacy risks for each platform.

An AI agent makes this process seamless. It isn’t restricted to a single platform, allowing businesses to support customers wherever they are. The only requirement is identifying preferred channels and coordinating with an AI provider to integrate them.

AI agents also address language barriers. Conversational AI translates and responds naturally in multiple languages, removing the need for offshore customer support or investing in separate translation services.

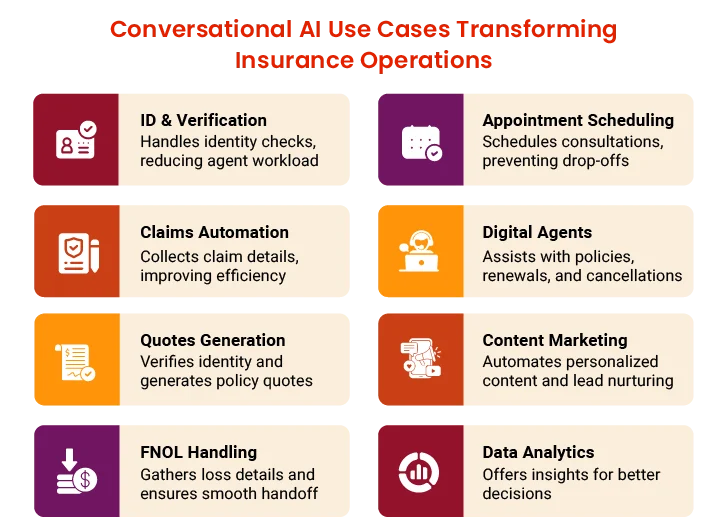

Key Conversational AI Use Cases in Insurance

To see how conversational AI benefits your business, it’s important to explore how it’s applied in the industry. Start by identifying the core processes within your operations. Then, evaluate how AI enhances these areas to ensure a smooth and effective adoption. Here are some of the top conversational AI use cases in insurance:

1. Identification and Verification

In any insurance company, most customer calls require some form of identification or verification. These processes are simple but time-consuming. They often lead to inefficiencies and frustration for both agents and customers.

An AI agent manages many repetitive tasks involved in ID&V. It guides customers through basic identity questions or requests document uploads for verification. Once completed, the AI agent summarizes the case and hands it to a human agent. This eliminates the need for repeated verification, allowing the conversation to continue seamlessly.

For most businesses, ID&V is the ideal starting point for AI adoption. In insurance, where accurate customer details are essential, an AI agent ensures fast and secure data collection.

2. Claims Automation

Like ID&V, every insurance company must collect essential details for claims processing. Relying on a human agent for every step, especially when it comes to minor claims, is inefficient. Furthermore, it frustrates customers who want quick resolutions.

AI agents transform how basic claims are handled. They take the initial call or claim report and recognize the customer’s intent. The AI then prompts them for the necessary details, streamlining the process.

Once the administrative steps are completed, the AI notifies a human agent. At this stage, the human agent has to address any complexities and finalize the claim. This reduces manual workload while improving efficiency and insurance claims service.

3. Quotes Generation

When a customer reaches out for a policy quote, insurers must verify their identity. They also need to gather basic details to calculate an accurate estimate.

AI Agents handle both tasks quickly and efficiently. They also engage with customers, understand their requests, and interact with backend systems to generate quotes.

This process can be fully automated, even allowing the AI to complete payment when a customer accepts the quote. More commonly, however, insurers configure the AI to notify human agents. This helps them finalize details or negotiate with the customer as needed.

4. First Notice of Loss (FNOL)

A first notice of loss (FNOL) call is often a customer’s first direct interaction with the team. Insurers must gather enough details to process the claim, while the customer needs reassurance and guidance.

Since FNOL is a common scenario, it is an ideal starting point for AI integration. The AI Agent handles the initial call, qualifies the customer, and requests necessary documents, including details like a description of the loss or a photo of the damage.

Thereafter, the AI Agent transfers the case to a human agent. Along with the call, it provides a detailed case log, ensuring a seamless handoff. The AI then summarizes the case and files it appropriately. This helps human agents spend less time on after-call work (ACW), minimizes Not Ready Time (NRT), and ensures regulatory compliance.

5. Appointment Scheduling

What happens when someone expresses interest in an insurance policy? Do you simply collect their details and leave them waiting? Well, not anymore! With conversational AI, insurance businesses can keep the momentum going and guide them through policy selection and enrollment almost instantly. A chatbot pop-up triggers when a user has scrolled through all the policy details or has spent X amount of time on a page—such behaviors indicate strong intent. So, why stop there? Addressing this drop-off point ensures the customer is not left waiting, checking out competitors, or second-guessing their decision.

Finalizing policy enrollment immediately demonstrates that the insurer prioritizes efficiency and customer satisfaction, setting the stage for a smooth experience. Plus, customers retain complete control over the process, enabling them to compare, customize, or finalize policies based on their preferences. This level of control makes the brand appear less aggressive and more accommodating!

6. Digital Agents

While exploring policies and managing enrollments are just a few aspects of customer service, conversational AI applications in insurance extend to digital advisors and virtual insurance agents. As mentioned, these AI-driven assistants suggest the most suitable policies based on customer needs and preferences while facilitating policy adjustments, renewals, and cancellations.

Similarly, insurance conversational AI tools integrate with or redirect users to platforms offering interactive policy explanations. Features such as AI-powered risk assessments, informative video breakdowns of policy terms, or interactive calculators help customers make informed decisions remotely. Based on customer interactions, the AI guides them through an automated sales journey while assisting with queries or concerns. If complex issues arise, the virtual agent escalates them to human representatives for personalized support.

7. Content Marketing

The deep-rooted integration of AI in insurance marks the next stage of the forthcoming digitization. As such, it’s feasible to use conversational AI for digital marketing.

Lead generation and personalized recommendations aside, conversational AI plays a mission-critical role in digital marketing, specifically content marketing. Most modern insurers attest to the efficacy of content marketing, making it the go-to strategy for achieving various organizational goals. Whether generating awareness, educating prospects, nurturing leads, or pushing for a sale, a well-crafted social media post or email copy makes a world of difference.

Such content assets go beyond geographical limitations and increase your sphere of influence. The resulting awareness will establish you as a top insurance brand!

8. Data Analytics

Another smart way to use AI in insurance revolves around developing smart tools and calculators that offer sharp, data-driven insights to prospects and policyholders. Such solutions serve a multi-fold purpose.

Firstly, the conversational element of this tool/calculator makes it easier for anyone to engage, assess, and explore policy options, thereby removing any geographical barriers. Second, it opens up avenues for collecting lead information where prospects may not be confident about engaging with chatbots as chatbots are commonly associated with sales. Third, it helps customers track data-driven market trends, compute risk, anticipate insurance demands, and perform detailed analyses to aid decisions.

Such a comprehensive analysis infuses customers with the required confidence and validation while selecting or upgrading coverage. These qualities empower customers and also minimize policy lapses and abandoned applications.

Streamline Your Insurance Operations with Conversational AI Solutions

Best Practices for Implementing Conversational AI in Insurance

Here are three effective strategies that insurers are using to implement AI successfully

- Develop a Structured Roadmap: Insurers tend to be cautious, often hesitating to move AI solutions beyond the pilot stage. Many prefer to keep testing indefinitely or wait for industry peers to validate success before committing. This hesitation is slowing AI progress. To overcome this, insurers should create clear, actionable roadmaps. They must set fixed milestones and follow pre-established timelines—from pilot programs to full-scale adoption.

- Customize AI Implementation for Specific Use Cases: Conversational AI for insurance and other AI-driven tools sometimes lead to a “black box” effect. Customers may not understand how AI makes decisions, making them skeptical about pricing and claims fairness. To prevent this, insurers should be transparent about how customer data is used. Regular audits should confirm that AI-generated decisions are clear, reasonable, and compliant with regulations like GDPR.

- Close the Technology Skills Gap: The shortage of skilled tech professionals is a growing challenge for insurers. As AI becomes more embedded in operations, this gap is widening. Insurers must address this issue in two ways:

- a) Train Existing Employees: Companies must invest in workforce training and teach staff about robotics, cybersecurity, and data analytics.

- b) Create an Innovation-Friendly Workplace: Upskilling helps, but some roles require specialized expertise. Traditional insurers struggle to compete with insurtech firms, which are seen as more advanced. To change this perception, insurers should modernize outdated systems and highlight their digital transformation efforts.

Conclusion

Conversational AI has transformed the insurance industry, enhancing policyholder experiences while boosting operational efficiency. Chatbots, virtual assistants, and voice assistants enable insurers to deliver personalized, interactive services while cutting costs. By integrating Conversational AI use cases in insurance, insurers streamline processes, improve service delivery, and operate more efficiently.