In the last blog, we discussed how insurers simplify the claims process using data analytics. In today’s blog, we will talk about the role of automation/hyperautomation technologies in boosting claims efficiency. But, before that let’s dive into the differences between “automation” and “hyperautomation”.

Automation plays a crucial role in digital transformation. However, insurance businesses have always been aware that enterprise automation comes with its own set of challenges, such as availability of massive volumes of unstructured data that impairs business process automation.

Hyperautomation, on the other hand, was specifically designed to address this challenge and is focused on addressing highly complex business processes. It represents a better version of automation, including advanced technologies that facilitate end-to-end automation processes. By streamlining workflows and eliminating repetitive daily tasks, hyperautomation empowers businesses to accelerate efficiency.

Moreover, the emergence of tech-native insurance providers has established new standards of customer experiences. Modern-day policyholders expect everything to flow smoothly and painlessly. At the same time, insurers have to balance this customer expectation with efficiency to ensure profitability and sustainability.

Against this background, relying on manual work, working on repetitive back-end operations, and using outdated processes will only pose a roadblock in the way of achieving growth.

Intelligent process automation/hyperautomation is what insurers need to strike the perfect balance, especially when it comes to claims-related processes.

The Impact of Insurance Claims Automation

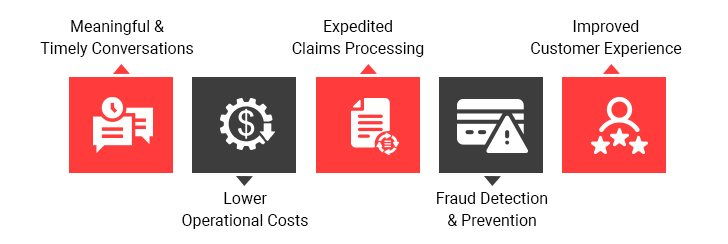

Here’s a look at how claims automation/hyperautomation can propel insurance beyond mere efficiency:

1. Meaningful & Timely Conversations

Traditional insurance had little to no communication with policyholders. However, modern-day consumers are not only looking at different channels to interact with insurers but also expecting their experience to be consistent throughout. Such a demand intensifies when it comes to claims-related interactions.

Automating insurance claims processing pushes businesses to centralize data for end-to-end claims processing. This centralization and digital transformation of insurance claims operations allow insurers to become truly omnichannel. Resultantly, policyholders can raise claims or claims-related queries on any channel of their convenience. Further, they will also receive automatic and timely updates on their claims through different channels. Even if a claim is returned, the claims automation tools can seek clarification, which gives the policyholder another opportunity to rectify the claim instead of facing rejection.

2. Lower Operational Costs

Claims handling and processing have a direct correlation with operational costs. The more resources insurance companies have, the more capable they will be of managing claims, and these resources cost money.

Typically, these resources primarily comprise employees or agents. As the insurance business grows or witnesses claims en masse, they have to invest in these resources to manage these rising or peak demands. Naturally, such resources will have to be appropriately compensated, which can erode profit margins.

Automation in insurance claims decouples this resource dependence and allows insurance businesses to grow scalably without any operational overheads. For starters, tools and platforms for insurance claims processing automation are far more cost-effective than employees that need to be recruited, onboarded, trained, and retained. They come in tiered plans that insurers can switch between seamlessly to match their requirements.

3. Expedited Claims Processing

In addition to reducing claims-related operational costs, insurance claims automation also accelerates the processes.

Previously, insurers relied on human agents to collect claims data, analyze it with a view of the policy terms and conditions, adjust the claims, and process the settlement. Doing all these tasks manually would take days to weeks to even months – but that changed with the advent of automation.

Most automated insurance claims systems make use of Artificial Intelligence (AI) engines. This AI-powered claims management setup. leverages configurable rule-based algorithms to check, handle, and process claims. As a result, they can extract claims-related data from forms, verify the details, detect fraud or fraudulent patterns, and perform a range of activities within a span of a few minutes. This would lead to faster claims processing, which will improve employee morale and policyholder experience.

Transform your Claims Process with AI-Powered Automation

4. Fraud Detection & Prevention

Although insurance claims processing automation speeds up claims processing, it does not do so at the cost of accuracy or risk of fraud.

For starters, it can factor in the policyholder’s risk profile and previous claims history while capturing the claim. Those displaying greater risk or a history of repeat claims may be attempting to commit fraud. Interestingly, AI-powered claims automation solutions can even profile repeat offenders and let insurers identify policyholders that fit this description or fraudulent patterns so that they can always stay on alert. Insurance businesses can also set up next-generation authentication and verification methods such as biometrics to protect policyholders from identity theft. Doing so will also help prevent unauthorized access to policyholders’ accounts.

Most importantly, all the fraud detection and prevention will take place in real time. In contrast, failure to automate this angle will only result in instances of fraud and greater errors in claims processing.

5. Improved Customer Experience

An insurer’s ability to handle claims is a true reflection of the quality of service they offer. Delayed or opaque claims processing paired with inaccurate settlements will only cause more inconvenience to the policyholders. Aggravating customers at such a critical juncture will only affect brand perception and customer experience negatively.

On the other hand, insurance claims automation offers businesses several advantages that directly or indirectly also impact the customer experience and improve it by leaps and bounds. Which policyholder wouldn’t want timely updates on the status of their claims? Who would have a problem with an extra layer of security? Why would they wait around for their claim to undergo lengthy and tiresome processing? It is evident that claims automation will breed happier customers, who would be more willing to stick around and renew their policies. In fact, it could also enhance the customer experience to the point where it would trigger word-of-mouth advertising and long-term customer advocacy!

In Conclusion

Insurance claims automation elevates insurance companies from “efficient” to “hyper-efficient.” It achieves this goal by boosting customer experience, lowering operational costs, fast-tracking claims processing, detecting and preventing fraud in real-time, and increasing accessibility. With such cross-functional benefits, failing to introduce automation in insurance claims is nothing less than leaving money on the table! So, what’s stopping your insurance business from going beyond efficiency?

Case in Focus

A multi-line insurer had a property claims estimation system to generate claim loss reports containing damage estimates. However, the inaccurate loss estimation reports, human errors, and redundant operations made it difficult to process claims efficiently. The entire claims value chain was revamped using an AI-based roadmap to address these challenges. Several tools were employed to automate claims-related activities and prepare accurate loss reports. Such intervention allows the insurer to enjoy a value-driven, error-free claims process.

To learn how we made it happen, you can read about this case study in detail.