The insurance industry is transforming, with claims adjusters at the forefront. Insurance claims adjusters deal with ever-growing challenges, ranging from mountains of paperwork and increasing fraudulent activities to ever-changing regulatory compliance. Conventional methods no longer meet the requirements of today’s digital-first economy, and hence, technology solutions have proved to be a powerhouse for claims adjusters.

Modern insurance software solutions automate processes, eliminate tedious tasks, and improve accuracy, enabling adjusters to concentrate on key elements of claim assessment. With AI-powered fraud detection, real-time communication platforms, and mobile accessibility, claims adjusters can handle claims more effectively with fewer errors and delays. Digital disruption is not a trend; it is revolutionizing how the insurance sector functions.

Table of Contents

Major Challenges Faced by Claims Adjusters

- I. Time-Consuming Manual Processes

- II. Inaccuracies in Claim Appraisal

- III. Communication Breakdown Between Stakeholders

- IV. Heavy Workload and Case Overload

- V. Lack of Standardized Claims Processes

- VI. Delays in Damage Inspections and Assessment

How Technology Solutions Help Insurance Claims Adjusters

How to Select the Right Technology Solutions for Claims Adjusters

Major Challenges Faced by Claims Adjusters

Time-Consuming Manual Processes

Claims adjusters handle a lot of paperwork, from claim forms to policy statements and supporting documents. The conventional process demands the physical filing of documents, manual checks, and multiple follow-ups, thus delaying claim payments immensely. The inefficiency in paper-driven processes results in misplaced documents, causing more frustration for adjusters and policyholders.

In addition, autonomous claims adjusters handling multiple cases simultaneously find it difficult to follow different case files. The absence of centralized computerized records again lengthens the processing time. A settlement delay affects customer satisfaction and can cause reputational harm.

To address this, advanced claims handling systems and intelligent document processing software are now a requisite for process acceleration.

Inaccuracies in Claim Appraisal

Efficient claims assessment requires greater accuracy in damage estimation, policy coverage interpretation, and payout calculation. Human factors such as errors in data entry, misinterpretation of policies, and inadequate documentation can translate into inaccuracies, resulting in claim denials or overpayment. Auto claims adjusters, for instance, must estimate automobile repair costs accurately as slight calculation mistakes can lead to monetary inaccuracies.

If a public adjuster misrepresents damages or fails to properly document the extent of damage, it affects their claims. Such errors delay settlements and increase the chances of disputes and litigation. Automation and AI-based estimation software reduce the risk of such errors, ensuring accurate claim assessments.

Communication Breakdown Between Stakeholders

Claims processing involves multiple entities, including policyholders, insurers, associated industry firms such as hospitals, auto-repair centers, banking and financial institutions, and legal advisors. As such, unorganized communication results in misunderstandings, delays, and claim disputes.

Auto claims adjusters, for example, must interact with vehicle repair shops, insurance agents, and policyholders. Any issue with information transfer or breakdown in communication may lead to delays in claim settlements. Home-based independent claims adjusters may also struggle to get approvals or clarifications within the time.

Lost messages and delayed responses make conventional communication strategies like emails and phone calls ineffective. Incorporating real-time communication platforms, including integrated messaging systems and automated alerts, facilitates smooth collaboration among all stakeholders.

Heavy Workload and Case Overload

Independent claims adjusters juggle many cases simultaneously, resulting in workload pressure. Processing different claims, authenticating documents, evaluating damages, and coordinating with various stakeholders consume considerable time and effort. Certain claims, like auto claims, need careful assessment, and an excessive caseload can cause burnout and inefficiencies.

Overworked adjusters may rush evaluations, leading to substandard claim assessments or missed fraudulent cases. To maintain accuracy under high volumes, insurers require streamlined workload management and automation tools that support adjusters throughout the process.

Lack of Standardized Claims Processes

Methods of claim processing vary with insurers, types of policies, and regions. Such variations cause deviations in the evaluation and settlement of claims. Claims adjusters hired by multiple insurers need to operate through differing requirements for documents and methods of assessments, leading to increased complexity.

For instance, auto claim adjusters frequently struggle in estimating automobile damage based on multiple models. A unified approach backed by custom software for auto claims management helps simplify processes while ensuring uniformity and clarity.

Delays in Damage Inspections and Assessment

Quick claim settlements depend on accurate damage assessments. However, arranging inspections, confirming damages, and obtaining expert opinions may take time. Consider the case of auto claims. Auto claims adjusters inspect vehicles, gather repair estimates, and liaise with body shops, while public adjusters must meticulously document property damage. Delays in these processes lead to delays in claim resolution.

AI-powered image recognition software, drone inspections, and remote evaluation technologies speed up the evaluation process, enabling quicker settlements and enhanced customer satisfaction.

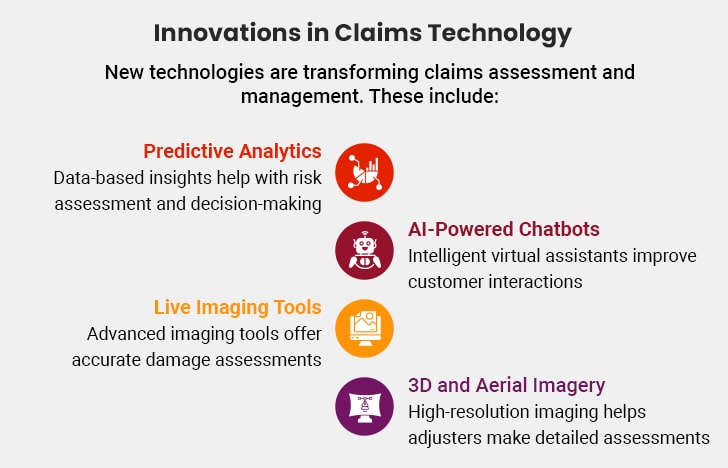

How Technology Solutions Help Insurance Claims Adjusters

New technologies are transforming claims assessment and management. These include:

I. Simplified Claims Processing

Insurance software assist adjusters in processing claims more quickly by automating processes, cutting paperwork, and eliminating manual data entry. This is especially useful for independent claims adjusters working on different cases. The software synchronizes with databases for real-time verification, enhancing accuracy. Whether public adjuster claims or auto claims, automation allows adjusters to make quick evaluations while staying compliant.

II. Enhanced Precision with Reduced Errors

Claim assessment errors result in losses and conflicts. To reduce this risk, insurance claims adjusters rely on software systems that improve calculation accuracy and documentation. Automation reduces human error and promotes standardized practice. Independent claim adjusters without any support staff especially benefit from these software systems with their guaranteed precision. Insurance solutions help ensure fair and justified settlements across a wide range of claims.

III. Quick Settlements of Claims

Processing delays can cause customer dissatisfaction. Insurance software allows claims adjusters to automate notifications, paperwork, and approvals, resulting in more rapid settlements. This benefits insurance claims adjusters who handle several claims simultaneously. The software speeds up negotiations and minimizes waiting times for policyholders by flagging incomplete information and generating accurate estimates.

IV. IImproved and Highly Precise Fraudulent Claims Detection

Insurance fraud is a major issue, and software tools help identify suspicious claims by monitoring data patterns. AI-powered fraud-detecting tools flag inconsistencies, helping assessors avoid inaccurate payouts. For adjusters handling multiple and high claims volume, automated alerts highlight potential red flags, saving insurers from excess financial losses.

V. Centralized Data Management

Claims handling entails processing large volumes of data. Insurance software integrates all claim data into one secure, centralized repository. It allows claims analysts quick access to policy information, prior claims, and supporting documents. Remote insurance professionals, such as independent claims assessors, need cloud-based solutions that enable real-time access from anywhere. These solutions improve efficiency and reduce the administrative workload.

VI. Compliance with Regulations

Strict local laws regulate insurance businesses and claims adjusters must ensure that every claim meets compliance standards. Modern insurance software includes built-in regulatory checks, assisting adjusters in complying with legal regulations. Independent claims adjusters benefit from automated compliance alerts that flag rule changes and reduce the likelihood of violations.

VII. Improved Communication and Collaboration

Claims handling involves coordination across insurers, policyholders, and associated industry firms. Insurance software supports smooth communication through messaging tools, document sharing, and status updates. Insurance claims adjusters benefit from cloud-based systems that allow collaboration with various stakeholders, increasing efficiency and minimizing delays in resolving claims.

VIII. Data-Driven Decision Making

Insurance software generates comprehensive reports and analyses, enabling claims adjusters to make informed decisions. Adjusters can review claims trends, determine patterns, measure risks, and enhance strategies. Independent claims adjusters can leverage such information to streamline workflow and maximize claim examinations, improving claims accuracy and customer satisfaction.

IX. Mobile Accessibility for On-the-Go Adjusters

Most claims adjusters are field workers who inspect damages at their original locations. Mobile accessibility features in insurance software enable users to transfer reports, pictures, and details of the claims. Independent insurance adjusters working on automobile or property damage cases can leverage immediate data input and web-based remote work, lessening processing times and enhancing service.

X. Cost Savings and Operation Efficiency

Insurance software automates repetitive tasks to minimize operational costs and maximize productivity. Claims assessors do less administrative work and more actual claim analysis. Independent claims adjusters can handle heavy claims volume efficiently without extra resources.

Generative AI further improves efficiency by automating document processing. In fact, this technology can cut loss-adjusting costs by up to 25% and reduce claim leakage by up to 50%. Eventually, these solutions result in quicker settlements, enhanced customer satisfaction, and greater profitability for insurance firms.

Reduce Complexity in Claims Adjustments with Smart Claims Software

How to Select the Right Technology Solutions for Claims Adjusters

1. Determine Particular Claims Adjusting Requirements

Various adjusters—independent, public, or auto claims adjusters—have different operational needs. Careful analysis of business issues, including coping with high volumes of claims, improving fraud detection, or maintaining regulatory compliance, is necessary.

For instance, public adjuster claims require a technology solution with strong document management and communication capabilities, whereas auto claims adjusters might gain more from AI-based image recognition for damage inspection. Matching software capabilities with real workflow requirements guarantees maximum efficiency and productivity.

2. Ensure Seamless Integration with Existing Systems

An end-to-end technology solution must integrate well into an existing environment, such as claims management systems (CMS), customer relationship management (CRM) platforms, and accounting applications. Inefficient integration can hinder workflow effectiveness, forcing adjusters to switch between platforms manually.x

API-friendly solutions, facilitating one-click data exchange, eliminate redundancies, optimize information flow, and reduce errors. Real-time synchronization between platforms improves accuracy and operation efficiency.

3. Prioritize AI and Automation for Speedy Processing

Manual claims processing is labor-intensive and susceptible to human error. Smarter insurance technology solutions use AI-facilitated automation to streamline workflows, minimize claim approval times, and maximize accuracy.

Automated document verification, fraud detection, and predictive analytics help adjusters concentrate on complex cases instead of redundant administrative work. Auto claim adjusters, for example, can take advantage of AI-powered image analysis to inspect vehicle damage in seconds, achieving much faster claim settlements.

4. Go for Robust Fraud Detection Features

Fraudulent claims account for heavy financial losses in the insurance sector. The most suitable technology platform should have AI-based fraud detection processes, employing machine learning to screen claims data and detect anomalies.

Sophisticated features like pattern detection, identity verification, and predictive analytics optimize the capacity for flagging questionable claims for additional scrutiny. Integrating strong fraud prevention processes safeguards monetary resources and facilitates unbiased claim settlement.

5. Facilitate Compliance and Regulatory Support

Insurance regulatory requirements are sophisticated and region-specific. Insurance technology systems must have compliance monitoring as a built-in feature to assist adjusters in following state and federal rules. Automated audit reports, electronic signature validation, and safe document storage make regulatory compliance easier and reduce legal exposures. A compliance-supported system guarantees adherence to industry best practices and avoids possible contraventions.

6. Assess Reporting and Analytics Functionality

Data-driven decision-making increases the effectiveness of claims processing. An effective technology solution includes sophisticated reporting dashboards offering real-time information on claim status, processing time, fraud detection, and customer interaction. Customizable reports, KPI monitoring, and predictive analytics enable the identification of trends and workflow automation, making business decisions more informed. Sound analytics capability enhances individual insurance claims adjuster performance and enterprise-wide efficiency.

7. Plan for Scalability for Future Growth

As insurance companies grow, the selected digital solution must be scalable to meet increasing volumes. An adaptive, cloud-based system can handle higher volumes of claims, more adjusters, and new policy types without compromising performance.

Cloud solutions offer advantages like remote access, automatic upgrades, and increased security, allowing operations to stay flexible in response to changing industries and business demands.

8. Check Cost Effectiveness and Return on Investment

Investment in insurance technology solutions must yield quantifiable benefits in efficiency, cost reduction, and claim processing speed. Conduct a proper cost-benefit analysis to compare subscription costs, implementation charges, and long-term financial benefits.

Solutions with claims automation, fraud detection, and data-driven intelligence capabilities lead to increased accuracy and decreased claim processing times, which eventually justify the investment. Organizations must measure short-term and long-term return on investment (ROI) while choosing the most appropriate insurance technology platform.

Conclusion

Future-looking insurance companies are making investments in digital platforms that automate processes. These platforms streamline claim inspections with automated assignment, efficient routing, built-in quality checks, and speedy document processing. With such innovative technologies, insurers can optimize accuracy, reduce settlement time, and improve policyholders’ experience, all while ensuring a fast, accurate, and digital future for claims.