Insurance fraud is a grave problem plaguing all insurance service providers. Even the smallest of frauds can snowball and turn extremely expensive. As a result, businesses must be careful while analyzing every claim during the insurance claims settlement process. And while it is not possible to manually verify every single claim, the claims settlement process in insurance can be made easier through artificial intelligence.

Let us take a look at how artificial intelligence-based fraud detection can simplify the insurance claims process.

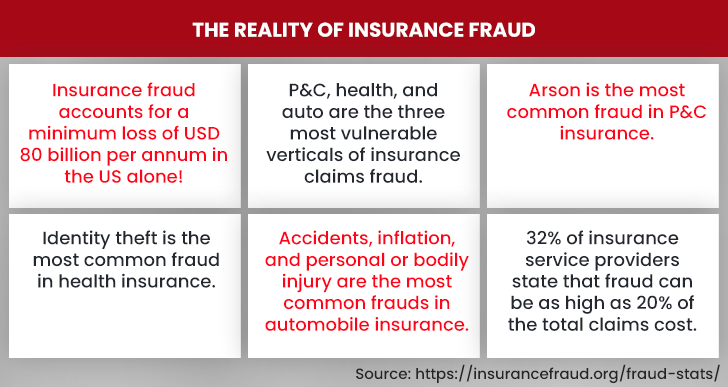

The reality of insurance fraud:

- 1. Insurance fraud accounts for a minimum loss of USD 80 billion per annum in the US alone!

- 2. C, health, and auto are the three most vulnerable verticals of insurance claims fraud.

- 3. Arson is the most common fraud in P&C insurance.

- 4. Identity theft is the most common fraud in health insurance.

- 5. Accidents, inflation, and personal or bodily injury are the most common frauds in automobile insurance.

- 6. 32% of insurance service providers state that fraud can be as high as 20% of the total claims cost.

Types of Insurance Claims Fraud

Insurance claims fraud is singularly the broadest form of insurance fraud to take place. Some classic examples of fraud to crop up during the claims settlement process in insurance are illustrated below:

- 1. Faking an accident, injury, or damage to file a claim against an insurance policy

- 2. Filing a claim against an incident that did not take place

- 3. Filing a claim by submitting false information

- 4. Intentionally causing damage to file a claim

- 5. Filing false police reports to raise claims against fake incidents

- 6. Inflating the damage and filing additional claims for damage that does not exist

- 7. Stealing someone’s identity to claim their insurance

- 8. Forging insurance and subsequent claims

How can Artificial Intelligence help Detect Fraud During Insurance Claims Settlement?

The introduction of Artificial Intelligence in insurance claims settlement cycle can derive the following benefits:

Estimating the Probability of Claims

Artificial intelligence can power predictive models that can calculate the probability of an incident occurring by processing the historical data available. Not only that, these can even estimate the value of the claim by assessing the typical claims raised by the policyholder in the previous instances. As such, claims beyond this threshold value can be escalated to the Special Investigations Unit (SIU).

Detecting Fraudulent Activities and Patterns

Insurance companies can leverage AI-based models to detect fraudulent activities and patterns. The triggers in such cases could be repeated filing of claims, historical rejection of claims, and more. By clubbing together high-risk profiles based on common parameters, insurance agencies can closely monitor future claims raised by such policyholders to prevent fraud.

<h3Authorizing Insurance PolicyholdersAI-powered engines can grant access to the claims settlement process in insurance after conducting thorough authorization. Rather than depending on obsolete security measures like passwords and OTPs that are susceptible, policyholders can set up biometric-based authentication that will protect them from identity theft. As a result, they can use unique identifiers like voice, fingerprint, or iris scans to raise a claim.

Real-Time Monitoring of Activities

One of the greatest USPs of insurance fraud detection using Machine Learning and Artificial Intelligence lies in its ability to process data quickly and in real-time. Resultantly, insurance agencies spend less time recovering from fraud and more time preventing it. Real-time flagging and reporting of events allow businesses to respond proactively and mitigate any losses.

Growing Continuously

Artificial intelligence systems grow smarter after every iteration. Hence, they would scale and adapt in proportion to the miscreants. With a wealth of data by its side, there will come a point where even the most nefarious actors will be unable to bypass the robust security measures put in place by Artificial Intelligence.

Final Outlook

The use of Artificial Intelligence in the claims settlement process in insurance will go a long way in making the process less cumbersome and more hands-on. Automating the insurance claims process also frees up human resources that can be put to better use than sifting through documents. Moreover, the resultant ROI raked in by mitigating fraud will incentivize businesses growth and consolidate the insurance provider as a market leader.

So, avail end-to-end claims automation services now to reap these results!